VanEck has laid out a long-term framework that reframes Bitcoin less as a speculative trade and more as a structural component of future global finance, arguing that its real value will emerge over decades rather than cycles.

In a new research paper focused on capital market assumptions, the asset manager models how Bitcoin could evolve between 2026 and 2050 as pressure builds on sovereign debt systems and traditional reserve assets.

Key Takeaways

VanEck frames Bitcoin as a long-term monetary asset driven by global liquidity and sovereign debt pressures rather than short-term trading cycles

The firm expects volatility to remain high, but sees derivatives and leverage as the main source rather than weakening fundamentals

Bitcoin’s correlation profile suggests it can improve portfolio efficiency even at small allocations

VanEck argues the biggest risk for long-term investors may be having no Bitcoin exposure at all

Rather than relying on conventional valuation tools used for equities, VanEck approaches Bitcoin as a non-sovereign monetary network whose adoption depends on settlement use, reserve diversification, and global liquidity trends.

According to the firm, short-term price movements will likely remain volatile and driven by leverage and liquidity conditions. However, the long-term thesis centers on Bitcoin’s ability to absorb capital as confidence in fiat-based systems gradually erodes.

Bitcoin’s long-term role goes beyond price cycles

VanEck’s analysis positions Bitcoin as a convex asset with asymmetric upside – one that does not behave like stocks, bonds, or even gold across full market cycles. The firm expects Bitcoin’s long-term return profile to be shaped primarily by global money supply growth and ongoing monetary debasement, rather than productivity or earnings.

In its base scenario, VanEck models Bitcoin compounding at roughly 15% annually over a 25-year horizon. Even in a conservative outcome where adoption stalls, the firm argues Bitcoin could still retain value due to its scarcity and existing network utility. More aggressive scenarios assume Bitcoin plays a meaningful role in global trade settlement and central bank reserve diversification, particularly if trust in sovereign debt weakens further.

The report stresses that traditional valuation methods fail to capture these dynamics, prompting the firm to instead focus on adoption-based penetration models tied to international trade and reserve allocation.

Liquidity, not sentiment, drives Bitcoin’s behavior

A key finding in the research is Bitcoin’s close relationship with global liquidity. VanEck’s data suggests changes in global money supply explain a significant portion of Bitcoin’s long-term price behavior, reinforcing the view that the asset functions as a “liquidity sponge” rather than a levered technology proxy.

At the same time, Bitcoin’s historical inverse relationship with the US dollar has begun to moderate. Rather than reacting purely to dollar strength or weakness, Bitcoin appears increasingly sensitive to broader fiscal instability across major economies.

This shift, VanEck argues, supports the idea that Bitcoin is transitioning from a niche hedge against dollar debasement into a more generalized hedge against global monetary stress.

Volatility remains high, but structural forces are changing

Despite its long-term potential, VanEck does not downplay Bitcoin’s volatility. The firm assumes sustained annualized volatility between 40% and 70% for long-term modeling, comparable to frontier markets or early-stage technologies.

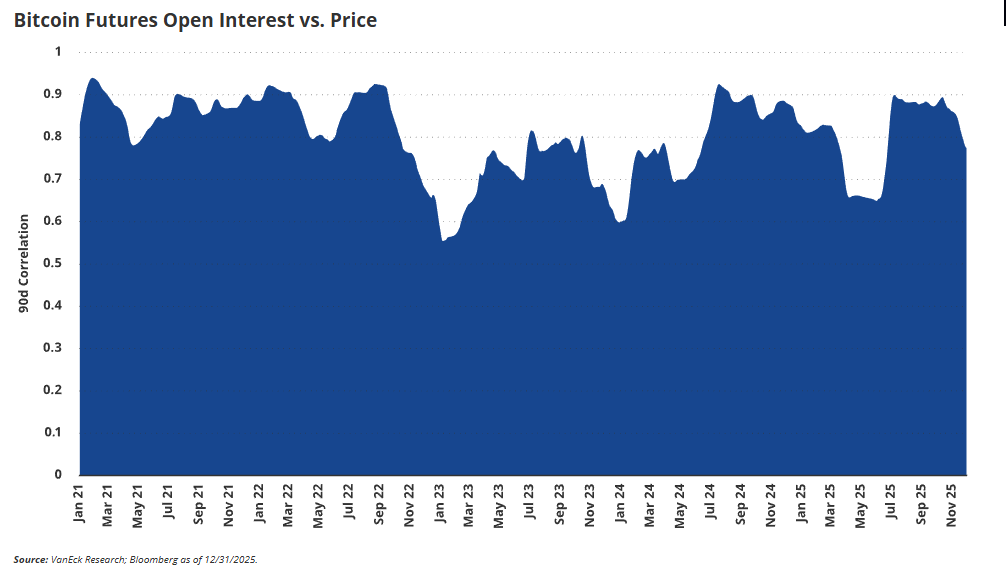

Importantly, much of this volatility is now attributed to derivatives and leverage rather than spot selling. Futures positioning and funding rates increasingly dictate short-term price swings, creating sharp but often mechanical moves that do not necessarily undermine the broader adoption thesis.

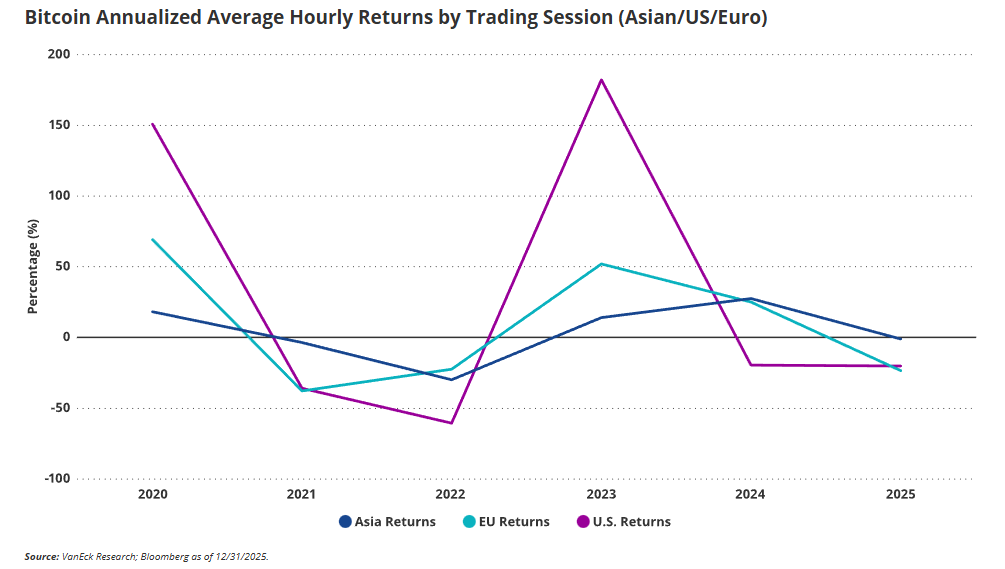

At the same time, realized volatility has gradually declined, suggesting Bitcoin’s market structure is maturing as global participation increases and price discovery becomes more evenly distributed across regions.

Portfolio implications for institutional investors

From an allocation perspective, VanEck frames Bitcoin as a portfolio efficiency tool rather than a core holding. Small allocations, typically between 1% and 3%, are presented as sufficient to improve risk-adjusted returns due to Bitcoin’s low correlation and asymmetric upside.

For investors with higher risk tolerance, larger allocations may enhance returns, but the firm emphasizes disciplined sizing to avoid allowing volatility to dominate portfolio outcomes.

Ultimately, VanEck argues that the real risk for long-term allocators may not be Bitcoin’s volatility, but having no exposure at all as global financial systems enter a prolonged period of debt strain and monetary experimentation.