Circle’s USDC has overtaken Tether’s USDT in annual transaction volume for the first time, marking a historic shift in the stablecoin landscape.

For a decade, USDT has reigned as the undisputed king of stablecoins. It still commands a $187 billion market cap—nearly 2.5 times USDC’s $75 billion market cap. Yet 2025 revealed a different story beneath the surface: the smaller stablecoin is now moving more money.

USDC Leads by 39%

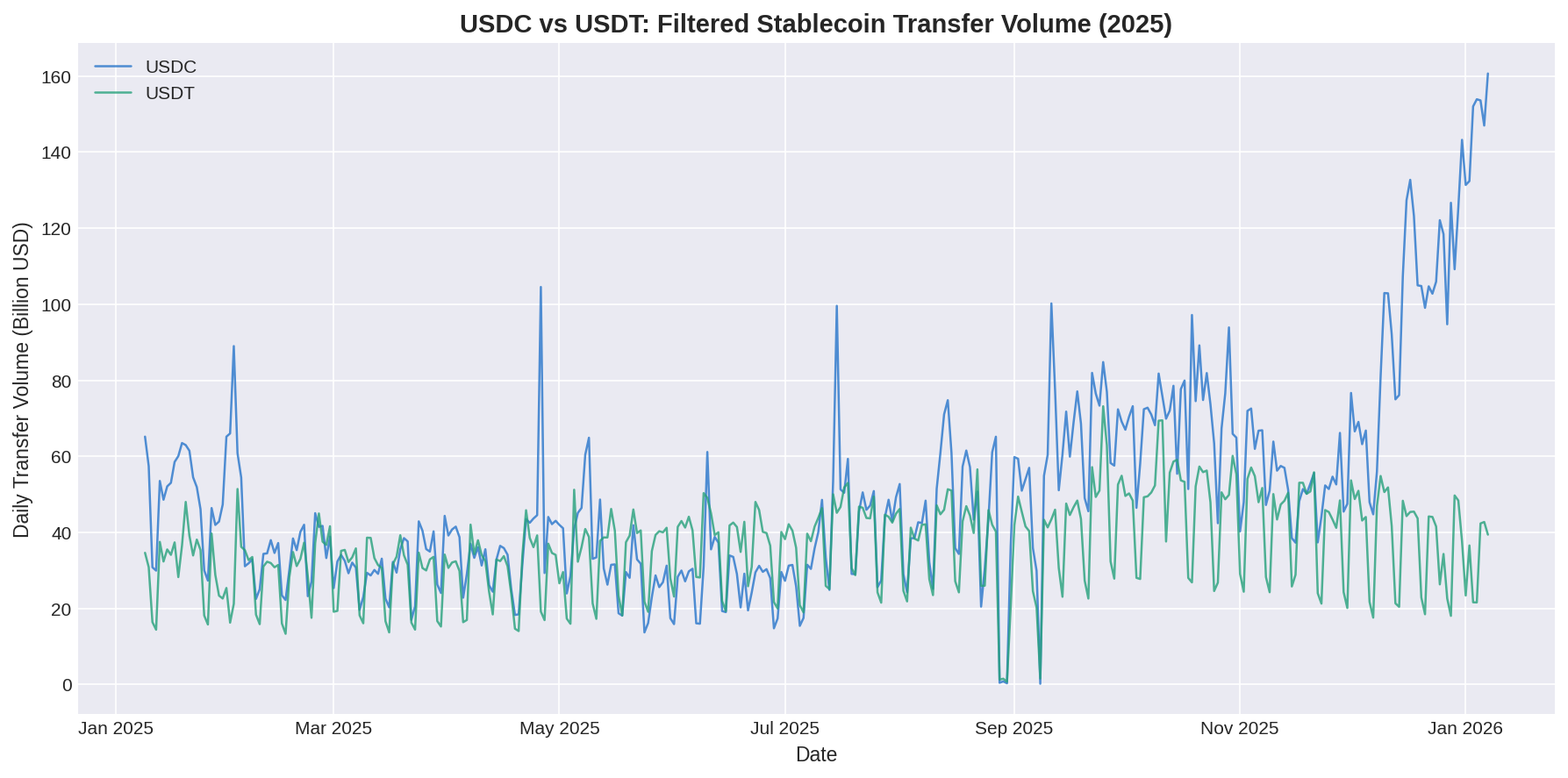

According to data from Artemis Analytics, USDC processed $18.3 trillion worth of transfers in 2025, compared to USDT‘s $13.2 trillion—a 39% gap.

Artemis Stablecoin Transfer Volume filters out MEV bot transactions and intra-exchange transfers, isolating the platform’s “organic” on-chain activity. This metric provides an upper bound on actual payments and DeFi usage, rather than raw transaction counts inflated by automated trading. In short, real-world payments, P2P transfers, and DeFi activity count; automated bot trades and exchange wallet reshuffling do not.

USDC processed $18.3 trillion worth of transfers in 2025, compared to USDT’s $13.2 trillion—a 39% gap. Source: Artemis (Edited by BeInCrypto)

Why USDC Pulled Ahead

The gap comes down to four factors: how DeFi works, where it’s happening, an unexpected catalyst, and regulatory timing.

1. DeFi Turnover

Analysts attribute the gap largely to how each stablecoin is used. USDC dominates decentralized finance platforms, where traders frequently enter and exit positions. The same dollar gets recycled multiple times through lending protocols and DEX swaps. USDT, by contrast, serves more as a store of value and payment rail—users tend to hold it in wallets rather than move it constantly.

2. The Solana Factor

Solana’s explosive DeFi growth became USDC’s primary engine. The stablecoin now accounts for over 70% of all stablecoins on the network, while USDT remains concentrated on Tron. In Q1 2025 alone, Solana’s total stablecoin supply surged from $5.2 billion to $11.7 billion—a 125% increase driven almost entirely by USDC inflows.

3. The Trump Token Irony

The January 2025 launch of the TRUMP memecoin inadvertently supercharged USDC adoption. The token’s primary liquidity pool on Meteora DEX is paired with USDC, not USDT. This meant traders rushing to buy TRUMP first needed to acquire USDC, creating a demand spike that rippled across Solana’s DeFi ecosystem.

The irony runs deeper: the Trump family launched its own stablecoin, USD1, through World Liberty Financial in March. Yet the TRUMP token they inspired ended up boosting a competitor’s stablecoin.

4. Regulatory Tailwinds

The July passage of the Genius Act in the US established clear legal standards for stablecoin issuers. Industry observers note that USDC’s longstanding emphasis on regulatory compliance and reserve transparency positioned it to benefit most from the new framework. In Europe, USDC’s MiCA compliance has given it an edge amid delisting pressure on several exchanges facing USDT.

A Rising Tide

The USDC surge contributed to record stablecoin activity overall. Total transaction volume reached $33 trillion in 2025, up 72% year over year. Q4 alone saw $11 trillion in flows, accelerating from $8.8 trillion in Q3.

Bloomberg Intelligence projects stablecoin payment flows could reach $56 trillion by 2030, positioning the sector as a major global payment rail alongside traditional networks.