BNB price forecast analysis shows bullish signals after the BNB coin surged to a fresh two-month high, sparking renewed interest from traders. Since its December low, the altcoin has surged over 16% and is building momentum above the 50-day moving average, eyeing the $1,000 pychological target.

Binance Coin’s growth is mainly driven by rising activity on BNB Chain. This is where users engage in DeFi and other blockchain applications. Recently, BNB Chain completed its 34th quarterly BNB token burn, which burned $1.27 billion worth of tokens. These token burns occur regularly, reducing supply and increasing demand for the crypto.

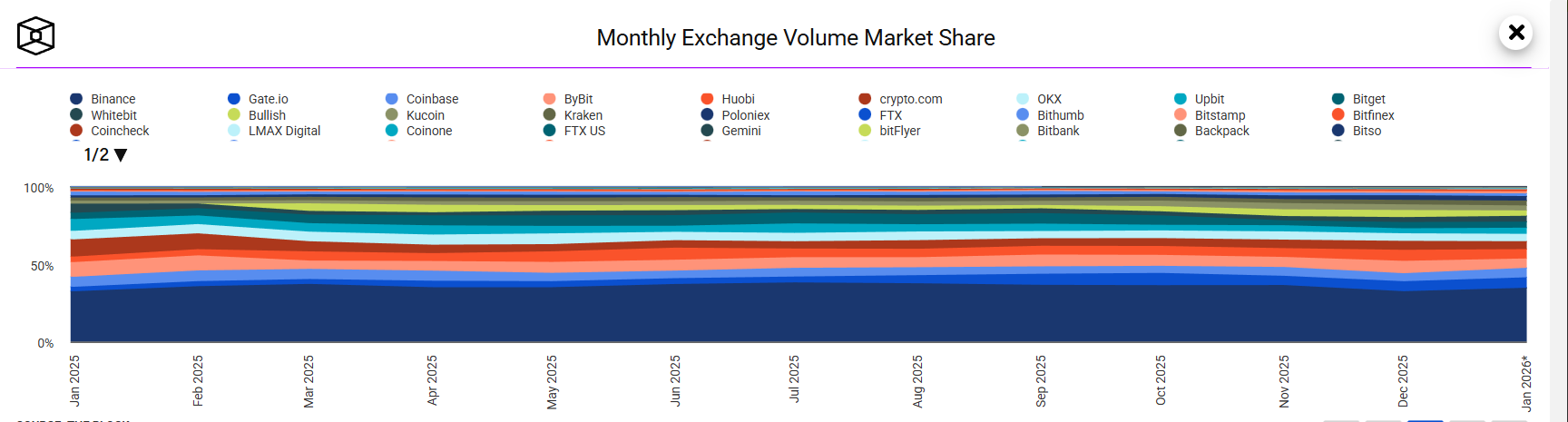

However, some negative factors, such as Binance’s spot crypto trading market share falling to its lowest level since 2021, are weighing on price action and prompting traders to remain cautious.

At press time, BNB traded around $930, down 0.92% in the past 24 hours. The token has pulled back slightly after the breakout session. As the broader market recovers, BNB’s climb toward the four-digit mark has strengthened.

Why Is BNB Price Rising?

BNB’s surge over $900 support was mainly driven by the broader market rebound. However, the strength above the crucial support level is now catching the eye of many crypto enthusiasts. The coin has now entered the stage 1 breakout, and if momentum persists, it could lead to the next bull leg to all time high.

The recent major upgrade – the Fermi hard fork has helped bullish momentum in the BNB price. This upgrade reduced block times from 0.75 seconds to 0.45 seconds, enabling the network to process transactions more quickly and confirm them more efficiently.

JUST IN: The Fermi Hard Fork is now live on #BNB Smart Chain.

The network just became significantly faster.

New blocks are now produced every 0.45 seconds.

Transactions confirm more quickly and more securely.

Several small improvements and fixes have also been added.

The… pic.twitter.com/4L1fMhiWVL

— Wilberforce Theophilus (@Eze_Wilberforce) January 14, 2026

Many experts believe the BNB price forecast could turn more bullish, especially after Binance’s 34th quarterly BNB token burn, which has significantly reduced supply.

BNB Token Burn Reduces Supply

BNB Chain has officially completed its first quarterly token burn of 2026, with the 34th quarterly BNB token burn, which took out around 1.37 million BNB tokens out of circulation. This consisted of 1,371,703.67 BNB using the normal burn system and 100.1 BNB using the Pioneer Burn Program.

The 34th quarterly $BNB token burn has been completed directly on BNB Smart Chain (BSC).

1.37M #BNB has been burned ?

View the details of the burn below ?https://t.co/QKSVBhHK0T pic.twitter.com/dpvm8e4TDu

— BNB Chain (@BNBCHAIN) January 15, 2026

The whole number of tokens burned was worth about $1.277 billion at the time of processing. The total circulating supply dropped to 136.36 million BNB, moving closer to the long-term goal of 100 million tokens.

The token burn process is a core feature of BNB’s tokenomics, as outlined in its whitepaper. The model aims to reduce BNB’s total supply from 200 million to 100 million. Token burns are bullish for the ecosystem because they reduce supply, leading to fewer tokens available, increased demand, and higher prices. However, there is no immediate impact of the token burn; analysts believe it could be priced in after the recovery.

Crypto Trading Market Share Fall: Risks Could Limit BNB’s Upside

As offshore exchange platforms gain popularity, Binance is losing market share, which could significantly affect BNB’s price. Binance is the world’s largest cryptocurrency exchange, and its declining dominance suggests other players are gaining traction. Binance’s spot share has fallen from 60% to 25%, and its derivatives share has fallen from 70% to 35%.

According to recent data, Binance’s share of global spot trading volume fell to 25% in December, the lowest level recorded since January 2021.

Source: DeFiLlama

Traders are increasingly moving their activity away from U.S.-based platforms and toward offshore exchanges such as Bybit, HTX, and Gate, as well as on-chain derivatives platforms like Hyperliquid. As a result, a growing share of U.S. crypto trading now happens through OTC desks and other non-exchange channels rather than traditional centralized venues.

Even though Binance still leads the global market for both spot and derivatives trading, the recent drop in activity points to a deeper shift. Competition is getting tougher, and the market structure itself is gradually changing in how and where crypto trades are executed.

Can BNB Price Forecast Reach $1,000?

In the January 13th breakout, BNB has broken out of a multi-week range, paving the path for a possible $1,000 target. The broader market strength, as Bitcoin trades above $95,000 and Ethereum above the $3,000 support level, indicates a bullish shift. However, for further upside, the altcoin has to clear the pullback breakout.

Technical analysis shows support levels remain above $920, with deeper support levels around $900 and $880. While resistance near $960-970 is crucial. Breaking through this resistance will undoubtedly set the stage for a substantial rise toward $1,000. However, market cycles suggest we should anticipate a consolidation phase before the next major surge.

BNB price chart. Image courtesy: TradingView

The Relative Strength Index (RSI) on the daily chart sits above 60, indicating that bulls are currently in control. The Moving Average Convergence Divergence (MACD) lines are trading above the midline, indicating that bullish momentum is sustained despite the recent pullback.

Reaching the $1,000 mark is highly possible in the coming weeks; however, the broader market sentiment will have a significant impact. For that move to happen, money needs to flow back into the market, buyers must step in with conviction, and trust in Binance’s ecosystem must remain strong over time.