Hackers returned 90% of the assets recently stolen in the GMX hack. Correspondingly, the GMX token rose 15%, recovering most of the damage from the incident.

Nonetheless, GMX has yet to clearly describe how the attack took place. Hopefully, the team can patch up any security vulnerabilities and restore user confidence.

GMX Hack Largely Resolved

Two days ago, the GMX hack took the whole community by surprise, pillaging $42 million from the popular decentralized exchange.

After it happened, developers encoded a message to the attackers, offering a 10% white hat bounty if they returned 90% of the funds. In exchange, GMX wouldn’t pursue legal action. Apparently, the hackers took them up on the offer:

The #GMX hacker chose to return the stolen $42M assets for a $5M white-hat bug bounty.Currently, $10.49M $FRAX has been returned.Another $32M assets had been swapped into 11,700 $ETH, which is now worth $35M—netting a ~$3M gain.

— Lookonchain (@lookonchain) July 11, 2025Will the hacker return all 11,700…

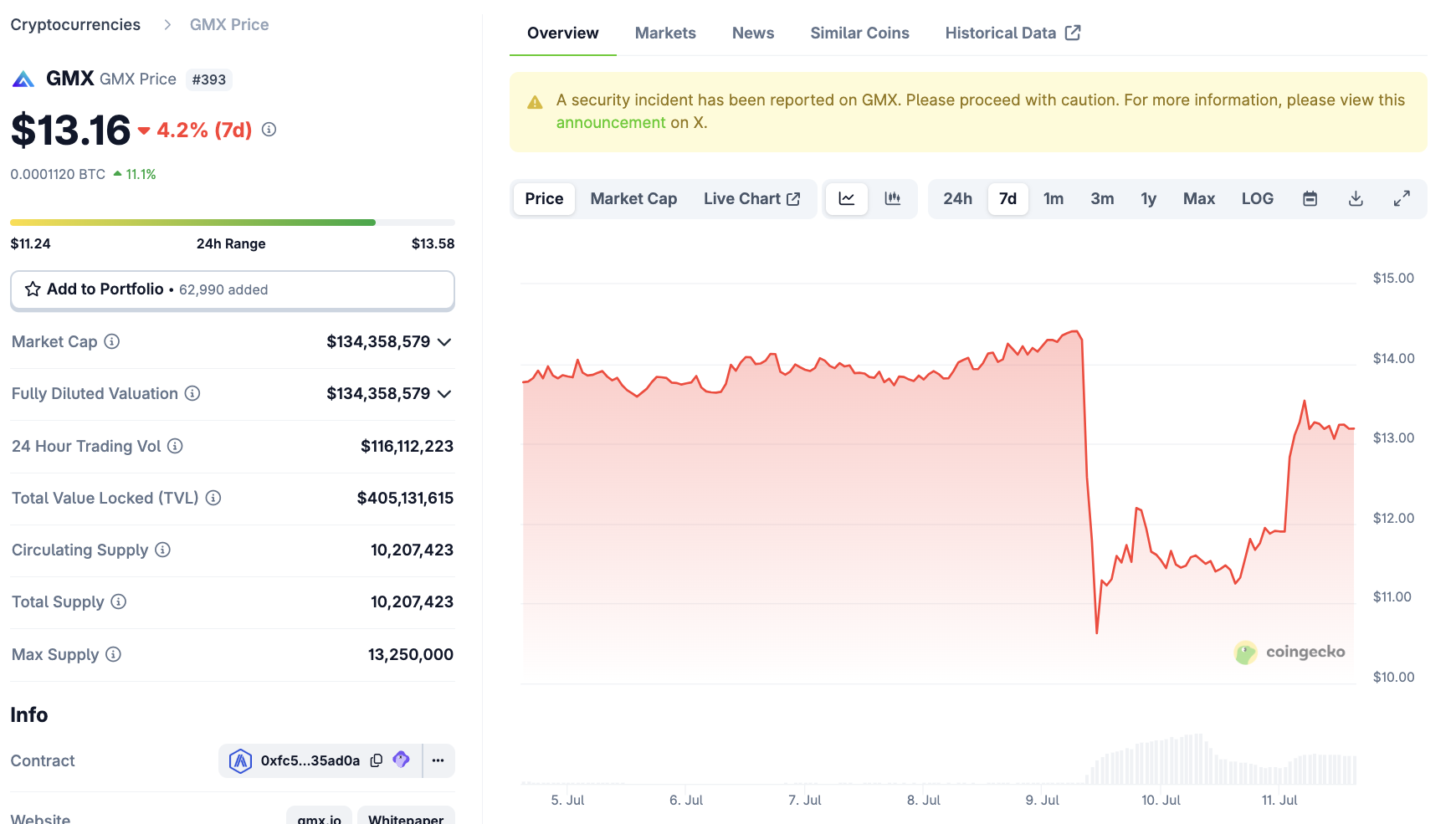

At the time of this writing, the vast majority of GMX hack proceeds have already been returned. GMX’s token crashed more than 35% after the incident, but it rose 15% after attackers began reimbursing the exchange.

This hasn’t been sufficient to reverse all the tokens’ losses, but the community is nonetheless relieved at the news.

GMX Price Performance. Source: CoinGecko

Additionally, even though the perpetrators returned most of the money, they still had an opportunity to profit. Specifically, they used Ethereum to launder funds after the hack, becoming one of the week’s largest ETH transactions.

The price of Ethereum has increased dramatically since the incident took place. In other words, since it’s been converted to ETH, 10% of the stolen GMX money is now worth substantially more than it was before the hack.

Although there was a little speculation that the perpetrators might try to sell this ETH and return fiat currency to GMX, they kept everything on-chain.

Unfortunately, there is one remaining loose end. We still don’t have a clear idea of how the GMX hack took place. Since crypto crimes are so rampant right now, this could be very valuable information.

If GMX can reassure its users that the exploit has been fixed, it might restore some confidence.