Hashflow (HFT) is shaking up decentralized finance (DeFi) with its innovative approach to trading and liquidity.

Unlike traditional automated market makers (AMMs), Hashflow uses a request-for-quote (RFQ) system to connect traders with top-tier market makers, offering better prices, zero slippage, and a seamless experience.

In this guide, we’ll break down what Hashflow is, how it works, and why it’s a game-changer for DeFi. We’ll also dive into its token, HFT, and how stakers can earn rewards. Let’s get started!

Want to trade crypto while reading our latest news? Head over to Bitrue and explore your options today!

Understanding Hashflow’s Core Concept

Hashflow is a decentralized exchange (DEX) protocol designed to make trading crypto assets faster, cheaper, and more reliable.

Its RFQ system is the secret sauce, connecting traders (takers) with professional market makers who provide liquidity. This setup ensures tight spreads, no slippage, and protection against common DeFi pitfalls like front-running and sandwich attacks.

How Does Hashflow’s RFQ System Work?

Instead of using the constant-product pricing model common in AMMs (like Uniswap’s xy=k formula), Hashflow moves pricing off-chain.

Market makers source liquidity from various places and use sophisticated off-chain pricing strategies. These strategies factor in real-world data like historical prices, market volatility, and other metrics to offer competitive quotes.

Here’s the kicker: once a market maker provides a quote, they cryptographically sign it. This locks in the price for the trade’s duration, guaranteeing traders get exactly what they see, no surprises, no slippage. It’s a win for both traders and market makers.

Why Hashflow Stands Out in DeFi

Hashflow’s RFQ system tackles some of DeFi’s biggest pain points:

Zero Slippage: Traders get the exact price quoted, unlike AMMs where prices can shift mid-trade.

MEV Protection: No front-running or sandwich attacks, ensuring fair trades.

Cross-Chain Support: Hashflow works across major blockchains, making it versatile.

Top-Tier Liquidity: With over 25 market makers, Hashflow delivers deep liquidity for various assets.

Hashflow’s Fee Structure: Simple and Smart

Hashflow charges fees on trades to keep the protocol running and reward its community. The fee model is straightforward but varies depending on the trading pair.

Dynamic Fees for Blue-Chip Pairs

For popular pairs like USDC-WETH, Hashflow uses dynamic fees that adjust every five seconds based on live market data.

This keeps quotes competitive without hurting trading volume. Fees are baked into the price quote, so traders don’t need to worry about extra costs at checkout.

Static Fees for Non-Blue-Chip Pairs

For less common pairs like USDC-USDT or USDC-ARB, Hashflow applies static fees. These are also included in the quoted price, ensuring transparency. Whether dynamic or static, fees are automatically deducted when trades execute.

Earning with HFT: Revenue Sharing for Stakers

HFT, Hashflow’s native token, isn’t just for governance, it’s a way for stakers to earn a slice of the protocol’s revenue. Trading fees are distributed monthly to support the ecosystem and reward HFT holders.

How Revenue Is Shared

The protocol splits its revenue as follows:

50%: Goes to HFT stakers as rewards.

30%: Funds the community treasury for future HFT buybacks.

20%: Covers the Hashflow Foundation’s operating expenses.

This model incentivizes staking while ensuring the protocol remains sustainable. Stakers benefit directly from Hashflow’s growth, making HFT an attractive asset for long-term holders.

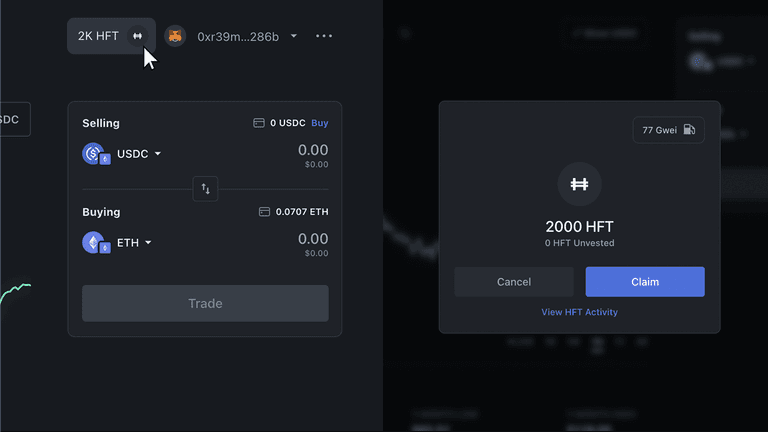

How to Claim Your HFT Rewards

Claiming rewards is easy:

Visit the Hashflow trading app on your desktop.

Click the Hashflow icon in the top-right corner of the dashboard.

If eligible, you’ll see your HFT balance and a “Claim” button.

Click “Claim” and follow the prompts in your wallet.

Make sure your wallet is connected, and you’re good to go!

Read Also: What is Annoncelight?

Hashflow: The Future of DeFi Liquidity

Hashflow is redefining how liquidity works in DeFi. By combining off-chain pricing with on-chain security, it offers a faster, more efficient way to trade.

Its RFQ system delivers better prices, deeper liquidity, and a premium experience without the need to build complex infrastructure from scratch.

Why Hashflow Matters

For traders, Hashflow means reliable pricing and access to top-tier liquidity.

For market makers, it’s a streamlined way to scale operations and tap into high-quality flow. For HFT stakers, it’s a chance to earn passive income through revenue sharing.

The Bigger Picture

As DeFi grows, platforms like Hashflow are paving the way for more efficient, secure, and accessible trading. With its cross-chain support and focus on user experience, Hashflow is well-positioned to stay a leader in the space.

Conclusion

Hashflow (HFT) is more than just another DEX, it’s a liquidity layer that’s changing the game for traders, market makers, and stakers. Its RFQ system eliminates slippage and MEV risks, while its fee model and revenue-sharing keep the ecosystem thriving.

Whether you’re trading, providing liquidity, or staking HFT, Hashflow offers a seamless, rewarding experience. Ready to dive in? Check out the Hashflow trading app and explore the future of DeFi liquidity today!