Solana price prediction is at the forefront of market discussions as it reached a new weekly high above $140 amid strong institutional demand, a major ecosystem update, and broader market revival.

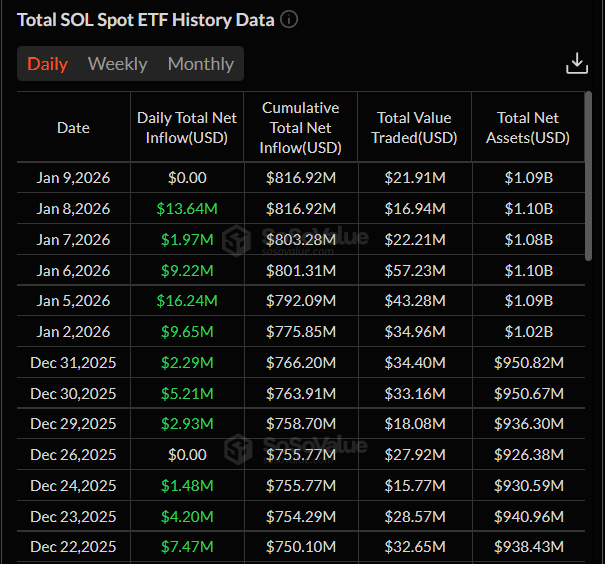

Steady inflows in SOL ETFs have contributed to the bullish momentum in SOL price. As of Friday’s closing, US SOL Spot ETFs now have $816.92 in total net inflows. Despite being a new contender in the space, it has already outperformed Bitcoin and Ethereum ETFs, which have suffered heavy outflows in recent times.

Another key catalyst over the weekend was an urgent v3.0.14 upgrade for all Mainnet-Beta validators, reinforcing stability across its $76.8 billion ecosystem. This critical update shows that the network is making efforts to improve resilience, particularly with the highest transaction speed in the industry and rising developer activity.

However, the market momentum is the most important factor in shaping price action in the current market conditions. SOL is currently trading above the $141 support level, retesting the previous resistance level and setting momentum for a potential rebound toward the $150 resistance area.

How ETF Inflows Are Impacting Solana Price?

Since their inception, Solana ETFs have recorded strong, persistent institutional accumulation, which is building a foundation for a potential bullish Solana price prediction.

The steady inflows into these products indicate long-term positioning by investors, not short-term speculation. This means these accumulations can eventually translate into sustained upward price momentum for the underlying asset.

Source: Sosovalue

According to Sosovalue data, the total net asset value of SOL spot ETFs has reached $1.09 billion. The net asset ratio of these ETFs relative to Bitcoin’s total market value is 1.43%, and cumulative historical net inflows have reached $816 million. This is a strong number compared to spot BTC ETFs, which saw $680.90 million in net outflows last week.

Solana treasury companies that accumulate SOL for staking and investment purposes have done well last week. Crypto analyst Ted Pillows recently highlighted that these companies have performed well in the stock market. These stocks often move ahead of the spot price (Solana token price) because they reflect long-term positioning and institutional interest.

Solana treasury companies are doing well this week.

If this continues for a few more weeks, we could see accelerated $SOL buying.

And if the rally fades, SOL will continue its downtrend. pic.twitter.com/w5r7uwypEw

— Ted (@TedPillows) January 10, 2026

SOL’s Critical v3.0.14 Upgrade Drops

Pivotal infrastructure update took place in Solana as developers deployed an “urgent” security patch across the network’s validators. On January 10, Solana Status released a notice recommending all Mainnet-Beta validators upgrade to v3.0.14.

URGENT RELEASE: The v3.0.14 release is now recommended for general use by Mainnet-Beta validators.

This release contains a critical set of patches and should be applied to staked and unstaked Mainnet-Beta validators.

— Solana Status (@SolanaStatus) January 10, 2026

Solana has released this update while the network moves deeper into the v3 validator phase and sees stronger usage across its ecosystem. As a Layer 1 blockchain, Solana runs on its Mainnet Beta and uses Proof of History to organize transactions by time before they reach consensus. This approach reduces delays and allows the network to handle transactions more efficiently.

The v3.0.14 release fits into Solana’s broader development plans. Instead of adding new features, the update targets core network improvements. It strengthens performance, boosts stability, and prepares the blockchain to scale as demand grows. With more users and applications placing heavier loads on the network, these changes aim to keep Solana running smoothly under increasing pressure.

Solana Price Prediction: What Comes Next for SOL?

In recent weeks, the Solana price has been retesting the $145 resistance zone. A decisive breakout above the zone could trigger bullish buying towards the $150-$160 level. Currently, the altcoin is holding strongly near the $140 level, with a 3.47% increase over the past seven days.

Momentum indicators reinforce the bullish bias, with the RSI (relative strength index) holding above 60, indicating bullish sentiment. Sustained acceptance above the 60 level could further attract buyers and pave the way towards higher levels.

Solana price chart. Image Courtesy: TradingView

The $135 level, in confluence with the 50-day and short-term moving averages, is solid support for short-term volatility. However, if the price fails to hold these levels, it could drop to the $130 support level.

Upside momentum looks more promising as the $145 resistance has been weakened. If SOL breaks out above the level, $170 could be the first target. However, if momentum sustains and the broader market remains bullish, the altcoin could surge to the target of $200. Such a move would reintroduce upside potential, confirming the bullish trend in the Solana price.