Pieverse price predictions attract many beginners who want to understand this new token before investing. In mid-January, PIEVERSE trades around $0.45. In the last month, the price moved a lot. The monthly low was $0.36 on December 17. The monthly high reached $0.91 on January 8. This shows strong volatility and strong interest at the same time.

Many new investors ask simple questions. What is Pieverse? Why does the price change so fast? Can this token grow in the future? This article answers these questions step by step. It explains the project in simple words. It also shows what may affect the price in the coming years.

You will learn what Pieverse does and why it exists. You will also see possible scenarios for the future. If you are new to crypto, this article will help you understand the basics. If you already invest, it will help you judge the risk better. Let’s start with the fundamentals and build a clear picture of Pieverse.

| Current PIEVERSE Price | PIEVERSE Price Prediction 2026 | PIEVERSE Price Prediction 2030 |

| $0.45 | $0.75 | $8 |

Pieverse (PIEVERSE) Overview

Pieverse, with the ticker PIEVERSE, is a Web3 payment and compliance infrastructure built mainly on BNB Smart Chain. Its main goal is simple. It connects normal on-chain crypto payments with documents that accountants and tax offices can accept. These include invoices, receipts, and checks. The project targets the coming “agentic era.” In this world, AI agents and machines will make payments on their own. At the same time, Pieverse solves a common problem. Crypto payments often have no proper paperwork for taxes or audits.

In practice, Pieverse turns raw blockchain transactions into verified financial records. Each record includes clear data about who paid, for what, when, and how much. The system adds timestamps and cryptographic proof. This makes every payment easier to track and easier to explain to auditors. The team often calls Pieverse a “timestamping layer for compliant value exchange.” This describes its role in a very direct way.

The network runs mainly on BNB Chain today. It also integrates with Base and plans to expand to Ethereum L2 networks. The PIEVERSE token has two roles. It works as a utility token inside the system. It also serves as a governance token. Holders can vote on future changes, fees, and new integrations.

The target users include freelancers, companies, DAOs, and content creators. Another important group are AI agents and machine-to-machine systems. Some partners also present Pieverse as part of a broader “metaculture” and Web3 identity world. This layer adds a lifestyle and gaming narrative. Still, the core product stays focused on payments, compliance, and audit-ready records.

PIEVERSE Price Statistics

| Current Price | $0.45 |

| Market Cap | $82,286,608 |

| Volume (24h) | $21,290,980 |

| Market Rank | #324 |

| Circulating Supply | 185,000,000 PIEVERSE |

| Total Supply | 1,000,000,000 PIEVERSE |

| 1 Month High / Low | $0.92 / $0.36 |

| All-Time High | $0.9947 Dec 8, 2025 |

Pieverse Price Chart

CoinGecko, January 13, 2026

Pieverse (PIEVERSE) Price History Highlights

Pieverse entered the market at the end of October 2025 with a Pre-TGE that priced the token at only $0.01. The team raised about $200,000 in BNB by selling 20 million tokens. Shortly after, the token appeared on smaller exchanges. At first, trading stayed quiet. Access was limited and volume remained low. Many early buyers waited for a larger listing and a real market opening.

That moment came in mid-November 2025, when trading started on Binance Alpha. The price jumped fast and gave early investors more than an eleven times return. This excitement did not last long. Within days, strong selling pressure pushed the token into a sharp correction. On November 14 and 15, the price reached its first major bottom near $0.115. For many new traders, this drop felt brutal. For Pre-TGE buyers, it still meant a strong profit.

After this low, the market changed mood. Buyers returned and new exchanges listed the token. Between November 16 and 20, PIEVERSE staged a fast recovery. The price climbed to around $0.55. This meant a four times move from the bottom in just a few days. News about partnerships and the launch of futures trading added fuel to this rally.

At the end of November and the start of December, the price moved sideways. It mostly traded between $0.35 and $0.5. Volume stayed high, but the market waited for a new impulse. That impulse arrived in early December. Buying pressure increased again and the token pushed toward new highs.

On December 7 and 8, 2025, Pieverse reached its all-time high near the $1 level. Some sources even reported slightly higher prints. At this point, the gain from the November low exceeded 800 percent. The market cap climbed to around $110 million and the token entered the top ranks on CoinMarketCap.

After such a fast rise, a correction became unavoidable. In the days that followed, the price dropped hard. At one point, it fell more than 29 percent in a single day and touched the $0.4 area. This move came from profit taking and over-leveraged positions.

In late December, volatility stayed high. The token even jumped again close to $0.69 before pulling back. By early January 2026, the price settled around the $0.5 area. This still keeps it well above the November low, but far below the euphoric peak.

Pieverse Price Prediction: 2026, 2027, 2028, 2029, 2030

| Year | Minimum Price | Maximum Price | Average Price | Price Change |

| 2026 | $0.48 | $1.09 | $0.75 | +70% |

| 2027 | $0.53 | $2.32 | $1.5 | +240% |

| 2028 | $0.58 | $4.63 | $2.5 | +470% |

| 2029 | $0.64 | $8.78 | $5 | +1,050% |

| 2030 | $0.6 | $15.93 | $8 | +1,700% |

Pieverse Price Prediction 2026

LBank expects Pieverse to trade around $0.49 in 2026, which implies a modest gain of roughly +10% compared to the current price. This forecast reflects slow but steady ecosystem growth.

BeInCrypto presents a slightly wider range. According to their estimates, PIEVERSE could trade between $0.48 (+10%) and $0.83 (+90%), with an average price near $0.67 (+50%), suggesting improving market confidence.

Hexn.io is clearly more optimistic. Their 2026 forecast places Pieverse between $0.53 (+20%) and $1.09 (+150%), with an average price of $0.78 (+75%), assuming broader adoption and stronger speculative interest.

Pieverse Price Prediction 2027

LBank projects a price near $0.52 in 2027, which would represent a gain of about +15% from current levels.

BeInCrypto sees gradual expansion continuing. Their 2027 outlook ranges from $0.53 (+20%) to $0.92 (+110%), with an average price of $0.73 (+65%), pointing to steady but controlled growth.

Hexn.io remains significantly more bullish. Their models forecast Pieverse between $1.12 (+155%) and $2.32 (+430%), with an average of $1.65 (+275%), driven by expectations of accelerating ecosystem development.

Pieverse Price Prediction 2028

BeInCrypto expects Pieverse to continue its upward trend in 2028, with prices ranging from $0.58 (+30%) to $1.01 (+130%), and an average price around $0.81 (+85%).

Hexn.io, however, anticipates a much stronger expansion phase. Their 2028 forecast places PIEVERSE between $2.36 (+435%) and $4.63 (+950%), with an average trading price near $3.37 (+665%), assuming the project gains strong market traction.

Pieverse Coin Price Prediction 2029

BeInCrypto predicts further, but still moderate, growth in 2029. Their price range spans from $0.64 (+46%) to $1.11 (+150%), with an average of $0.89 (+100%).

Hexn.io again offers a far more aggressive scenario. According to their estimates, Pieverse could trade between $4.70 (+970%) and $8.78 (+1,900%), with an average price of $6.53 (+1,400%), reflecting a potential speculative expansion cycle.

Pieverse Price Prediction 2030

LBank forecasts Pieverse at around $0.6 in 2030, which would equal a gain of roughly +35% versus today’s price.

Hexn.io, on the other hand, presents an extremely bullish long-term outlook. Their 2030 projection places PIEVERSE between $8.88 (+1,900%) and $15.93 (+3,520%), with an average price near $12.07 (+2,650%), assuming successful long-term adoption and strong market positioning.

PIEVERSE Price Prediction: What Do Experts Say?

Several well-known analysts and research teams have already shared their views on Pieverse, and their opinions help create a clearer picture of how the market sees this project. One of the most visible named experts is Anton Kharitonov from Traders Union. He has over twenty years of experience in financial markets and has traded actively since 1999. His work combines classic technical analysis with a strong focus on fundamentals. In the case of Pieverse, he often describes the project as an agent-native and compliant payment stack designed for real business use.

Kharitonov follows the PIEVERSE/USD pair using tools such as moving averages, RSI, and key support and resistance zones. He also watches funding rates, open interest, and large wallet activity to detect overheating in the market. In his recent notes, he pointed out that the 50-day moving average near $0.51 works as an important support level. He also observed strong selling pressure near the $0.54 to $0.55 area. His broader view highlights three main drivers. The first is wider exchange availability, which improves liquidity. The second is the launch of futures contracts with up to 40x leverage, which increases both volume and volatility. The third is the compliance narrative, which gives Pieverse a unique position in the market.

A more institutional view comes from the Phemex research team. In a report published in late 2025, they presented a cautiously bullish scenario. Their analysts believe PIEVERSE could trade between $1.5 and $1.95 by 2026 if the ecosystem keeps growing and new partnerships appear. They value the gasless payment layer and the timestamping system as important first-mover advantages. At the same time, they warn about future token unlocks. Only a small part of the total supply is in circulation, so new tokens could create selling pressure. They expect price behavior to become more stable in the $1.30 to $2.10 range later, as the market matures.

Bitrue’s editorial team shares a similar view but offers more aggressive long-term targets. They focus on Pieverse as a practical compliance and accounting layer for businesses, AI systems, and DAOs. Their scenario suggests prices around $1.5 to $1.95 in 2026 and even $4.5 to $7 by 2030 if the project becomes a core Web3 standard. They also note that recent rallies followed real news, not only speculation.

PIEVERSE USDT Price Technical Analysis

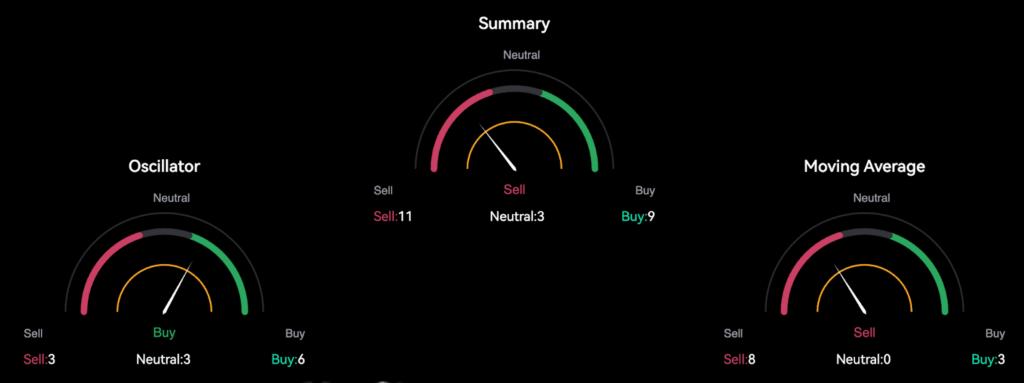

This technical overview is based on data from LBank, which provides a clear snapshot of how PIEVERSE/USDT looks from a technical perspective. When all indicators are combined, the current technical rating shows a Sell signal. Out of all tracked tools, 11 point to sell, 9 suggest buy, and 3 remain neutral. This tells us the market stands in a mixed phase, but short-term pressure still leans to the downside.

LBank, January 13, 2026

Looking first at oscillators, the picture looks more balanced and even slightly positive. The oscillator group shows a general Buy bias, with 6 indicators suggesting buy, 3 neutral, and 3 sell. RSI stands at 43.2, which sits in a neutral zone. This means the token is not clearly overbought or oversold. Indicators like Stochastic, Stochastic RSI, Williams %R, and CCI point to oversold conditions and hint at a possible rebound. At the same time, MACD, ROC, and Bull/Bear Power still show weakness. This mix suggests that selling pressure may be losing strength, but buyers have not fully taken control yet.

The moving averages tell a different story. The signal is clearly Sell. Eight moving averages suggest selling, while only three point to buying. Short and medium-term averages like EMA(10), SMA(10), EMA(20), and EMA(50) all sit above the current price area, which confirms a downtrend. The 50-day averages around $0.51 and $0.52 are especially important, as they form a strong resistance zone. Price would need to move above these levels to change the trend.

Pivot points from LBank also help define key levels. Important support zones sit around $0.4 to $0.43. On the upside, resistance appears near $0.47, $0.49, and then around $0.51. As long as the price stays below these resistance levels, the technical structure remains cautious.

In short, LBank data shows that PIEVERSE is in a recovery attempt, but the trend still needs clear confirmation.

What Does the PIEVERSE Price Depend On?

The price of PIEVERSE depends on several simple but important factors. Like most cryptocurrencies, it reacts both to what happens inside the project and to what happens in the wider market. For beginners, it helps to think about this in a very practical way. If more people want to use or hold the token, the price usually goes up. If they lose interest or need to sell, the price often goes down.

One of the most important drivers is real adoption. Pieverse focuses on payments, compliance, and accounting-ready crypto transactions. If more freelancers, companies, DAOs, or AI systems start using this infrastructure, demand for the token can grow. More usage usually means more transactions and more reasons to hold PIEVERSE.

Another key factor is exchange availability and liquidity. When a token appears on more exchanges, more people can buy and sell it. This often increases volume and attention. It can also increase volatility, especially when futures trading and leverage are available.

The price also reacts strongly to news and announcements. This includes partnerships, new integrations, product updates, or listings on new platforms. In young projects like Pieverse, even one important announcement can change market sentiment very fast.

There are also several technical and market factors that matter at the same time:

Overall crypto market trend and Bitcoin direction.

Token unlocks and changes in circulating supply.

Activity of large holders, often called whales.

Funding rates and open interest on futures markets.

Another big element is market psychology. When the price rises fast, many traders fear missing out and start buying. When the price drops, fear takes over and people sell. This creates strong swings, especially in smaller and newer projects.

Finally, regulation and the compliance narrative play a special role for Pieverse. The whole project is built around legal and audit-friendly payments. If the market starts to value regulation-ready crypto tools more, Pieverse can benefit. If regulation news hurts the crypto sector, the price can suffer, even if the product stays strong.

PIEVERSE Features

Pieverse offers a set of features that focus on making crypto payments simple, compliant, and usable in real life. The core of the system is the x402b payment protocol, which is designed for both humans and AI agents. It uses the HTTP 402 “Payment Required” standard. This allows payments to happen without users holding gas tokens. In practice, this removes one of the biggest barriers for new users and automated systems.

Another important feature is stablecoin support through pieUSD. This token works as a 1:1 wrapper of USDT and follows EIP-3009 standards. It allows programmable payments and automated transfers. This makes it suitable for recurring payments, machine-to-machine transfers, and AI-driven workflows. To remove friction even further, Pieverse uses a facilitator model. A third-party relayer pays the blockchain gas fees first. The system later reimburses these costs using stablecoins. Users only see a simple payment, not the technical complexity behind it.

Pieverse also focuses strongly on compliance and auditability. Every transaction includes immutable timestamping recorded on-chain. This creates a permanent proof of when and why a payment happened. On top of that, the protocol generates automated receipts. These receipts include cryptographic proofs and are stored on BNB Greenfield, which is a decentralized storage network. This approach creates records that can be used for accounting, taxes, and audits.

Compliance logic is built directly into the system. The protocol supports tax and reporting rules for multiple jurisdictions, including the United States, Singapore, Japan, and the United Kingdom. Privacy still matters, so Pieverse integrates zero-knowledge proofs. These allow KYC and AML data to be embedded into receipts without exposing sensitive information publicly.

From a performance view, the system shows strong early metrics. During the first week of the x402 launch, the network processed around 500,000 transactions. This marked a massive increase compared to earlier periods. Transaction costs stay very low, often near $0.003 per payment. Over six months of live testing, the infrastructure handled more than 100 million real-world payments across apps, APIs, and AI agents.

On the blockchain level, Pieverse follows a multi-chain strategy. It launched mainly on BNB Chain as a BEP-20 token and also supports Ethereum standards. The project works with Binance infrastructure programs and plans to expand to Ethereum Layer-2 networks with cross-chain payments in the future.