The Ethereum price forecast is showing bullish signals after Standard Chartered said, “2026 will be the year of Ethereum.”

The bank cited improving relative fundamentals despite Ethereum’s lagging performance against BTC, which has weighed on the broader crypto market.

Bank’s Global Head of Digital Assets Research, Geoffrey Kendrick, said in the latest digital assets report, “I think 2026 will be the year of Ethereum, much like 2021 was.” The analyst cited growing adoption and ecosystem expansion as reasons for Ether outperforming peers.

As of January 15, 2026, the Ethereum price is trading at $3,300, up 4.92% over the past seven days and building momentum toward a breakout above the $4,000 psychological level. With strong demand from corporate treasuries, ETF optimism, and broader market bullish formation, the stage could be set for ETH’s biggest rally since 2021.

Why Standard Chartered Is Bullish on Ethereum for 2026

Standard Chartered is bullish on ETH for 2026, arguing that its fundamentals could improve relative to Bitcoin. The analysts pointed out in the report that the second-largest crypto could end years of lagging performance and finally outperform Bitcoin in 2026, driven by a confluence of factors.

“2026 will be the year of Ethereum" – Standard Chartered

The bank expects ETH to outperform Bitcoin as stablecoins, RWAs and DeFi scale, even as near-term price targets are trimmed.

Standard Chartered ETH outlook:

• End-2026: $7,500 (cut from $12,000)

• End-2027: $15,000… pic.twitter.com/Akd8EqyePz— Naga Avan-Nomayo (@JeSuisNaga) January 12, 2026

The report shows an Ethereum price forecast suggesting that the price ratio between the top two tokens could return to the 2021 high of around 0.08, which has currently fallen to around 0.03. The growth triggers for these bullish predictions include Ethereum’s leading position in stablecoins, RWAs, and DeFi, as well as ongoing efforts to scale the network.

The bank forecast the Ethereum price to be between $7,500 and $12,000 in 2026 and between $15,000 and $18,000 in 2027. The bank added that its long-term price prediction suggests Ethereum could outperform Bitcoin and reach $40,000 by 2030.

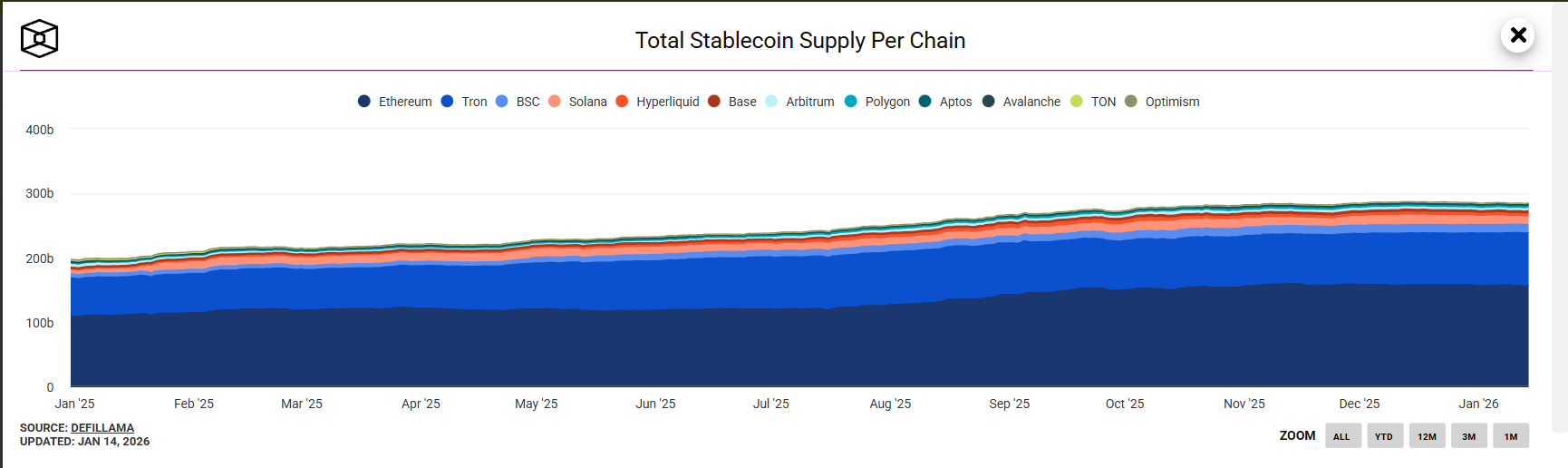

Dominance in Stablecoins Strengthens the Bull Case

Ethereum is currently the largest blockchain ecosystem, with over $10 billion in crypto and RWAs. It is also the biggest stablecoin player in the space, with a market cap of $164 billion, led by top ETH-based stablecoins like Tether (USDT) and USD Coin (USDC) leading the space.

These stablecoins are aimed for a 1:1 peg with the U.S. Dollar, consisting of cash, Treasury bills (T-bills), and other highly liquid assets

Source: DeFiLlama

Source: DeFiLlama

One of the major focuses of this prediction was the growing adoption of stablecoins and the ways in which traditional financial firms are considering them and tokenization. The current stablecoin market capitalization stands at $317.9 billion, and it is expected to grow to $3 trillion by 2030.

Due to high stablecoin activity, Ethereum’s transaction count has reached fresh all-time highs in recent weeks. This is why the bank predicts that the altcoin could benefit from the exponential rise of on-chain finance.

Ethereum ETFs & US’ Clarity Act Add Macro Tailwinds

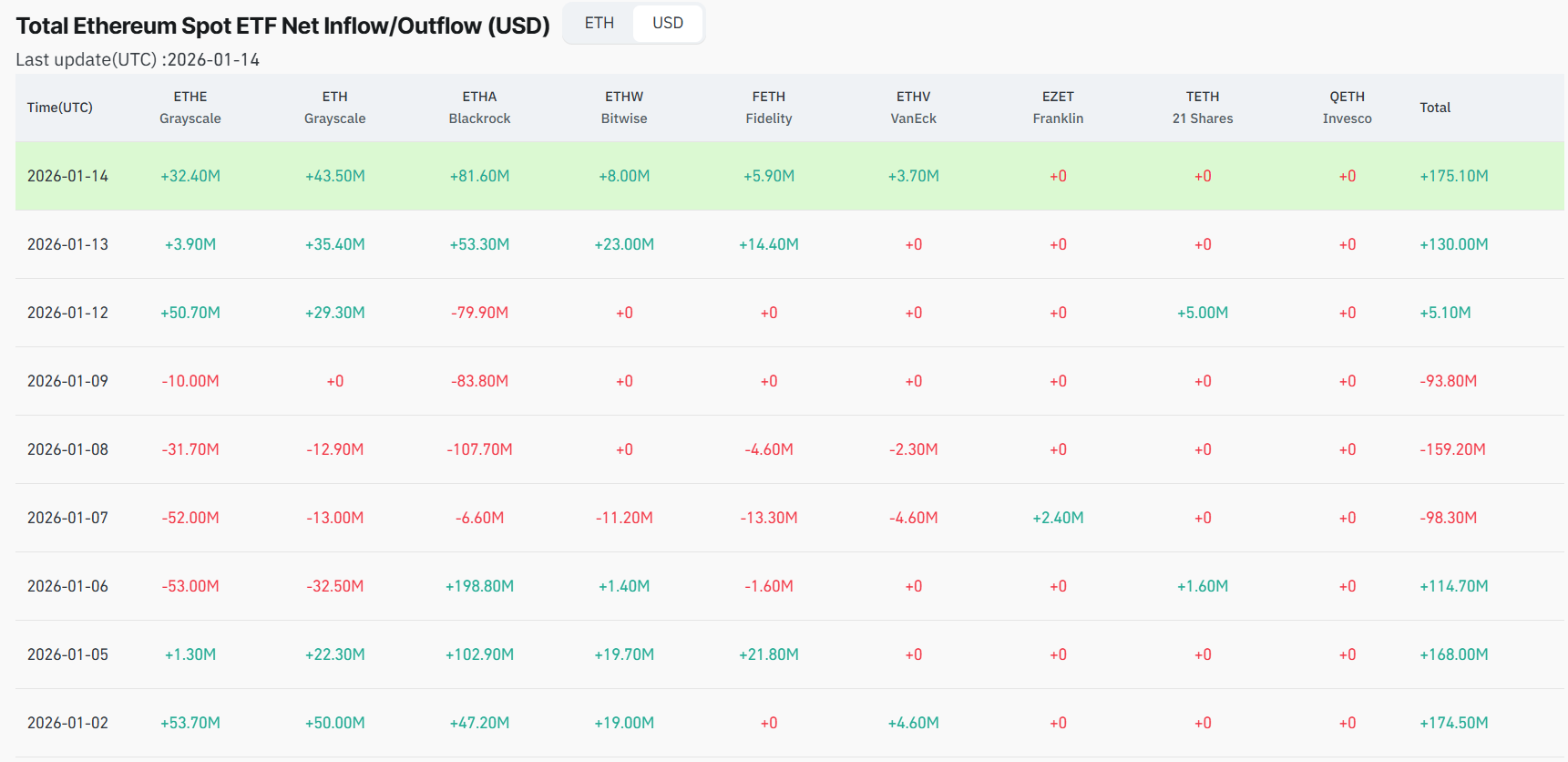

Strong on-chain performance is not the only reason for a highly bullish Ethereum price forecast; institutional confidence in spot ETH ETFs and optimism around the US’s clarity act are also contributing. Despite a net outflow of $1.62 billion since November, ETH institutional products are still outperforming BTC’s.

This week, inflows are back into ETFs, as the last three sessions saw a net inflow of $310 million. This month is trading in positive territory, and with a price revival underway, it could be a positive month after two consecutive outflow months.

Source: Coinglass

Source: Coinglass

Standard Chartered said clearer rules could further lift the crypto market. The bank highlighted the proposed U.S. Clarity Act, which it expects lawmakers to approve in the first quarter. If the bill passes and U.S. stock markets stay strong, Bitcoin could break past its previous record in the first half of the year. The bank added that such a move would also strengthen the long-term growth prospects of Bitcoin and Ethereum.

Standard Chartered analyst Kendrik added, “We expect Clarity Act passage, along with solid US equity-market performance, to push BTC to a fresh all-time high in H1, defying fears of further price declines at this stage of the Bitcoin ‘halving’ cycle.”

What Does This Mean for Ethereum Price Forecasts Into 2026?

The bank’s report clearly indicates that if Ethereum’s dominance in stablecoins, DeFi, and tokenization continues, it could outperform Bitcoin over the medium to long term. According to CoinMarketCap data, ETH’s market cap is around $400 billion, with 24-hour volume at $31B, indicating strong backing behind the recent moves.

Ethereum price chart. Image courtesy: TradingView

Ethereum price chart. Image courtesy: TradingView

The recent price action, along with a bullish reversal in the crypto market, shows the bullish shift, with buyers barging in at every demand level. The token has reclaimed the 50-day simple moving average. The RSI is holding above 62, and the hourly MACD is continuing to climb, further validating upside potential.

A broader consolidation structure has formed on the Ethereum price daily chart, and the breakout resistance sits near the $3,400. The pattern has lower support around $3,000 and $2,700, which protects the downside. If the crypto brekaouts in upside is confirmed by high trading volume, targets around $4,000 and $4,500 could be visible in the coming weeks.