Lagrange Labs – a prominent emerging name in the blockchain technology space – is attracting attention after Binance Alpha announced information about the project. With a focus on zero-knowledge proof (ZKP) infrastructure and an open market model for proofs, Lagrange (LA) Coin is taking its first solid steps into one of the most vibrant technology races in the blockchain industry today.

1. What is Lagrange Coin?

Lagrange Coin (LA) is an ERC-20 standard token on the Ethereum network, serving as a unit of payment and security for the Lagrange Prover Network infrastructure – a platform for generating decentralized zero-knowledge proofs. The main goal of the project is to accelerate the proof generation process, reduce verification costs, and open a global proof market for developers and validators.

LA is used for:

Paying proof generation fees.

Staking asset for provers (proof-generating nodes).

Rewards for participants in verification.

The fixed total supply is 1 billion LA, helping to limit inflation and create transparency for investors.

2. How the Lagrange Ecosystem Works

The operational model of Lagrange is built around three main components:

Requester (Proof requester): Sends requests and pays fees through smart contracts.

Prover (Proof-generating node): Provides computing power to generate ZK proofs, receiving LA rewards.

Verifier: Ensures valid results and no fraud.

Open market mechanism:

Proof generation requirements are publicly listed.

Provers bid or propose prices to gain processing rights.

If a prover fails or commits fraud, the stake will be slashed.

The final proof is recorded on the blockchain, allowing rollups, AI oracles, or smart contracts to use it easily.

The Lagrange network is integrated with EigenLayer, reusing staking infrastructure to enhance security without having to rebuild from scratch.

3. Economic Model of LA Coin

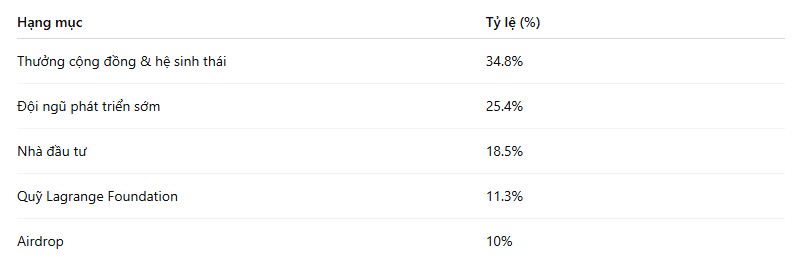

Total supply allocation:

The highlights of the design are:

The maximum new issuance rate is only 4% per year, ensuring low and sustainable inflation.

A portion of transaction fees will be burned, creating a long-term deflationary effect.

Staking profits depend on the amount of real proof processed, not on phantom interest rates.

Governance delegationallows even those who do not directly participate in staking to have voting rights.

This model encourages real usage rather than pure speculation, while promoting liquidity for the ecosystem.

4. Future Potential of Lagrange Coin

After a successful Airdrop and listing the LA/USDT pair on several major exchanges, LA Coin has taken initial steps to create stable liquidity. According to the plan, in the second half of the year, Lagrange Labs will:

Promote collaboration with Layer-2 (rollup) projects to provide proof services.

Enhance integration with AI Oracles, expanding the application of proofs in the AI field.

Promote coin burning based on usage fees, creating long-term price increase incentives.

Stimulate community development through funding and reward programs.

However, it is also important to note that:

Competition in the proof market is very high, with strong competitors like Scroll, Starknet, Risc-Zero.

Volatility in Ethereum fees and legal constraints (such as KYC requirements if treating proof sales as revenue) can create barriers.

If network demand is low, staking profits will decrease, affecting the demand to hold LA.

5. Summary

Lagrange Coin represents a new wave in the ZK race by bringing the concept of Proof-as-a-Service into reality. With an open market model, staking mechanisms tied to real performance, and a vision of applying ZK to AI and off-chain data, the project is opening a promising direction.

However, long-term success will depend on expanding real user adoption, the speed of integration with rollup projects, and the ability to maintain a competitive edge against other giants in the ZK field.

If you are interested in ZK technology, practical staking, and the decentralized proof market, then Lagrange is worth watching in the upcoming period.