Bitcoin price prediction strengthened after BTC surged above $96,000, supported by steady U.S. CPI data and renewed inflows into spot Bitcoin ETFs. The largest crypto surged to a two-month high on Tuesday and is currently holding above $95,000.

The price jumped more than 4% within 24 hours following the release of December CPI data. The report showed that year-over-year inflation held steady at 2.7%, while monthly prices rose 0.3%. As inflation pressures appeared to stabilize, investor concerns eased, triggering a rally in risk assets.

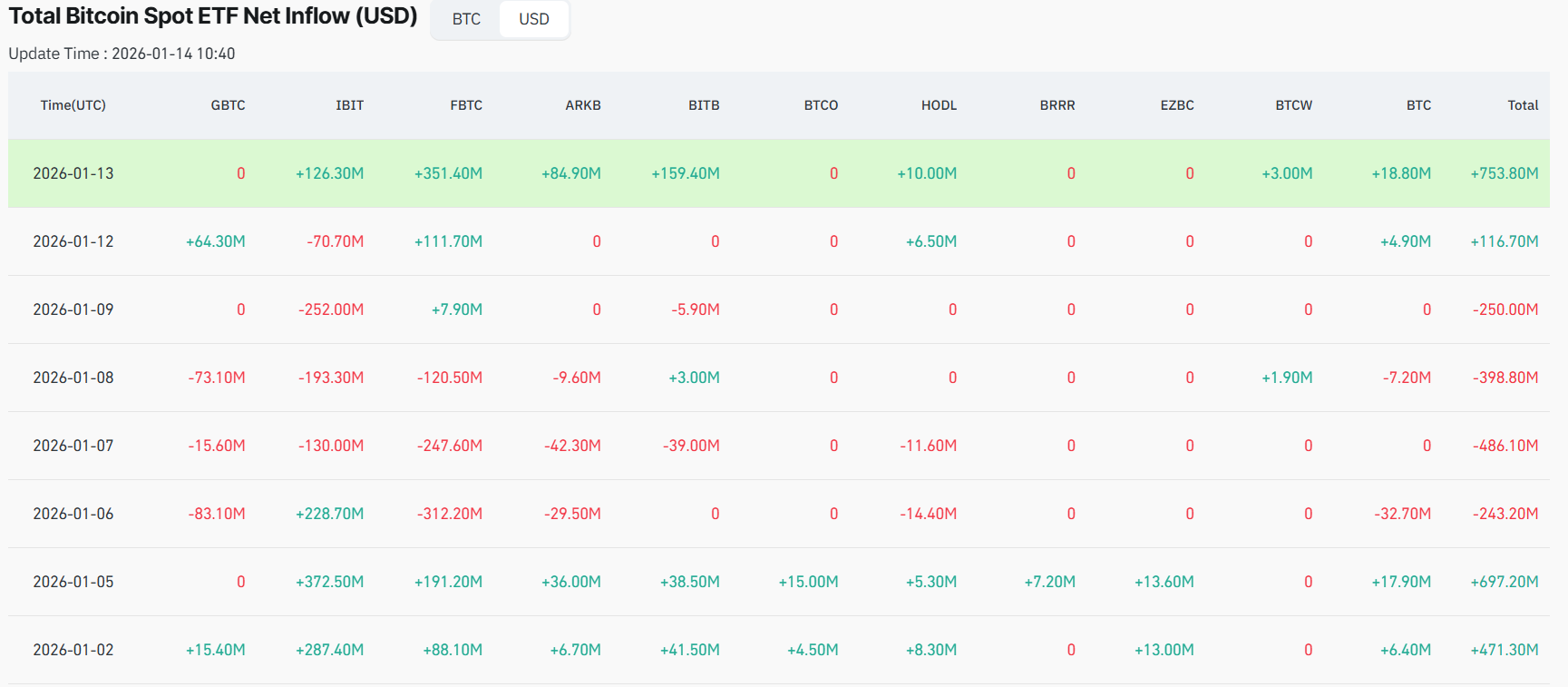

The sharp upmove coincided with a strong inflow rebound in spot Bitcoin ETFs. On Tuesday, BTC’s ETF products saw inflows of $753.8 million, the highest levelso far in 2026. Strong inflows generally increase demand, pushing prices up by bringing new capital into the market.

With macro-economic tailwinds and institutional demand in focus, traders are eyeing whether Bitcoin could regain the $100,000 psychological level in the coming weeks.

CPI Data and Its Impact on Bitcoin Price

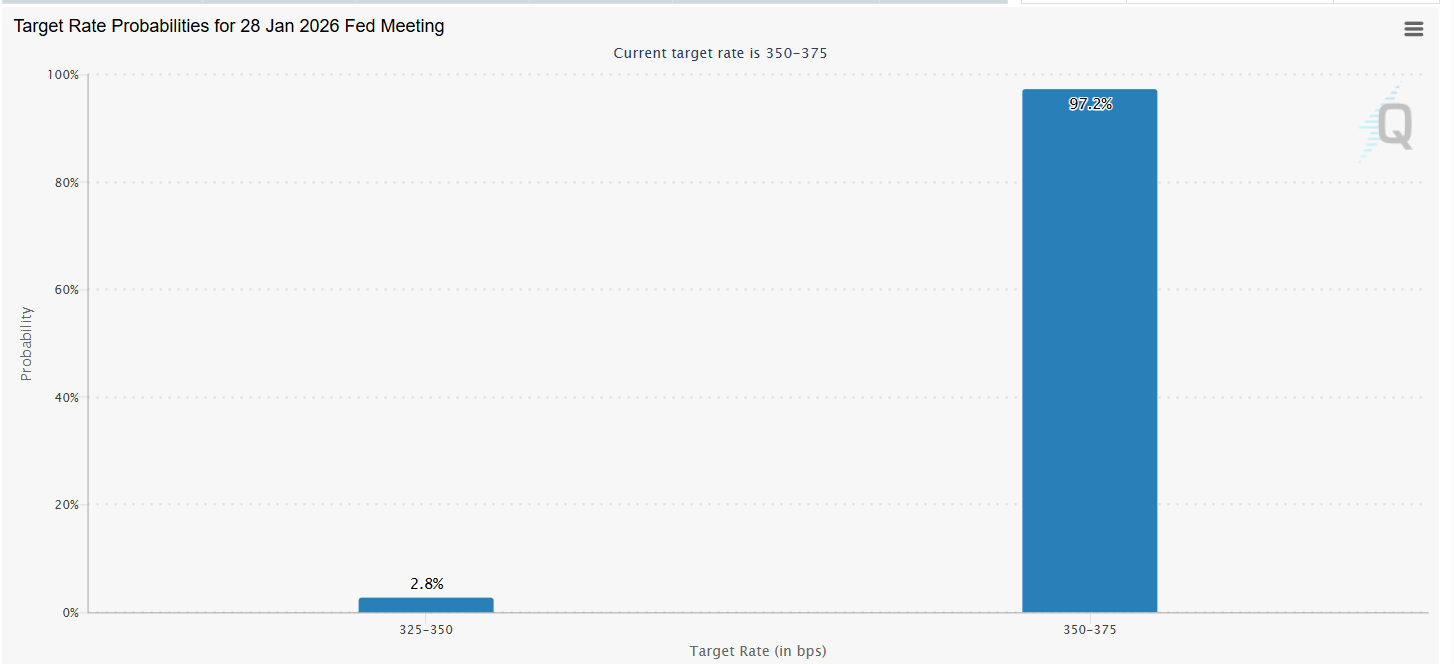

Steady CPI inflation data has eased high uncertainty around the Fed’s monetary policies, supporting higher-risk assets like Bitcoin. On January 13th, the Bureau of Labor Statistics released economic data showing that the CPI rose 0.3% month over month in December and 2.7% year over year. The readings suggested that the Fed is highly likely to keep interest rates unchanged at the upcoming meeting, which could trigger a bullish Bitcoin price prediction.

Data from the FedWatchTool shows a 97.2% probability that the target rate will remain unchanged at 350-375 BPS.

Source: Fedwatchtool

With inflation showing signs of steadiness, markets could price in a potential pause or rate cut at upcoming meetings. Lowering interest rates reduces the opportunity cost of holding non-yielding assets, improving the short-term outlook for Bitcoin.

ETF Inflows Strengthen Institutional Demand

After net outflows in the last two weeks, US spot Bitcoin ETFs have finally seen strong inflows, breaking the losing streak. In the last two sessions, BTC’s institutional products saw inflows of $870.5 million, with Tuesday registering the highest profit day in 2026 yet.

Fidelity’s FBTC ETF led the last two sessions’ rally with $111.70 million and $351.40 million in inflows. BlackRock’s IBIT ETF added around $55.6 million in the same period, while Grayscale’s GBTC added about $64 million. Strong investor participation has lifted the cumulative spot Bitcoin ETF inflows to more than $57.63 billion.

Source: Coinglass

The strong inflows signaled renewed institutional appetite, driving fresh demand for Bitcoin. This rally has pushed BTC’s market cap to around $1.9 trillion, and the price is now aiming for a psychological $100,000 target.

Can Bitcoin Price Prediction Reach $100,000 Next?

As market enthusiasm surges amid stable CPI data and institutional inflows reviving in BTC ETFs, it’s not difficult for Bitcoin to regain the crucial $100,000 mark. With Tuesday’s breakout, the crypto broke out of the converging triangle pattern that had been forming since November 2025.

The breakout was accompanied by strong volume, showing that bulls are interested in this bounce. BTC’s 24-hour volume has surged to $61 billion, among the highest in recent weeks. It has surged to its highest level in the past two months, breaking above the November 17 high of $95,950.

Bitcoin price chart. Image courtesy: TradingView

On the path to the $100,000 target, $96,500 and $98,000 will be the immediate resistance levels, where supply could kick in. $94,000 will be crucial support in case of profit-taking by bulls who bought at lower levels.

If the price keeps rising, it may climb toward $98,000 and attempt a breakout. Continued momentum could push it closer to $98,500, with $99,000 and even $100,000 coming into view as the next key hurdles for buyers. On the flip side, a failure to clear the $96,000 zone could trigger fresh selling pressure. In that scenario, the price may slide back toward immediate support around $95,000.

Market watchers also point out that this liquidity boost extends beyond Bitcoin alone. They believe capital is flowing back into the broader market, which could unlock sharp upside in newer tokens and drive a broader revaluation of privacy-focused projects. This shift signals growing market participation, not just a one-off move in a single asset.