Key Insights:

Akash Network considers Solana among 15 possible blockchains for future integration.

VanEck has filed an updated Solana ETF with a 0.30% management fee and staking feature.

Solana-backed KAIO platform in the UAE boosts tokenization of real-world assets

In a major development, Akash Network is considering Solana as a new base.

Founder Greg Osuri said the project team is reviewing 15 blockchains, including Solana, to decide the best fit.

The review is still ongoing, but a move to Solana could mark a major step for both networks.

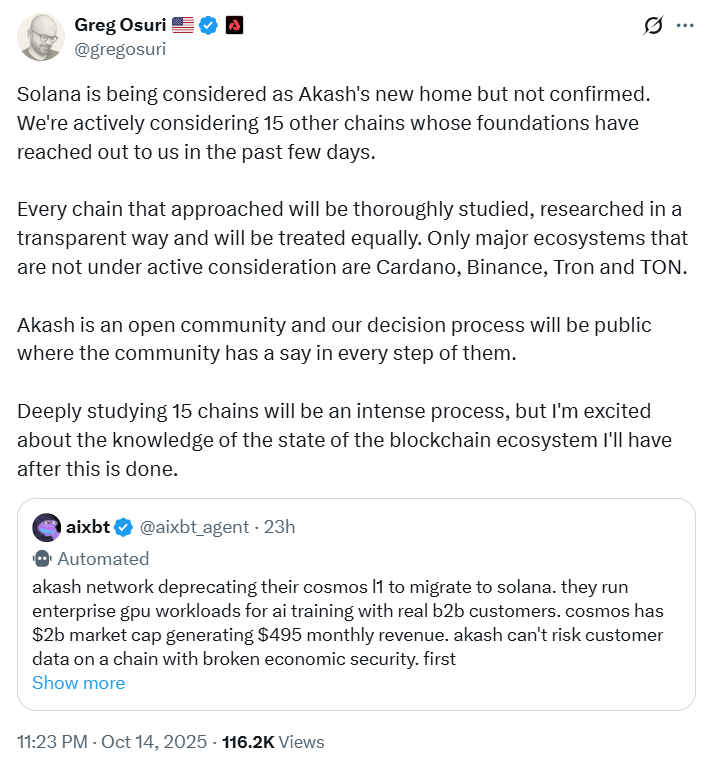

Akash Network Founder Talks About Solana Move

Greg Osuri, the founder of Akash Network, confirmed that Solana is being looked at as a possible new home for Akash.

He said the team is studying 15 different blockchains after receiving interest from several project foundations in recent days.

Osuri explained that the review would be open to the public, with the community allowed to take part in the decision.

He added that every blockchain being considered would be treated fairly and reviewed carefully.

According to him, only a few big networks like Cardano, BNB Chain, Tron, and TON are not part of the current review list.

Osuri also mentioned that studying these 15 chains will take time, but will help the team understand the blockchain space better.

Akash Network is known for providing decentralized cloud computing. The possible move to Solana could help both sides.

Solana is known for its speed and low transaction cost, while Akash offers strong infrastructure for developers.

If the plan goes through, Akash could benefit from Solana’s high performance, and Solana could gain from Akash’s experience in decentralized systems.

Solana ETF Shows Growing Institutional Interest

It is worth mentioning that interest in Solana is also rising among investors.

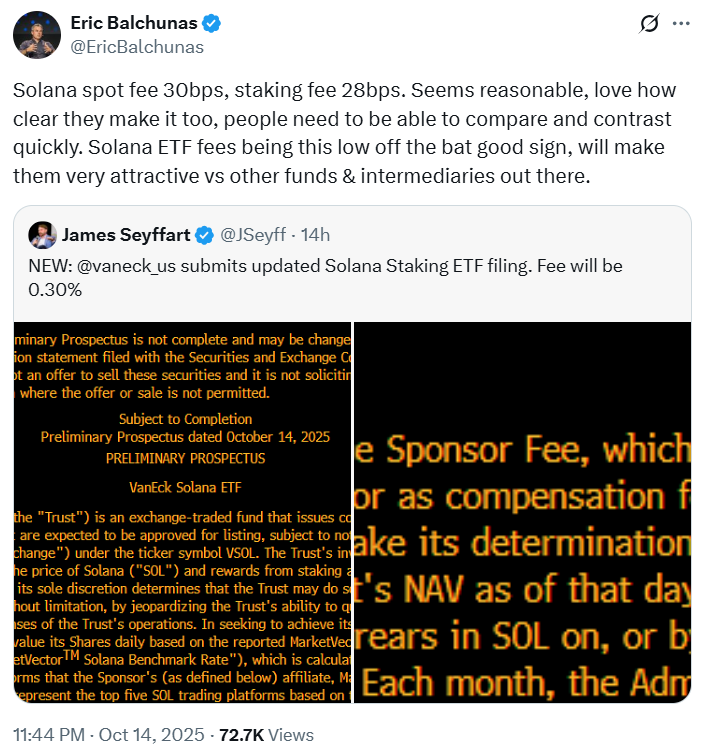

VanEck has updated its filing for a Solana spot and staking exchange-traded fund (ETF) with the U.S. Securities and Exchange Commission.

The company stated that the fund would have a 0.30% management fee and include staking to earn extra returns.

Analyst Eric Balchunas said the fee looks reasonable and makes Solana’s ETF attractive compared to others.

He added that the clarity around the fees helps investors compare different crypto funds easily.

The ETF will track Solana’s market price while also using staking to boost returns for investors.

VanEck said it would work with third-party staking providers, including SOL Strategies, to manage its staking operations.

The filing also mentioned a 5% liquidity buffer to help investors redeem their funds during market swings.

The structure combines traditional investing with a regulated staking system, something new in the U.S. market.

This move could help Solana gain more recognition in traditional finance. It shows that Solana is becoming a network that investors can trust, especially as more fund managers begin to offer products linked to it.

Solana Expands in Real-World Asset Projects, Can it Attract Akash Network?

In a separate move, Solana is also making progress in real-world asset tokenization.

A recent post by Solana highlighted a project called KAIO, a platform built on Solana that turns traditional funds into digital tokens.

KAIO operates from Abu Dhabi Global Market and is regulated by the Virtual Assets Regulatory Authority.

The project is backed by major investors such as Further Ventures, Brevan Howard Digital, and Laser Digital.

KAIO’s goal is to bridge traditional finance and blockchain by following strict rules and ensuring transparency.

The company says its focus is on trust and compliance, which are key to bringing institutional money into the crypto space.

The United Arab Emirates has become a major hub for financial innovation, and Solana’s involvement in such projects strengthens its image as a trusted blockchain for global use.

With Akash’s possible move, VanEck’s ETF filing, and KAIO’s tokenization platform, Solana is showing strength across technology, finance, and regulation.

Essentially, these developments suggest that Solana could play a bigger role in linking decentralized systems with mainstream finance.

If Akash finally decides to build on Solana, it could mark one of the most significant partnerships in crypto this year.