If Zcash (ZEC) was one of the winners of 2025, 2026 could become the year for Monero (XMR).

Several factors indicate that XMR has the potential to become a standout performer in 2026. However, the same characteristics also make it a sensitive asset. They may expose users and investors to legal risks.

Stable On-Chain Transaction Demand Over Many Years

The first catalyst comes from XMR’s on-chain transaction demand. This trend appears clearly in blockchain data.

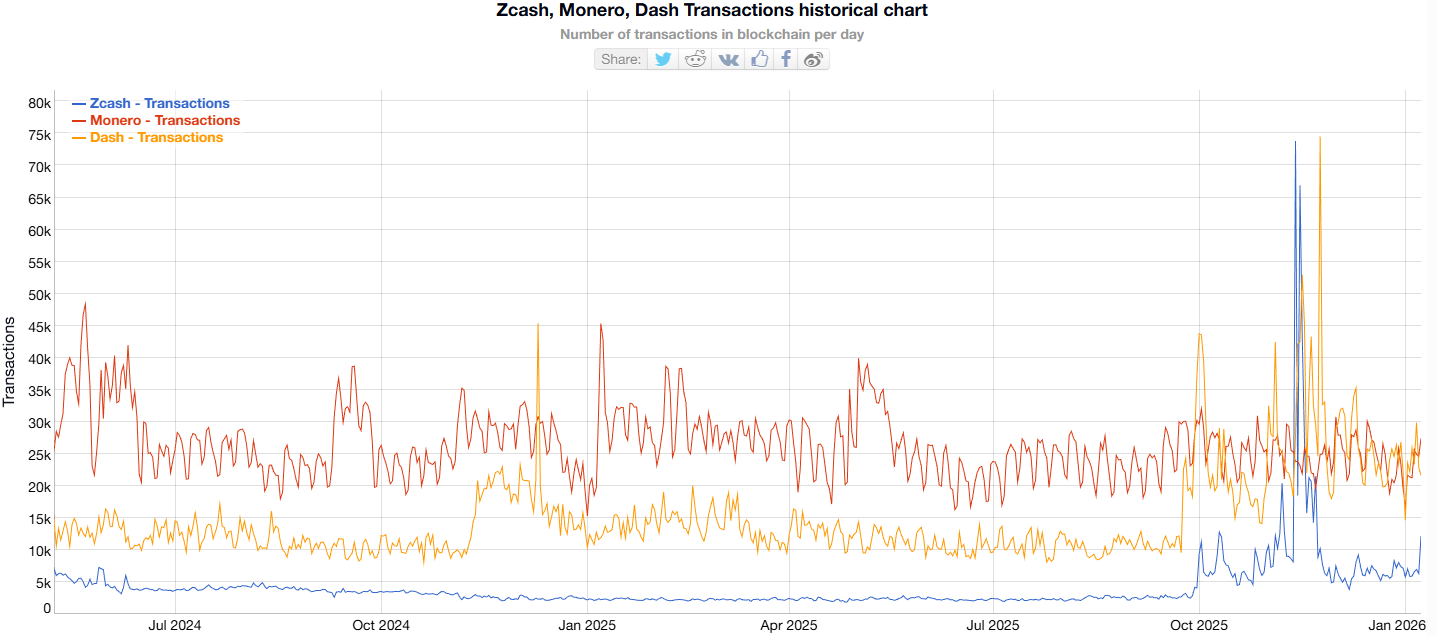

Bitinfocharts data tracks daily transaction counts for the three leading privacy coins over nearly the past three years.

Transaction volumes for ZEC and DASH surged in Q4 2025 and then declined sharply. In contrast, XMR transaction counts have remained stable for many consecutive years.

Zcash, Monero, and Dash Daily Transactions. Source: Bitinfocharts

Stable demand provides a solid foundation for long-term growth and stability. It differs fundamentally from growth driven by short-term hype and speculation.

Additionally, recent reports suggest that over longer time frames, XMR exhibits stronger trading volume and user activity than both ZEC and DASH.

Monero May Avoid Risks Similar to Zcash (ZEC)

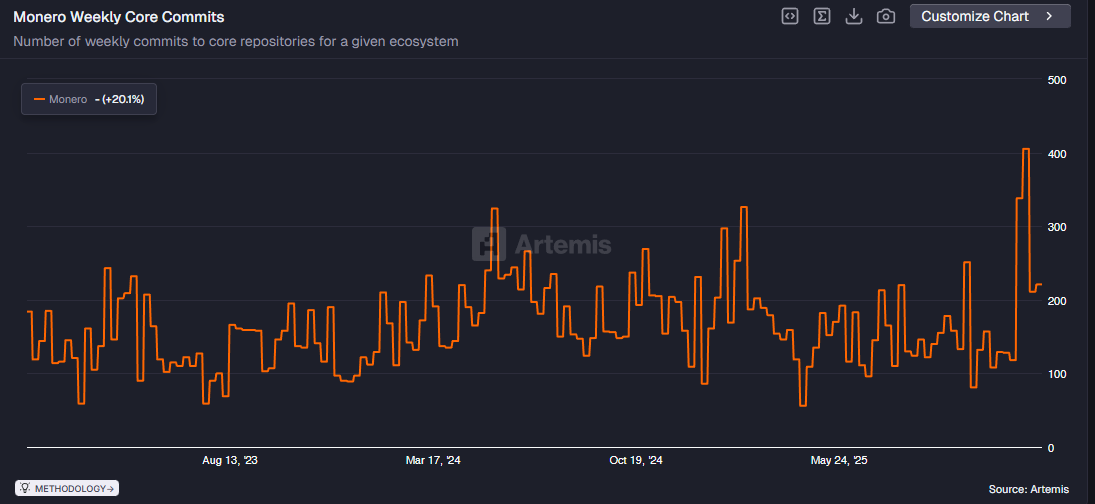

The second catalyst comes from signs of strong and consistent developer activity around Monero.

Unlike many projects, Monero (XMR) does not operate under a formal company. A decentralized community of researchers, developers, and volunteers maintains and develops the protocol.

This structure helps XMR avoid risks similar to those faced by the ZEC development team. Many investors believe this factor could support new price highs. This is especially important as investors increasingly avoid assets with centralized governance risks.

“XMR remains the most exciting large-cap alt in my sights for the near future. A decade-long track record of real use as private money, not a hyped speculation play. XMR also avoids the corporate overhang seen with ZEC. A break above all-time highs favors a major upside move,” investor The Crypto Dog said.

Artemis data also shows that Monero’s weekly core developer commits reached 400 in late December last year. This marked an all-time high.

Monero Weekly Core Commits. Source: Artemis

This signal reflects a strong commitment from the development community. It may help build confidence among new investors.

Privacy Becomes Central in the Era of Crypto Tax Reporting

The third catalyst comes from rising demand for privacy as new crypto tax reporting frameworks take effect in 2026.

A BeInCrypto report notes that the European Union’s new DAC8 directive on digital asset tax transparency came into force on January 1, 2026. The rule requires exchanges, brokers, and custodians to report detailed user and transaction data to national tax authorities.

“Monero (XMR) is the ultimate nightmare for tax authorities. It is engineered from the ground up to resist tracking through ring signatures, confidential transactions, and stealth addresses,” investor CR1337 said.

Using XMR to conceal transactions may be considered illegal under many legal frameworks. Even so, this reality still reflects a segment of market demand.

This dynamic resembles two sides of the same coin. As regulatory pressure increases, demand for privacy tools also rises. A market for Monero, therefore, continues to exist, provided the asset delivers real utility aligned with user objectives.

However, acting against government authority and interests also exposes XMR users to legal risks.