Ripple (XRP) may be a top crypto, but in 2026 it lacks momentum. There are no strong catalysts and its network activity has slowed. On the other hand, Mutuum Finance (MUTM) is providing asymmetrical investment opportunities due to low market capitalization, high adoption rates, and actual use. Currently valued at just $0.04 in Presale Phase 7, MUTM is already going viral as one of the best low-cost cryptos to invest in and is being regarded as the next crypto to explode by many analysts.

XRP Fights to Reclaim Momentum

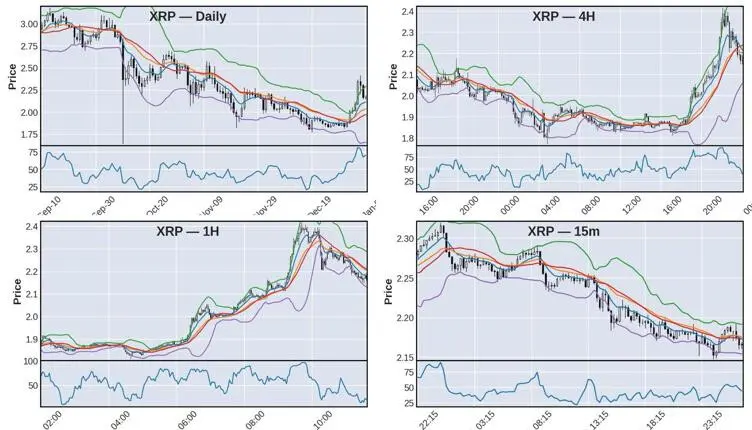

While there’s a clear attempt at a short-term rebound for the XRP coin to support the price around the regions of $2.15-$2.18, there still seems to be very little strength in the trend. A clear break-out past the $2.50 mark is required to demonstrate a trend change. However, there’s only very limited strength in the volume. Such limitations point to one of the reasons why investors seeking high growth have largely begun to focus on the smaller market cap DeFi token Mutuum Finance, which is increasingly being called a top crypto for early-stage investing in 2026.

The MUTM Presale Opportunity

Mutuum Finance’s presale event has attracted 18,770+ participants, raising $19.7 million. This is evidence of substantial support for the project. Phase 7 tokens sell at $0.04, which is the lowest they will ever go for. Phase 8 will raise the price to $0.045 while public trading will open at $0.06. Early investors receive valuable pricing as a lead-up to regular market exposure. Experts forecast that if adoption persists, MUTM could reach $0.40, delivering a 10x ROI for investors accumulating in this phase. For those who wait to join in phase 8, the return will shrink to 8x and just 6x for those who wait for $0.06 listing price.

In contrast to XRP, whose high market cap prevents substantial gains, MUTM’s low cost of entry and adoption trajectory provide a historic opportunity for substantial gains. Many consider MUTM the next crypto to explode, making it a prime candidate for portfolio diversification in 2026.

Mutuum Finance is a token that goes beyond being a speculative token, it is a decentralized lending and borrowing platform. It offers Peer-to-Contract (P2C) lending and Peer-to-Peer (P2P) lending. The former relies on smart contracts to dynamically adjust interest rates according to market conditions. Users can expect to earn $900-$1,800 per year with 10,000 USDT at 9-18% APY. The P2P approach enables users to set their own interest rates on volatile assets such as Dogecoin. These rates could go higher than P2C’s rates, depending on the agreement between transacting parties. This multi-functional approach to DeFi investment makes MUTM a viable DeFi crypto token and increasingly regarded as a top crypto for serious investors.

Security and Rewards

MUTM uses the buyback-and-redistribute mechanism wherein a certain amount of the protocol fees is used to buy back the token from the open market to reward the staking of mtTokens to users. In this manner, the tokenomics establish an incentivized ratio between the use of the platform and the rewarding of the users, which is not the case with legacy cryptocurrencies such as XRP.

Securing the platform is also a foundation of Mutuum Finance. The project successfully passed a Halborn Security and adopted all recommendations to improve security. Soon, the V1 protocol will be deployed to the Sepolia testnet will support direct interaction with liquidity pools, mtTokens as representatives of deposits, debt tokens for loans, and an automated liquidator bot for under-collateralized positions. The protocol, initially supporting ETH and USDT, will expand to other assets and multiple chains as well, and early testnet access alleviates concerns about the project’s functionality and future prospects among investors. With its strong fundamentals, Mutuum Finance is steadily earning a reputation as a top crypto with real DeFi utility.

MUTM Poised for Asymmetric Gains

Although XRP is likely to provide modest returns, Mutuum Finance presents an early development chance with great potential. This comes with a cheap entry point, the revenue-sharing reward program for presales investors, and a functional DeFi environment. Looking ahead into the 2026 bull cycle, MUTM may outperform XRP in its price increase and thus be considered one of the cryptos with explosive breakout potential and the next crypto to explode.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://mutuum.com/

Linktree: https://linktr.ee/mutuumfinance