A cryptocurrency analyst has pointed out how Bitcoin could risk a crash to $69,230 if the support level of this Bear Pennant doesn’t hold up.

Bitcoin Might Need To Hold Above $87,200

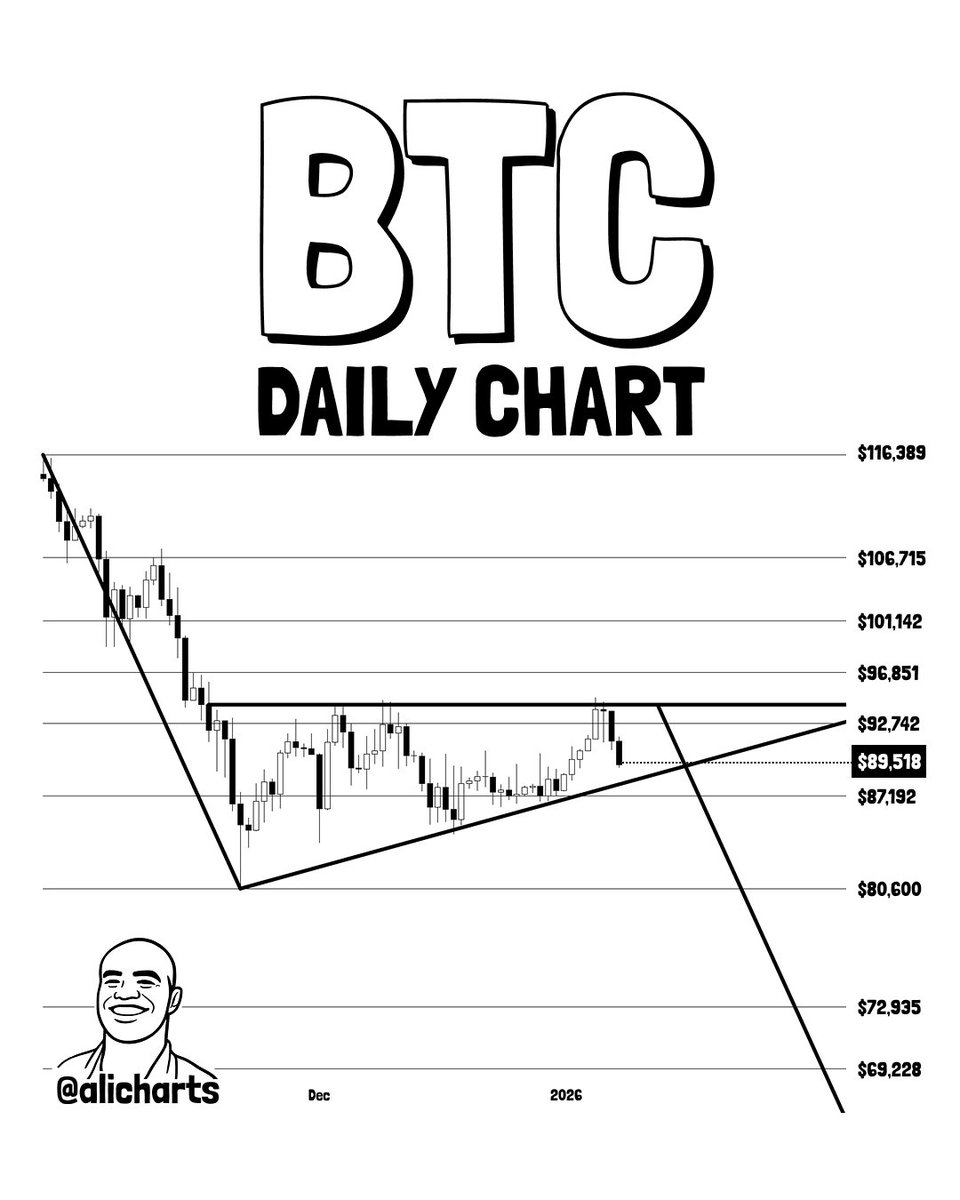

In a new post on X, analyst Ali Martinez has talked about a support level that BTC might have to hold in order to avoid a steep drop. The level in question is the lower line of a Bear Pennant.

A Pennant is a pattern from technical analysis (TA) that’s similar to a Flag. Both of these patterns are characterized by an initial sharp move (commonly known as the “pole”) and a subsequent phase of consolidation. But unlike Flags, which involve a parallel consolidation channel, Pennants involve a triangular channel instead.

When the price is trading inside the consolidation portion of the Pennant, it encounters resistance at the upper line and support at the lower one. A breakout of either of these levels may signal a sustained move in that direction. Pennants are generally considered to be continuation patterns, so a move may be more likely to take place in the same direction as the pole. In a Bear Pennant, the pole is represented by a downward move, implying that a bearish continuation could succeed the pattern.

Now, here is the chart shared by Martinez that shows the Bear Pennant that Bitcoin has been trading inside on the daily timeframe over the last couple of months:

As displayed in the above graph, Bitcoin retested the upper line of the Pennant’s consolidation region when its price surged above $94,000. This retest ended up in rejection, and the coin has since retraced to lower levels.

If the current trajectory in the cryptocurrency continues, it’s possible that a retest of the support level could take place, which is situated around $87,200. Since the pattern involved here is a Bear Pennant, BTC failing a retest of this line could signal a bearish breakout.

Pennant breakouts are usually considered to lead to a move that’s similar to the pole in length. Based on this, BTC’s breakout target from the current pattern could lie near $69,000. “Bitcoin $BTC must hold above $87,200 to avoid a drop toward $69,230,” explained the analyst.

Bitcoin is currently also trading near an important on-chain level: the Active Realized Price. This indicator keeps track of the average cost basis of the active network participants. According to data from on-chain analytics firm Glassnode, the Active Realized Price is located at $87,700 right now, meaning that the active investors are in a slight amount of net profit.

BTC Price

At the time of writing, Bitcoin is trading around $90,400, up more than 1% over the last week.