Litecoin (LTC) continued to trade under pressure this week, slipping below the $70 mark after briefly touching a three-month low of $65.58. The decline reflects a combination of large-holder selling activity, weakening market attention, and soft technical momentum, positioning Litecoin among the weaker-performing major altcoins in recent sessions.

The move matters as Litecoin has historically been viewed as a more defensive, payment-oriented cryptocurrency. Sustained weakness below key psychological and technical levels suggests shifting investor preferences and highlights how liquidity is rotating toward other assets within the broader crypto market.

On-Chain Data Signals Distribution by Large Holders

Blockchain analytics from Santiment indicate a notable change in positioning among Litecoin’s largest holders. Wallets holding between 1 million and 10 million LTC reduced their balances by approximately 1.08 million tokens since January 12. At the same time, addresses holding between 100,000 and 1 million LTC increased their holdings by around 0.78 million tokens.

Source: Santiment

This pattern is commonly interpreted as distribution by top-tier whales, with mid-sized holders absorbing some of the supply. While this does not imply capitulation, it often coincides with near-term price pressure, particularly when broader demand remains subdued.

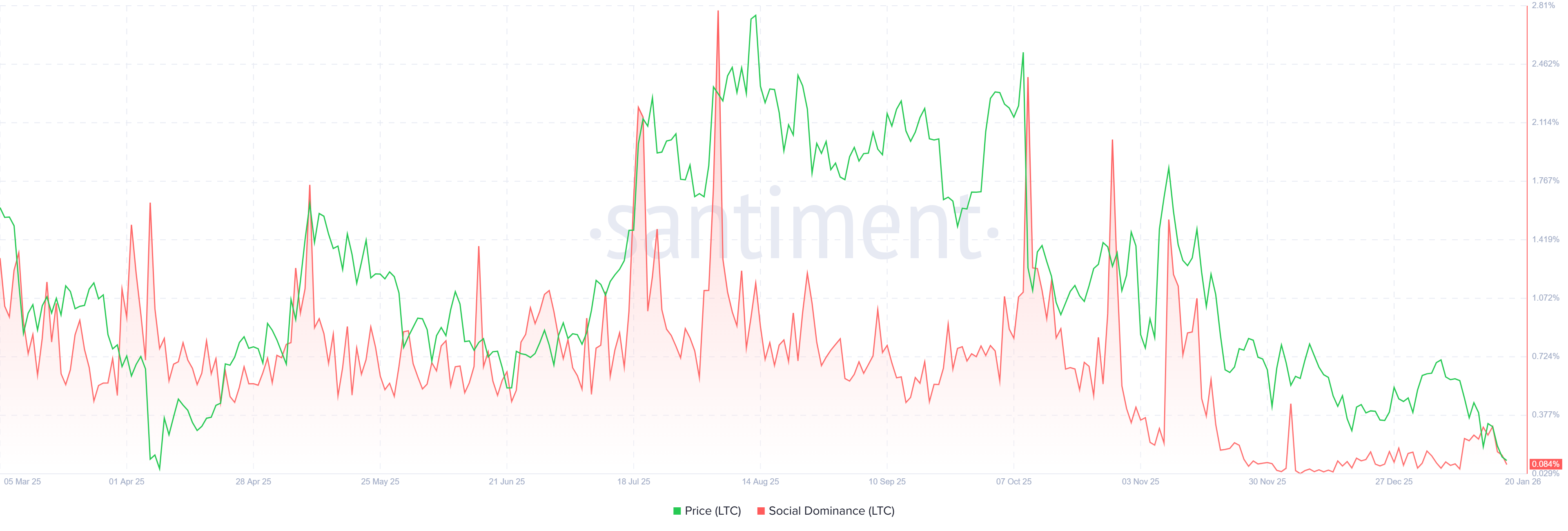

Sentiment indicators reinforce this picture. Santiment’s Social Dominance metric, which tracks the share of Litecoin-related discussions across crypto media and social platforms, has declined steadily and recently fell to about 0.084%. That reading approaches the lowest levels seen earlier this month, pointing to reduced attention and engagement compared with other large-cap cryptocurrencies.

Source: Santiment

Institutional Interest Remains Limited

Institutional flows have also lagged. Data from SoSoValue shows that Canary’s spot Litecoin exchange-traded products have accumulated roughly $9.1 million in net assets. By comparison, spot products linked to Solana and XRP report net assets of approximately $1.21 billion and $1.52 billion, respectively.

The disparity underscores Litecoin’s relatively limited appeal among institutional allocators, particularly as capital has concentrated around assets tied to smart contract platforms, tokenization narratives, and payments infrastructure with higher growth expectations.

Technical Structure Reflects Ongoing Weakness

From a technical perspective, Litecoin failed to hold above its 50-day exponential moving average near $80 earlier this month. The subsequent decline of nearly 10% pushed prices to levels last seen roughly three months ago.

Momentum indicators remain soft. The daily Relative Strength Index is near 33, below neutral territory, while the Moving Average Convergence Divergence indicator has remained in negative territory since mid-January. Together, these signals suggest sellers retain near-term control, even as price attempts to stabilize above recent lows.

Source: TradingView

However, crypto analyst Matthew shared another view of Litecoin, highlighting that under $70 could be a good buy right now as the similar trades have been profitable since 2017.

Litecoin $LTC has been a useful digital token for years due to its inherent price stability, fast block times, and widespread market acceptance. Buying now at $70 below the 200 week EMA almost guarantees an exit at $100. Similar trades have been profitable 15/15 times since 2017. pic.twitter.com/PVVqXDDEOr

— Matthew (@GoodTexture) January 19, 2026

Broader Implications for the Crypto Market

Litecoin’s recent performance highlights how market participants are prioritizing assets with stronger narratives, higher activity growth, or clearer institutional demand. While LTC remains a long-established network with consistent uptime and liquidity, current data points to a cautious environment.

For the broader crypto ecosystem, the episode reinforces the growing divergence between legacy altcoins and tokens attracting fresh capital flows. As investors reassess positioning early in the year, Litecoin’s trajectory may continue to serve as a barometer for risk appetite beyond the largest smart contract platforms.