The crypto landscape has undergone a seismic shift. We are no longer in an era defined solely by "HODLing" and spot accumulation. 2024 and 2025 witnessed an unprecedented explosion in the Futures and Perpetual (PERP) markets, with derivatives now accounting for over 75% of all crypto trading activity.

As of January 2026, monthly PERP trading volume has shattered records, topping $1.2 trillion for the first time. Leading the charge is the decentralized titan Hyperliquid, which currently processes over $40.7 billion in weekly volume and commands a staggering $9.57 billion in open interest. Alongside giants like Binance, Bybit, OKX, and dYdX, these platforms have turned the market into a high-velocity battlefield.

In this high-stakes environment—where leverage can amplify gains or wipe out accounts in seconds—the “New Breed” of crypto traders isn’t looking for moon-shots; they are looking for Absolute Returns. They need to profit in both up and down markets. They need more than just data—they need an Alpha Layer.

Enter CoinBros: The Intelligence Middleware for the Hyperliquid Era

CoinBros has officially launched its Presale Booster Stage, positioning itself as the primary Alpha Layer for the active trading community. While the broader market remains distracted by retail hype, CoinBros is engineering a sophisticated AI engine designed to feed the specific needs of the PERP trader: precision, speed, and directional conviction.

At a current entry price of $0.15 per $BROS, early adopters are securing a seat at the table of what analysts call the most critical AI launch of 2026.

Engineering Absolute Returns in Any Direction

The hallmark of a professional futures trader on platforms like Hyperliquid or GMX is the ability to short a breakdown as effectively as longing a breakout. The BroAI engine is built for this direction-agnostic reality:

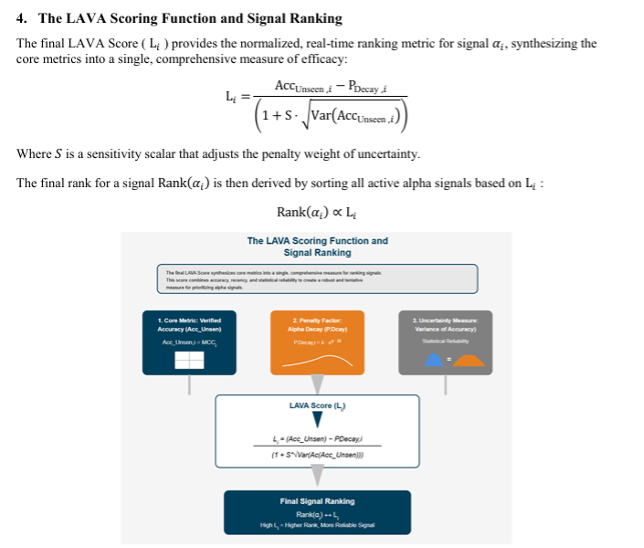

LAVA Pattern Engine: While spot traders look for long-term support, LAVA maps high-probability alphas for precision entries and exits—essential for high-leverage scalping where timing is everything.

BoomBust Sentiment Engine: In the PERP markets, sentiment often precedes price. BoomBust scans real-time social and news signals to detect “crowd exhaustion” or “impending liquidations,” allowing traders to front-run the volatility rather than being consumed by it.

Adaptive Fusion Core: Markets evolve hourly. This machine-learning architecture ensures the AI’s logic shifts alongside liquidity and volatility, providing a “future-proof” edge that thrives even during brutal bear market flushes.

The Elite Alpha Group: A Command Center for Active Traders

For the growing community of traders seeking a professional edge, CoinBros offers more than just a token. Participants acquiring 1,000+ $BROS unlock access to the CoinBros Elite Alpha Group for only $150—a premium service valued at $750 at launch.

This group serves as a “War Room” for the new breed of trader, featuring:

BroTrader Copilot: A trade execution assistant powered by predictive AI that provides conviction levels before you hit the “buy” or “sell” button.

Market Intel Streams: Real-time LAVA setups and sentiment overlays designed specifically for the fast-paced nature of futures markets.

Private Strategy Briefings: Direct feeds from AI performance dashboards tracking “smart money” and liquidity shifts.

The Roadmap to Market Dominance

As trading activity on futures markets continues to skyrocket—with annual volumes now exceeding $12 trillion—the demand for verified, actionable intelligence is at an all-time high. CoinBros is moving fast to meet this demand:

Public Presale Launch: Currently in the Booster Stage at $0.15, scaling toward a $0.75 launch.

CoinBros Alpha Release (Q1 2026): Providing a mobile-first command center for traders on the go.

BroTrader (Q3 2026): Allowing for seamless trading experince for the active crypto traders.

Join the Brovolution

The current explosion in futures volume on Hyperliquid, Bybit, and dYdX proves that the market is professionalizing. In a world of 50x leverage and 24/7 volatility, the “gut feeling” is dead. Only those armed with an Alpha Layer—an intelligence that learns, adapts, and extracts profit regardless of market direction—will survive.

With limited allocations and a projected 50× upside potential to its $7.50 target, CoinBros is the engine for the next generation of absolute return traders.