Stablecoins are quietly becoming one of the most important indicators of crypto market demand. Seeing how their supply changes - and how that supply interacts with Bitcoin’s valuation - offers a clearer picture of whether capital is entering the market or sitting on the sidelines.

Over the past cycle, periods of strong stablecoin growth have consistently aligned with constructive market phases. Rising stablecoin market caps usually reflect fresh liquidity waiting to be deployed, acting as dry powder for risk assets like Bitcoin.

Key Takeaways

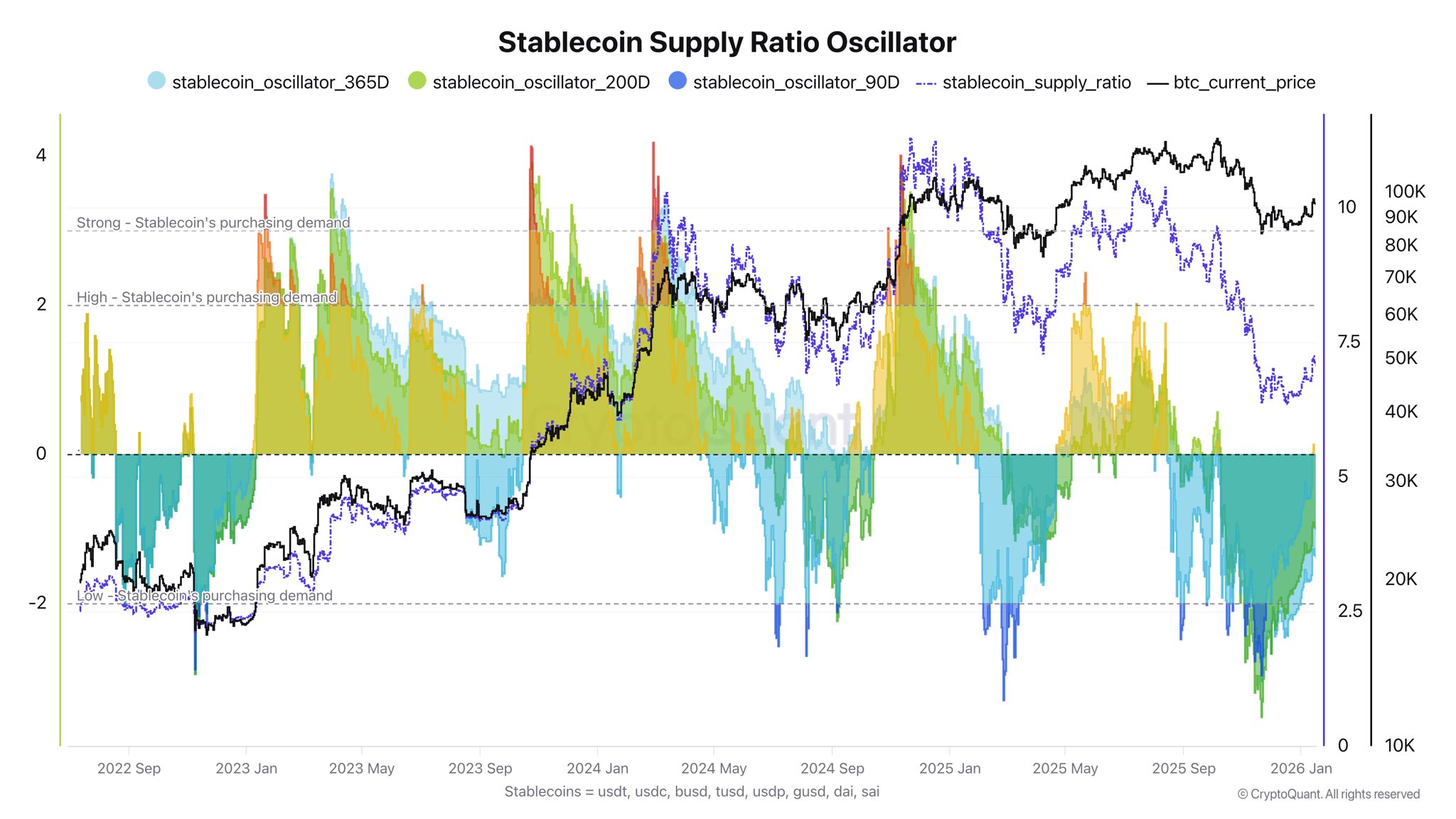

The Stablecoin Supply Ratio just recorded its sharpest drop of the current cycle, signaling potential Bitcoin undervaluation

Large stablecoin liquidity remains available, creating conditions that have historically aligned with market bottoms

A rising SSR and stable stablecoin market caps are needed to confirm that capital is re-entering the market

What matters most, however, is not just the size of that liquidity pool, but when and how it is used.

Why the Stablecoin Supply Ratio Matters

This is where the Stablecoin Supply Ratio (SSR) becomes critical. The metric compares Bitcoin’s total market capitalization to the combined value of major stablecoins. In simple terms, it shows whether Bitcoin is becoming expensive relative to available purchasing power.

When the SSR spikes higher, it often signals that Bitcoin’s market cap is expanding faster than stablecoin liquidity. Historically, this has coincided with overheated conditions or weakening momentum. On the flip side, sharp declines in the SSR indicate that stablecoin liquidity is growing faster than Bitcoin’s valuation, suggesting potential undervaluation.

The latest data shows one of the most aggressive SSR drops of the entire cycle following Bitcoin’s recent correction.

A Liquidity Imbalance Emerges After the Pullback

The recent move lower in Bitcoin triggered a sharp contraction in its market cap, while stablecoin supply remained comparatively resilient. This created a noticeable imbalance: a large pool of stablecoin liquidity sitting against a cheaper Bitcoin valuation.

Historically, similar conditions have often marked areas where market bottoms begin to form, as excess liquidity eventually starts flowing back into BTC. From a structural perspective, this setup has tended to favor recovery phases rather than prolonged downside.

However, one condition still needs to be met.

What Needs to Happen Next

For this signal to fully play out, the SSR needs to begin climbing again. That would indicate stablecoins are no longer idle and are actively being deployed into Bitcoin and the broader crypto market.

At the same time, stablecoin market caps must remain stable or continue rising. A decline in stablecoin supply would weaken the bullish interpretation, suggesting liquidity is leaving the system instead of preparing for redeployment.

Macro uncertainty remains a key risk. Ongoing geopolitical tensions and trade-related stress add another layer of unpredictability, meaning these on-chain signals should be monitored closely rather than taken in isolation.