What is Particle Network? The Universal Chain Abstraction Layer

Crypto has come a long way since its beginnings in 2009. From the slow, monolithic chains we started with, chains have since evolved and scaled significantly, pushing the boundaries of what was possible on-chain.

However, despite all of the improvements we have made as an industry, onboarding new users always remains a struggle. This is largely in part due to the large number of new chains that have emerged over the years including the hundreds of L2 chains and application-specific blockchains. These chains have fragmented users and liquidity across the crypto space, making it costly and cumbersome for users to constantly bridge funds and learn about new chains, while increasing overall capital inefficiency.

Enter Particle Network.

What Is Particle Network?

Particle Network is a Layer-1 blockchain, designed to improve the user experience on-chain through chain abstraction. This means that users no longer need to know what chain they are on, nor do they need to constantly bridge their funds across chains. The end goal: to replicate the Web 2.0 user experience, where users can focus solely on interacting with applications, without the need to understand the underlying infrastructure.

This is achieved through Particle Network’s main product, Universal Accounts.

How Does Particle Network Function?

Universal Accounts

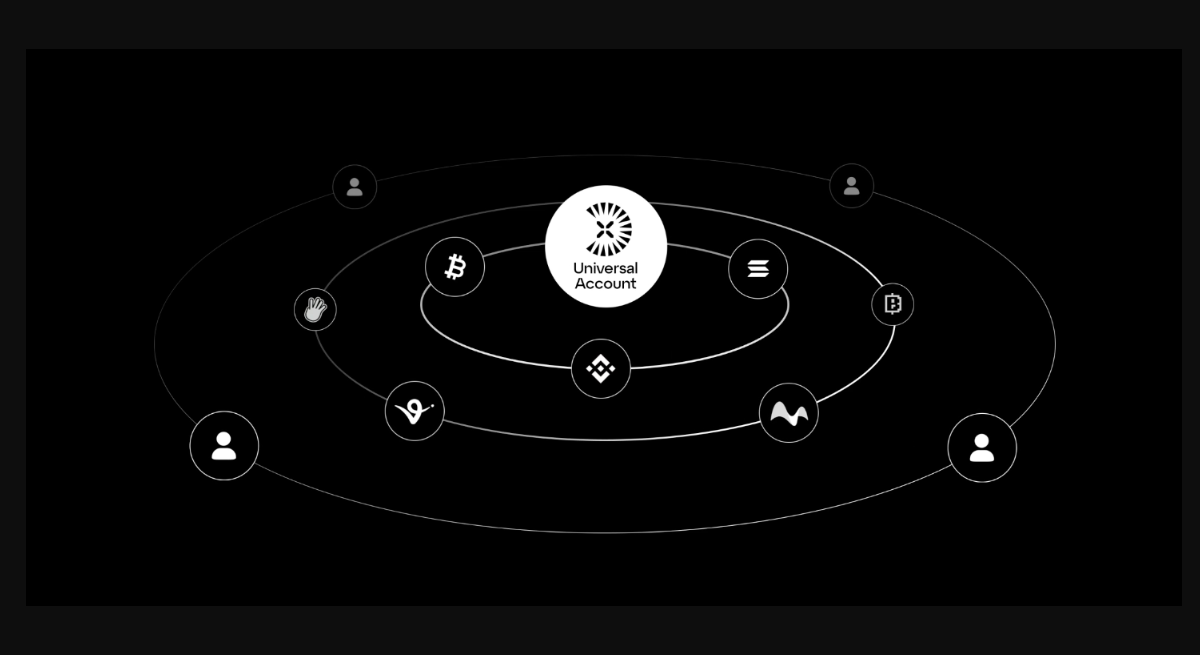

Chain abstraction on Particle Network is facilitated by Universal Accounts, an all-in-one tool to enable users to manage and utilize their assets across all chains from a single interaction point.

Universal Accounts empower users to interact with any application on any chain, pay for gas in any token, and to send transactions across chains without having to actively bridge their funds. These accounts are powered by ERC-4337, which are attached to an existing externally-owned address (EOA).

The Particle Network L1 Blockchain

However, since every blockchain is built differently and has its own infrastructure, Universal Accounts would be impossible without a standard for all chains to conform to, or a layer to coordinate transactions, assets and balances across all supported chains.

This layer is the Particle Network L1 blockchain. It consists of three primary modules:

Master Keystore Hub: Coordinates accounts deployed across all chains, which maintains the user’s single address.

Decentralized Bundler: Executes user transactions on their target chains through their Universal Account

Decentralized Messaging Network: Monitors all cross-chain interactions, while storing them on the Particle Network L1 blockchain

These three modules come together to support the core features of Universal Accounts.

The Particle Network L1 is secured by its validator set, which leverages dual staking of PARTI, the Particle Network governance token, and Bitcoin, which is powered by Bitcoin staking infrastructure project, Babylon.

UniversalX

On 3rd December 2024, Particle Network released UniversalX for public use.

UniversalX is Particle Network’s own fully chain-abstracted application, a chain-agnostic, non-custodial trading terminal, powered by Universal Accounts. For Particle Network, this was a demonstration of the capabilities of Universal Accounts.

UniversalX allows users to deposit, withdraw or trade any token across its 12 supported EVM chains and Solana, all within one unified interface. Gas, as expected, can be paid with any token and all trades are MEV-protected by default. Not to mention, UniversalX also supports Apple Pay, debit card, and credit card integrations to directly on-ramp to the platform.

Essentially, UniversalX takes the centralized exchange experience fully on-chain.

PARTI Diamonds Campaign

The PARTI Diamonds campaign was introduced on 11th March this year, to incentivize users to trade on UniversalX as well as to reward early adopters of the platform for their contributions.

A fixed supply of 10 million Diamonds were allocated to Season 0 and were distributed based on trade activity and referrals on UniversalX. Additional multipliers were also granted to participants in Particle Network’s prior programs, holders of specific Particle Network supported assets or traders on UniversalX who were active before the announcement of the program.

The PARTI Token and Tokenomics

The Particle Network team unveiled the PARTI token’s tokenomics on 25th March, leading up to their airdrop claim. The PARTI token has a total token supply of 1 billion tokens, with an initial circulating supply of 233 million tokens.

The majority of the token supply is allocated to Community Growth, which will receive 40% of the tokens. The next largest allocation goes to private sales, which form 24.9% of the token supply. This allocation will be locked initially, with a multi-year vesting schedule. Similarly, Team and Advisor allocations, which form 12.11% of the token supply will also be subject to a cliff and vesting schedule.

The remaining tokens are allocated between a KOL Round, Liquidity Provision, Initial DEX Offering (IDO), the Binance Wallet airdrop, the Binance HODLer airdrop, and a token reserve for future development and ecosystem growth.

The Particle Network Roadmap

Today, Particle Network supports over 80 chains and has integrated with more than 5,000 applications. However, its work is just beginning.

On their roadmap, Particle Network is only on Phase 1 of 3, with their permissioned ecosystem consisting of UniversalX. With Phase 2, Universal Accounts will continue to be integrated with other projects, with the Universal Accounts and the Universal SDK continuing to be improved. Finally, Phase 3 enables permissionless integration of Universal Accounts with any application, allowing all applications to be fully chain abstracted from launch.