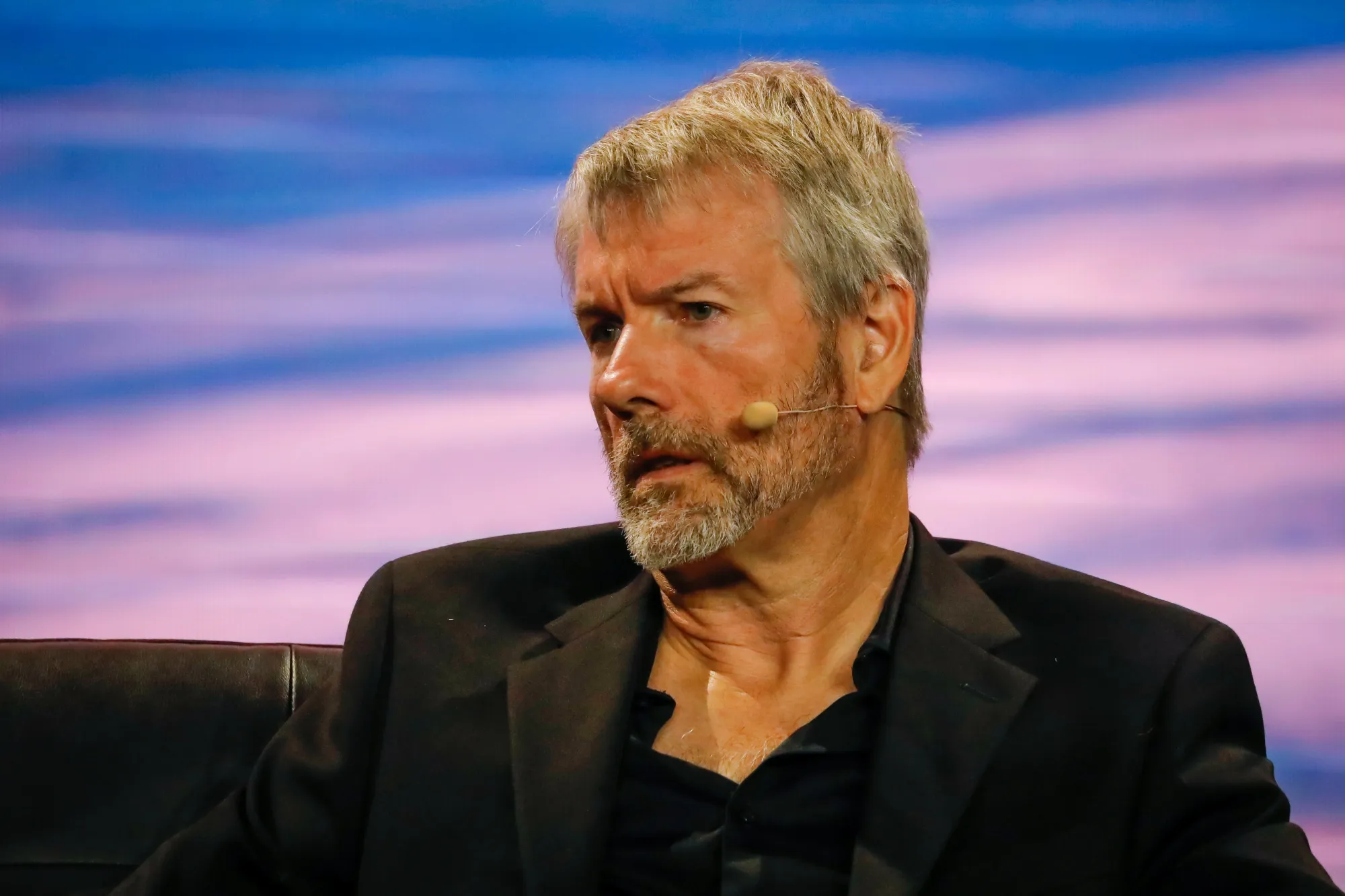

Michael Saylor used his appearance on the What Bitcoin Did podcast to challenge the way critics frame corporate Bitcoin treasuries, arguing that the debate is often misunderstood from the start.

Rather than treating Bitcoin as a speculative side bet, Saylor positioned it as a straightforward capital allocation decision – similar to how individuals choose between holding cash, bonds, or long-term assets.

Key Takeaways

Bitcoin is presented as a capital allocation choice, not speculation.

Operating losses do not automatically invalidate a Bitcoin treasury strategy.

Companies holding Bitcoin face harsher scrutiny than those that avoid it.

Michael Saylor argued that companies with excess cash are constantly making implicit bets, whether they realize it or not. Holding cash or low-yield Treasurys is still a decision, one that carries its own risks over time. In that context, allocating capital to Bitcoin is less about ideology and more about choosing what management believes offers the strongest long-term return relative to alternatives like buybacks or idle cash.

He emphasized that company size or business model does not fundamentally change that logic. Whether a firm holds a small amount of Bitcoin or builds a large position, the core decision remains the same: where capital is most effectively stored.

Profitability Is Not the Whole Balance Sheet

One of the central themes of the discussion was the criticism directed at unprofitable companies that raise capital to buy Bitcoin. Saylor rejected the idea that operating losses automatically invalidate a Bitcoin treasury strategy, arguing that financial health should be judged on total outcomes, not isolated line items.

From his perspective, a company running at a loss can still improve its overall position if the appreciation of its Bitcoin holdings outpaces those losses. He framed this as a balance-sheet reality rather than a philosophical argument – value creation does not care about the source, only the net result.

Saylor contrasted this with share buybacks, particularly for companies that are already losing money. Buying back stock, he argued, often accelerates negative outcomes by shrinking equity without changing the underlying business. Bitcoin, by contrast, introduces an external asset that is not tied to execution risk, industry cycles, or management performance.

In that sense, he presented Bitcoin not as a distraction from weak operations, but as a tool that can meaningfully alter balance-sheet dynamics when traditional options fail to do so.

Double Standards and a Shifting Corporate Landscape

Saylor also addressed what he sees as an uneven standard applied to Bitcoin-holding companies. Firms that ignore Bitcoin entirely rarely face criticism for that choice, while those that adopt it are often scrutinized aggressively, especially during downturns. He argued that this discourages experimentation and misrepresents the risks companies already accept by default.

The conversation took place amid a broader rise in corporate Bitcoin adoption, particularly through 2025, even as market conditions became less forgiving. While ownership remains concentrated among a handful of firms, Bitcoin treasuries are no longer a fringe concept.

Saylor’s broader point was not that every company should follow Strategy’s path, but that corporate finance leaders should be more honest about the trade-offs embedded in traditional treasury management. In a system where cash steadily loses purchasing power, refusing to question long-held assumptions may ultimately be the greater risk.