Financial markets in 2025 sent a mixed but revealing message. While metals and equities thrived, cryptocurrencies struggled to keep pace, highlighting a growing divide between assets tied to real economic activity and those dependent on liquidity cycles.

Precious metals delivered one of their strongest performances in years, stocks pushed to fresh record highs, and crypto – despite early excitement – ended the year on a noticeably weaker footing. The contrast has sharpened investor focus on where capital is flowing and why.

Key Takeaways

Metals strength in 2025 increasingly reflected industrial demand, not just crisis hedging

Stock markets reached record highs while crypto underperformed, signaling a clear divergence

Bitcoin continues to behave more like a growth-sensitive asset than a defensive one

Metals signal a shift toward real economic demand

The rally in metals was not driven by fear alone. Gold benefited early in the year from its traditional role as a hedge during uncertainty, but momentum increasingly rotated toward silver and industrial alloys. This transition mattered.

A falling gold-to-silver ratio pointed to capital moving away from pure crisis protection and toward materials tied to manufacturing and infrastructure. Silver’s strength was reinforced by momentum indicators pushing into overbought territory, a sign of demand pressure rather than speculative drift.

Copper quietly confirmed the story. Futures stayed above long-term trend levels for most of the year, a classic signal that industrial activity was firming. That message was echoed by strength across aluminum, nickel, zinc, tin, and steel futures, painting a picture of broad-based demand rather than a narrow trade.

In short, metals markets began to price in growth, not fear.

Stocks surge while crypto loses momentum

At the same time, equity markets marched higher. The S&P 500 repeatedly set new highs, supported by stable earnings expectations and strong performance from large-cap leaders, particularly in technology and AI-related sectors.

Crypto, however, failed to mirror that optimism. Bitcoin briefly pushed above six figures early in the year, but the move lacked follow-through. Most altcoins never reached previous cycle peaks, and the long-anticipated broad-based rally simply never materialized.

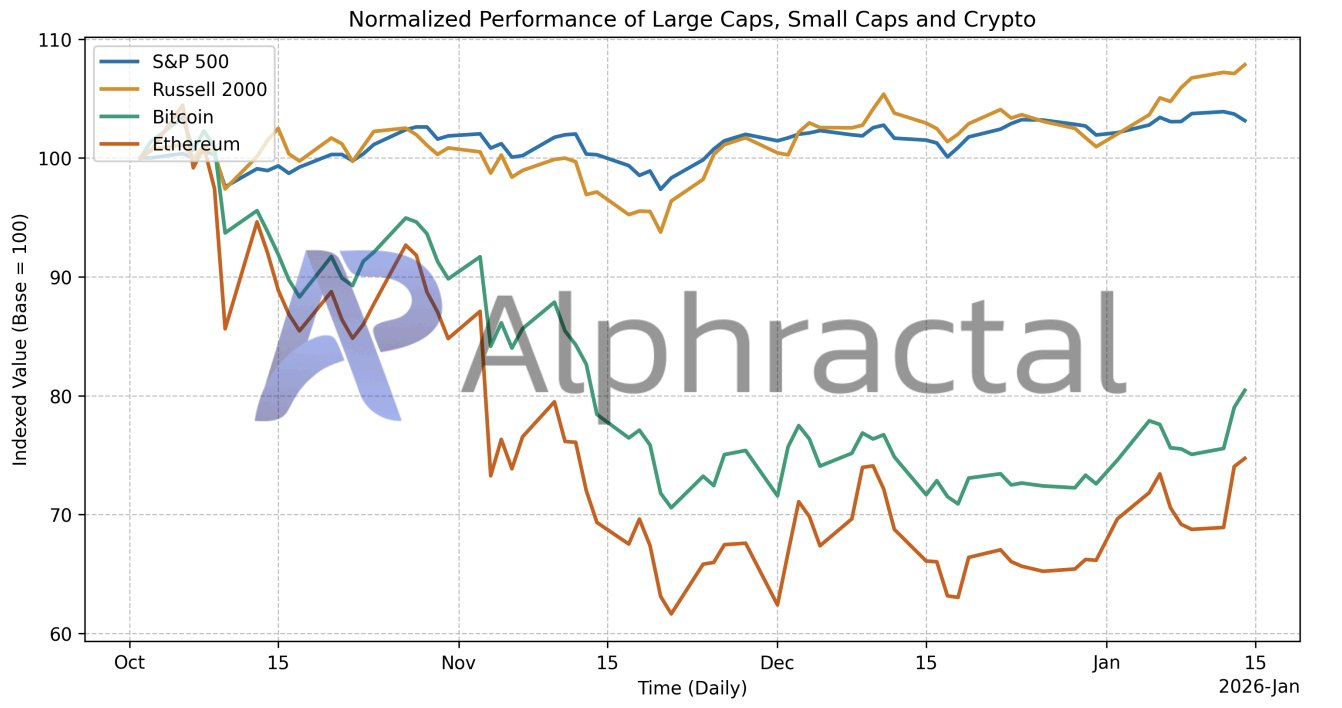

When performance is normalized and compared across assets, crypto’s behavior looks less like mega-cap equities and more like economically sensitive small-cap stocks. Over longer timeframes, Bitcoin has tracked more closely with the Russell 2000 than with the S&P 500, reinforcing the idea that crypto responds to growth conditions rather than defensive capital flows.

Sentiment cools without collapsing

Investor psychology reflected this divergence. Stock-market sentiment steadily recovered, moving deeper into optimism without reaching euphoric extremes. Crypto sentiment, on the other hand, oscillated sharply earlier in the year before settling into neutral territory.

Bitcoin’s valuation metrics tell a similar story. Profitability indicators cooled from elevated levels seen during the early rally but did not flip decisively bearish. Long-term holders remain in profit, yet enthusiasm has clearly faded compared with earlier phases of the cycle.

This combination – neutral sentiment, moderate profitability, and low excitement – often characterizes transition periods rather than market tops or bottoms.

Crypto’s place in the broader cycle

Taken together, 2025 highlighted crypto’s dependence on economic momentum rather than safe-haven demand. While metals began reflecting renewed industrial activity and stocks benefited from earnings stability, digital assets struggled in an environment of uneven growth and restrictive financial conditions.

The implication is not necessarily bearish. If economic expansion accelerates and central banks move toward lower short-term rates, crypto could reassert itself as a high-beta growth asset. The same forces lifting industrial metals could eventually spill over into digital markets.

For now, crypto appears to be waiting for macro confirmation.

Markets are no longer moving in unison. The assets leading today may be telling investors where the next phase of the global cycle is heading – and which ones need a shift in economic conditions before they can catch up.