Horizen price prediction is a topic that attracts many new investors who want to understand where this cryptocurrency could go next. Horizen is known for its strong focus on privacy and scalable blockchain solutions, which makes it different from many other crypto projects. Before looking into the future, let’s start with the current market situation to set the stage.

Right now, the price of ZEN is $13.2. This month, the market showed high volatility. The lowest price was around $7.16 on December 18, while the highest price reached $14.06 on January 15. Such a wide range shows that traders are actively reacting to market news and sentiment. These price swings make many people wonder whether this is a good time to buy or wait.

In this article, we will explore what Horizen is, how it works, and what makes it unique. We will look at its history, expert opinions, technical indicators, and long-term forecasts. You will also learn what influences its price and whether ZEN can be a good investment.

If you want a clear and simple breakdown of ZEN price prediction, this guide will walk you through everything step by step. Let’s get started and see if Horizen has the potential to grow in the coming years.

| Current ZEN Price | ZEN Price Prediction 2026 | ZEN Price Prediction 2030 |

| $13.2 | $25 | $75 |

Horizen (ZEN) Overview

Horizen is a blockchain platform built to solve three major problems in the crypto world: privacy, scalability, and interoperability. It started in 2017 but is now entering a completely new era with a shift to a Layer 3 model on Base, an Ethereum Layer 2 network. This makes Horizen the first specialized Layer 3 designed for applications using zero-knowledge proofs. The project aims to bring advanced privacy tools to everyday users and developers in a simple and useful way. The native token ZEN was originally launched on the Horizen mainchain but in July 2025 it officially migrated to Base as an ERC-20 token, improving accessibility and liquidity across the Ethereum ecosystem.

The story of Horizen began as ZenCash, a fork of ZClassic, which itself was a fork of Zcash. This means the project was deeply rooted in privacy-focused cryptography from day one. ZenCash launched on May 30, 2017 at block 110000 of ZClassic. The founders, Rob Viglione and Rolf Versluis, both worked on ZClassic and believed in a future where users could control their data while having a fair economic and governance structure. They wanted more flexibility than ZClassic allowed, so they created their own chain with expanded capabilities.

In July 2018, ZenCash rebranded to Horizen to reflect a broader mission. The upgrade included improved technology, a stronger community, and a more advanced governance model. In 2019, Horizen introduced its Sidechain System and SDK, expanding beyond privacy to support general-purpose blockchain applications. This opened the door to modular, scalable solutions where developers could build custom sidechains connected to the main network.

The biggest milestone came on July 23, 2025, when Horizen completed a full migration to Base. All ZEN balances from the old mainchain and the EON EVM chain were moved into a new ERC-20 contract. EON balances migrated automatically, while mainchain users had to manually claim their tokens due to different address formats. After migration, both old chains were discontinued, and major exchanges like Coinbase and Binance supported the transition.

This transformation created Horizen 2.0, an EVM-compatible Layer 3 appchain that prioritizes “trust without exposure.” It offers built-in privacy tools like zero-knowledge proofs and trusted execution environments. Developers can configure privacy settings for each application, making it suitable for a wide range of use cases. As part of the Base ecosystem, Horizen benefits from Ethereum infrastructure, Coinbase compliance, and seamless interoperability with the wider Web3 network. This positions Horizen as a next-generation privacy and scalability platform ready for mass adoption.

ZEN Price Statistics

| Current Price | $13.2 |

| Market Cap | $231,785,346 |

| Volume (24h) | $216,396,920 |

| Market Rank | #153 |

| Circulating Supply | 17,719,929 ZEN |

| Total Supply | 21,000,000 ZEN |

| 1 Month High / Low | $14.06 / $7.16 |

| All-Time High | $165.92 May 08, 2021 |

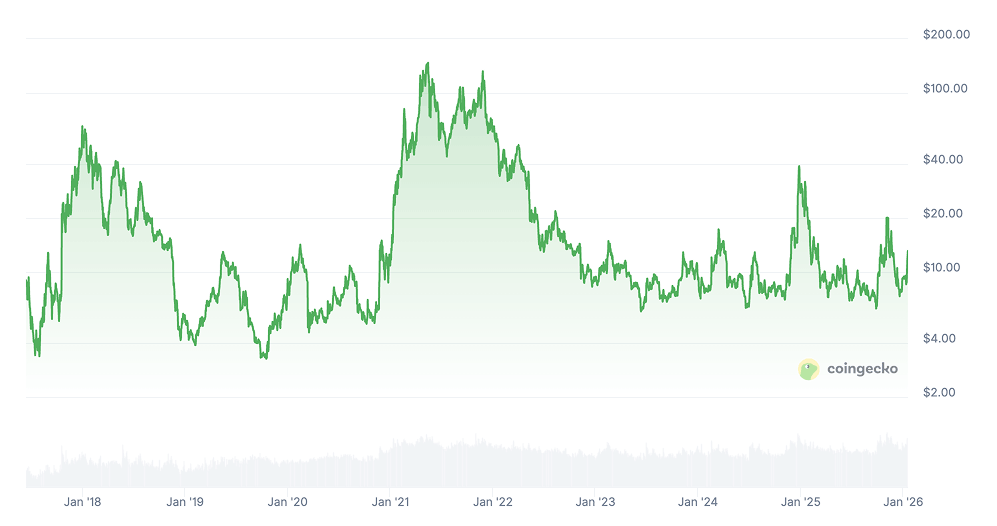

ZEN Price Chart

CoinGecko, January 16, 2026

Horizen (ZEN) Price History Highlights

2017: Market Debut and Strong First Impression

Horizen entered the market in November 2017 under the name ZenCash with a debut price of $27.43. Investor interest was high from the start due to its privacy focus and unique communication features. The token quickly gained momentum and ended the year at $59.79, delivering a return of more than 100%.

During its first months, it traded between $20.34 and $59.79, showing strong demand despite being a new project. This early success proved that the market believed in the long-term vision of privacy-focused blockchain technology.

2018: Bear Market Crash and Rebranding

The year 2018 was brutal for the entire crypto market, and Horizen was no exception. The price opened at $56.27 but collapsed to $5.32 by the end of the year, losing over 90%. At one point, it reached a local high of $67.3 before a dramatic drop. However, this year was also key for transformation. On August 22, the project rebranded from ZenCash to Horizen, signaling an expansion beyond payments into a full privacy platform with plans for sidechains and smart contracts.

2019: Finding the Bottom and Slow Recovery

After the collapse, ZEN spent most of 2019 stabilizing at low levels. It opened the year at $5.29 and recovered to $9.18 by December, gaining more than 70%. The all-time low of $3.14 was reached on September 30, marking the final capitulation point. From that moment, the market slowly regained confidence. The token’s highest price in 2019 was $12.91, showing that buyers were returning despite the long bear phase.

2020: First Halving and Volatility

The year 2020 brought major events that influenced price movements. The token opened at $8.39 and closed at $11.58, gaining nearly 40%. In March, Horizen fell sharply during the global pandemic crash, dropping 40% in a single day. However, recovery followed, and the first halving occurred on December 1, reducing block rewards from 12.5 ZEN to 6.25 ZEN. This increased scarcity and set the stage for future growth.

2021: Massive Bull Run and All-Time High

2021 was the best year in Horizen’s history. The token started at $11.79 and ended at $60.57, rising more than 400%. On May 8, it reached its all-time high of $168.15. Key catalysts included a 200% surge in January, a 115% rally in April, and a major Coinbase listing in September, which caused a 25% daily jump. Investor confidence peaked as Horizen became one of the most talked-about privacy projects.

2022: Deep Bear Market and Industry Collapse

The crypto market crashed again in 2022. Horizen opened at $64.02 and plunged to $9.19 by year-end, losing over 85%. The lowest price was $8.27, while the highest reached $65.06 early in the year. The FTX collapse in November triggered another 31% decline, causing widespread panic. Despite strong fundamentals, market fear dominated the price action.

2023: Stability and EON Launch

Although the price stayed relatively flat, 2023 was important for development. ZEN opened at $9.4 and closed at $9.05, moving only slightly. It traded between $6.02 and $14.85. The launch of Horizen EON, an EVM-compatible sidechain, and the introduction of Horizen DAO were major technical milestones. These upgrades showed the project was preparing for long-term growth even during low volatility.

2024: Bullish Comeback and Second Halving

2024 marked a major recovery. ZEN opened at $9.29 and closed at $28.94, gaining over 200%. The price hit a high of $38.93 and a low of $6.3. Powerful rallies occurred in February (+40%), November (+125%), and December, when the second halving cut rewards from 6.25 to 3.125 ZEN. The halving triggered a 63% monthly surge, proving strong investor confidence.

2025: Volatility and Transition to Horizen 2.0

Horizen experienced dramatic price fluctuations in 2025. The year began at $30, then fell to $6. By November, ZEN was trading around $20, then fell back to $7 by the end of the year. Despite this decline, the year was important for future growth. The project is prepared for Horizen 2.0, introducing a new architecture, upgraded tokenomics, and integration with zero-knowledge technology. This transition aimed to position ZEN for the next major expansion phase.

2026: New Achievements and New Heights

This year started with a rapid rise from a low of $8.5 to $14, a gain of over 65%.

Hedera Price Prediction: 2026, 2030, 2040–2050

| Year | Minimum Price | Maximum Price | Average Price | Price Change |

| 2026 | $15.85 | $34.06 | $25 | +95% |

| 2030 | $57.54 | $104.2 | $75 | +490% |

| 2040 | $169.6 | $7,211 | $3,500 | +27,000% |

| 2050 | $322.9 | $9,082 | $4,500 | +35,000% |

Horizen Price Prediction 2026

In 2026, DigitalCoinPrice sees further growth with a maximum of $31.16 (+150%) and a minimum of $26.04 (+110%).

PricePrediction.net suggests a more modest outlook, with a peak of $18.87 (+55%) and a low of $15.85 (+30%).

Telegaon estimates stronger momentum, forecasting a high of $34.06 (+170%) and a low of $25.23 (+105%).

Horizen Price Prediction 2030

Looking toward 2030, DigitalCoinPrice predicts ZEN could reach $65.88 (+440%) at its highest and $57.54 (+370%) at the lowest.

PricePrediction.net is even more optimistic, projecting a maximum of $84.89 (+590%) and a minimum of $69.85 (+470%).

Telegaon follows a similar bullish pattern, with a high of $104.21 (+750%) and low of $84.08 (+580%).

ZEN Coin Price Prediction 2040

PricePrediction.net anticipates explosive long-term growth by 2040, forecasting a maximum of $7,211 (+59,100%) and a minimum of $6,045 (+49,500%).

Telegaon is more conservative but still highly bullish, projecting a maximum of $203.84 (+1,500%) and a minimum of $169.56 (+1,250%).

Horizen Price Prediction 2050

For 2050, PricePrediction.net expects ZEN to reach extreme levels, with a peak of $9,082 (+74,500%) and a floor of $7,654 (+62,700%).

Telegaon offers lower but still strong targets, predicting a maximum of $375.78 (+2,900%) and a minimum of $322.91 (+2,500%).

Horizen (ZEN) Price Prediction: What Do Experts Say?

Several crypto analysts and market platforms have recently shared their outlook on Horizen, and most agree on one thing: ZEN is showing strength after a difficult period.

Crypto 4Light highlighted that ZEN doubled in value after bouncing from the $6.24 zone, calling it one of the cleanest accumulation opportunities of the year. He believes this recovery is not random, but driven by strong technical structure and renewed confidence after the Binance monitoring tag was removed. His cycle-end target of around $16.59 shows cautious optimism. While many investors dream of a return to all-time highs, he prefers realistic projections and believes $100 is a more achievable long-term goal.

Changelly also released a fresh market outlook in early October. Their analysts expect ZEN to move within a narrow range as it consolidates recent gains. They see mild growth potential in the short term, with possible higher movement in November if momentum increases. Their technical overview shows short-term strength on lower timeframes, while the daily chart still shows pressure due to a declining 200-day moving average. This indicates that ZEN is recovering, but not fully in a strong uptrend yet.

Institutional analytics platforms add another layer to the picture. According to AI-driven research from AInvest, ZEN showed impressive resilience during recent market downturns. While many tokens crashed, ZEN held its ground and even gained strength. Analysts noted that if trading volume stays strong, ZEN could push toward the mid-teens, although pullbacks remain possible. What stands out is that ZEN has built a stronger support base than many competing altcoins.

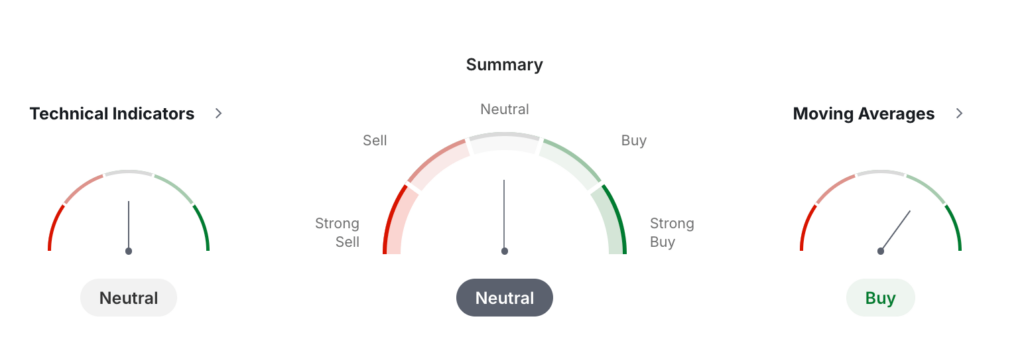

ZEN USDT Price Technical Analysis

The monthly technical analysis of the ZEN/USDT pair based on data from Investing shows a mixed market structure with no clear dominant trend. The overall technical summary is Neutral, which means price action is currently balanced between buyers and sellers.

Investing, January 16, 2026

Both the indicator summary and the combined outlook confirm this equilibrium. Technical indicators show 3 Buy, 3 Neutral, and 3 Sell signals, highlighting indecision. The Relative Strength Index (RSI 14) is at 49.82, sitting near the midpoint and confirming a lack of strong momentum in either direction.

Some oscillators show interesting signals. The Stochastic (9,6) is at extremely low levels, indicating oversold conditions, which often point to a possible rebound. Williams %R also confirms oversold territory, suggesting sellers may be losing strength. However, the Stochastic RSI and Ultimate Oscillator show Sell signals, meaning momentum is still weak. The MACD is also bearish, showing negative values, which warns of possible short-term corrections. On the positive side, the ADX is above 25, which signals a strengthening trend, while Bull/Bear Power and ROC point to buying pressure.

Moving averages offer a more bullish picture. The summary shows 7 Buy signals and 5 Sell signals, giving a slight advantage to buyers. Short-term and mid-term averages (MA5, MA10, MA20) are all above price and showing upward bias. This indicates that recent momentum has turned positive despite earlier declines. However, long-term moving averages such as MA50, MA100, and MA200 still show Sell signals, proving the macro trend remains weak. This split pattern suggests the market may be in the early stages of a potential long-term reversal.

Pivot points place strong support levels around $6.6 and $7.3, which align with recent lows. Resistance appears near $8.4 and $9.1, meaning breaking above $10 could unlock further upside. Overall, Horizen is in a consolidation phase. Short-term indicators lean slightly bullish, while long-term metrics remain cautious. A clear breakout above resistance or a drop below key support will determine the next major move.

What Does the Horizen Price Depend On?

The price of Horizen depends on a mix of technology, tokenomics, market conditions, and adoption. Unlike many simple cryptocurrencies, ZEN functions within a modular privacy-focused ecosystem, which means its value is heavily tied to real utility and development progress.

One of the biggest price drivers is network upgrades. Major events like the launch of Horizen EON or the transition to Horizen 2.0 directly influence investor confidence. When the project introduces new features such as zero-knowledge proofs, Layer 3 architecture, or improved interoperability with Ethereum, demand for ZEN often increases.

Halvings are another key factor. Horizen has a fixed emission schedule, and every halving reduces block rewards. This lowers supply and can create upward pressure on price if demand stays stable. The second halving in 2024 proved how powerful this effect can be, as ZEN surged more than 200% that year.

Investor sentiment also plays a big role. Listings on major exchanges, removal of “monitoring tags,” and interest from respected analysts or institutions can create strong buying pressure. On the other hand, fear in the crypto market, exchange collapses, or regulatory uncertainty can lead to panic selling.

Partnerships and ecosystem growth matter as well. If more apps are built on Horizen’s sidechains or Layer 3 platform, more developers and users will need ZEN to interact with the network. This increases token utility and long-term value. The project’s support from Coinbase Base and integration with zkVerify create credibility and technical advantage.

Market trends and Bitcoin cycles cannot be ignored. During bull markets, altcoins like ZEN tend to outperform because investors look for high-potential projects. In bear markets, even strong fundamentals may not be enough to prevent price drops.

Other important factors include:

Adoption of privacy technology in Web3

Liquidity on major exchanges

Staking rewards and tokenomics 2.0

Institutional interest and volume growth

Regulatory clarity for privacy-focused chains

Horizen (ZEN) Features

Horizen offers one of the most advanced technical architectures in the blockchain space. It originally operated on a multi-tiered Proof-of-Work consensus using the Equihash algorithm, similar to Zcash but optimized for scalability. Blocks are produced every 2.5 minutes, striking a balance between speed and security while maintaining a Bitcoin-like model. The total supply of ZEN is capped at 21 million, mirroring Bitcoin’s scarcity approach.

However, unlike Bitcoin, Horizen is evolving into a next-generation Layer 3 appchain on Base (an Ethereum Layer 2), which dramatically enhances flexibility, interoperability, and smart contract support. Once fully migrated, it becomes EVM-compatible, allowing developers to use standard Ethereum tools.

Privacy is at the heart of Horizen’s mission. The platform includes zero-knowledge proofs (zk-SNARKs) that enable optional private transactions. For more complex operations, it supports Trusted Execution Environments to process sensitive computations off-chain securely.

Attribute-based encryption allows users to share specific data without revealing everything. Multi-party computation enables collaborative handling of secrets without any single party holding full control. Fully homomorphic encryption allows computation on encrypted data, which is one of the most advanced privacy features in blockchain. Additionally, TLS integration provides secure communication between nodes, maintaining end-to-end encryption across the network.

Horizen also runs one of the largest node ecosystems in the industry. It uses a three-tier structure: regular nodes, secure nodes, and super nodes. With over 43,000 active nodes worldwide, the network is highly decentralized and resilient. Secure and super nodes provide additional services such as data integrity, sidechain support, and advanced consensus roles. The introduction of Single Address Staking simplifies participation, allowing users to stake and run nodes more efficiently.

Zendoo, Horizen’s sidechain framework, is another major innovation. It allows developers to launch independent sidechains with customizable logic and consensus. The mainchain does not need to track sidechain states, which improves scalability. Asset transfers are handled through the Cross-Chain Transfer Protocol, while asymmetric pegs and withdrawal certificates ensure safe movement between chains. The Latus implementation uses delegated Proof-of-Stake to increase speed and reduce costs. Recursive proofs verify state transitions efficiently, making the system scalable for enterprise and DeFi applications.

With Horizen 2.0, the platform becomes a Layer 3 privacy appchain on Base. It integrates natively with zkVerify for fast and optimized proof verification. EVM precompiles are built into the core blockchain to accelerate zero-knowledge operations. Transactions gain sub-second finality with extremely low fees, making it suitable for real-world financial use cases. Most importantly, Horizen gains access to Base’s DeFi ecosystem and liquidity, bringing privacy and scalability together in one powerful platform.