The DRIFT token, which powers the Solana-based perpetuals exchange Drift Protocol, surged over 40% on Monday before retracing slightly, after the platform crossed $1 billion in daily trading volume for the first time over the weekend.

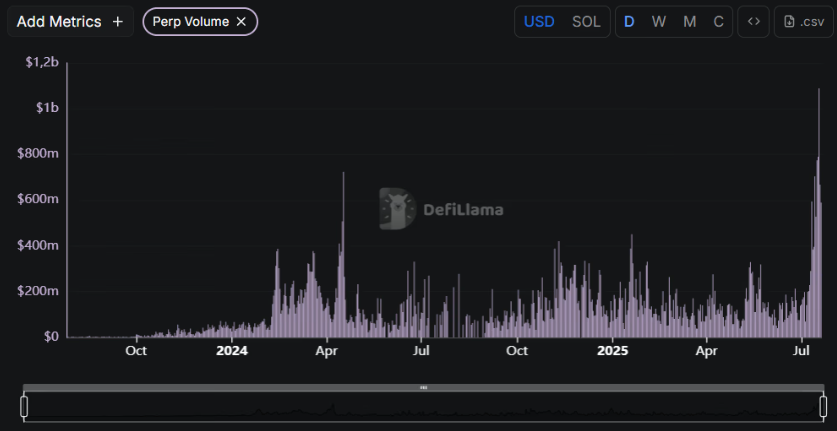

The token's rally started after Drift briefly became the second-largest perpetuals DEX by volume across all chains, and claimed the top spot on Solana, according to DefiLlama data. The volume spike on July 18 reached $1.089 billion, beating its previous all-time high from April 2024, when Drift saw around $720 million in perps trading in a single day.

As of press time, however, the protocol ranks fourth in daily trading volume of perpetuals across chains, trailing only edgeX, Jupiter, and Hyperliquid. Hyperliquid leads the pack with over $13 billion in daily perp volumes, with the next largest, Jupiter, seeing just under $1 billion.

Amid this influx of on-chain trading, DRIFT rose over 40% to peak at $0.73 today, and is currently up over 33%, while trading volume for the token shot up more than 2,800% to $323 million, based on CoinGecko data.

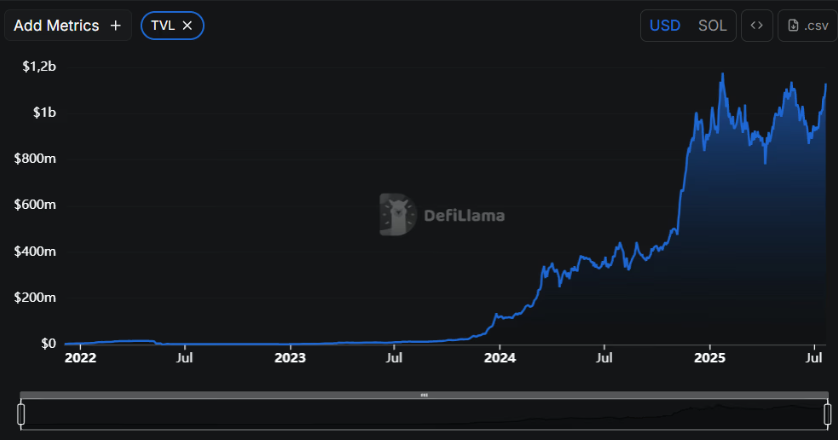

Drift’s total value locked (TVL) is currently sitting at about $1.13 billion, with a good chunk of that likely coming from its Drift Earn program, where users can earn yield via lending and market-making on the platform.

The latest wave of activity seems tied to a move Drift made earlier this month. On July 10, the protocol launched zero-fee ETH perpetuals with leverage up to 101x, meaning traders could open massive positions without paying trading fees.

In the days following the rollout, Solana-wide perpetual futures trading volumes increased by 234%, and Drift seems to have picked up a good chunk of that activity, showing that traders are really responding to the zero-fee, high-leverage setup.