Discover the top crypto presale trends for 2026 with $IPO. Explore AI-driven deal discovery & tokenized markets reshaping finance. Join the new presale crypto!

If one Senate delay can shake prices, what happens when tokenized finance becomes the main headline every week?

Heading into January 19, 2026, that is not a theory. U.S. market-structure talks have hit fresh bumps. And the fight over stablecoin rewards has turned into a loud “who controls yield” argument.

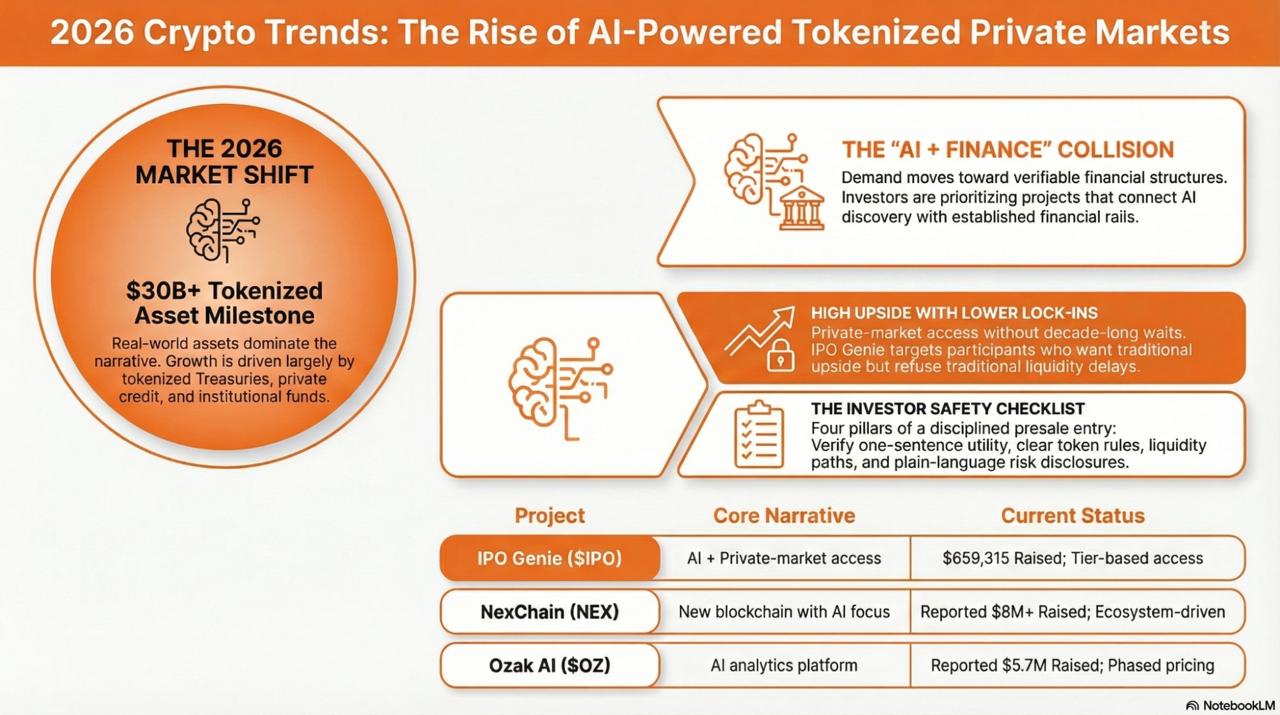

At the same time, tokenization keeps expanding. Industry tracking and coverage have pointed to tokenized real-world assets crossing the $30B mark, with Treasuries and private credit among the biggest drivers. That single data point explains the mood: buyers are no longer only chasing memes. Many are looking for presales that feel connected to real financial rails.

That is where IPO Genie keeps showing up. Early participants already know the basics. What is changing now is speed. Promotions, watchlist mentions, and the “exit anytime, without decade-long waits” message are pulling attention from people who usually ignore presales until it is too late.

Key takeaways

IPO Genie is being talked about as a private-market access play that tries to bring smaller participants into deals that used to feel gated.

AI token presales remain hot, but the best comparisons focus on verifiable structure, not price guesses.

Presales are high risk. The best move is to check rules and risks first, then size the buy with discipline.

January 2026 Setup: Why Private Markets & AI Tokens Are Colliding

January 2026 is loud for one reason: the “rules” conversation is back. Stablecoin rewards are being argued like a bank issue, and tokenized assets are being debated like a market issue. When that happens, serious money pays attention, even if it does not buy yet.

Also, tokenization has moved from buzz to measurable growth. Coverage tied the $30B milestone to rising institutional activity, especially in

tokenized Treasuries,

private credit,

and funds.

Therefore, any presale that connects itself to private markets is going to get clicks, watchlists, and heated group chats.

This is why people keep comparing IPO Genie with AI blockchain projects like NexChain and Ozak AI. The public conversation is not only “AI.” It is “AI plus finance.”

IPO Genie vs NexChain vs Ozak AI: Top Crypto Presale Narrative for 2026

Notes on competitor data: Some reporting has claimed NexChain presale totals “over $8M.” Other older press pieces cited different totals, which shows why investors should verify primary sources. For Ozak AI, the official website shows roughly $5.7 M raised and a multi-phase pricing ladder. While the IPO Genie raised $659,315 & multiple phase pricing structure as well.

New Presale Crypto Checklist for Investors Before Investing

When buyers search for a presale, the smartest ones run the same basic checklist.

First, can the token’s job be explained in one sentence?

Second, are the token rules clear enough to verify?

Third, is there a believable path to liquidity, even if it is not quick?

Fourth, does the project speak about risk in plain words?

This matters because a New presale crypto can trend for a week, then vanish from search interest when people cannot confirm the basics.

Why IPO Genie Is Gaining Attention Fast

The spike around IPO Genie is not coming from one factor. It is coming from a stack of factors that hit different buyer emotions at once.

One factor is reported traction. Some outlets have published presale progress claims and “raised” figures for IPO Genie, which pushed it into more watchlists. Even when analysts take those reports with caution, the effect is real: more eyeballs, more chatter, more urgency.

Another factor is the offer cycle. IPO Genie has kept attention with timed campaigns. The airdrop push gave early followers a reason to share. The Black Friday bonus created a clear deadline. The December Dubai Misfits Boxing tie-in, plus giveaway-style promotion, brought fresh people into the funnel. Then the Christmas bonus campaign kept momentum alive. None of that proves returns. Still, it explains why people keep talking about it.

The biggest factor, though, is the AI+private-market promise packaged in crypto language: “no lock-ins.” In traditional private deals, time is the tax. In crypto, time is the enemy. IPO Genie’s message fits the early participant who wants AI-powered deal discovery upside but refuses a decade-long wait.

That is why some analysts call it a top crypto presale pick for 2026 themes, even while they keep a clear risk mindset.

Why Earlier Matters Before the End of January

Presales are built around time pressure. Therefore, late buyers often end up acting on emotion instead of math.

Earlier buyers usually get more room to decide calmly. They can track updates, check links, and build a position in steps. Late buyers often rush because they feel the crowd moving.

If the goal is to join before the month closes, waiting adds a simple cost: less time to act with a clear head.

That does not mean early equals profit. It means early equals time.

Safety Checklist in 60 seconds

Only use official channels and verified links.

Treat bonus links sent by strangers as high risk.

Use a separate wallet if possible.

Start smaller if uncertain.

And remember: presales can go to zero.

Where IPO Genie Sits in the January 2026 Watchlist

This watchlist is not about promising a winner. It is about explaining why one new crypto project is being talked about more than the others right now. With tokenization hitting new milestones and U.S. policy debates pulling crypto into mainstream finance news, the market is rewarding projects that feel tied to real financial shifts.

In that setting, IPO Genie sits in a unique position, AI+private markets framed with a crypto-style time advantage, plus a promo calendar that has kept attention high. For interested investors considering January, that combination is exactly why the presale keeps resurfacing.