The Digitap ($TAP) crypto presale offers 124% staking APR with a functional omni-banking platform, while ETH, ADA, and TRX trail behind with lower opportunities.

Staking has become one of the most popular ways to earn passive income in crypto. Investors look for projects that offer solid returns, real utility, and long-term growth potential. But a top staking altcoin to buy should deliver more than just staking rewards. It needs a working product, strong tokenomics, and a clear path forward.

This list focuses on four projects that stand out in 2026:

Digitap ($TAP) – Live omni-banking platform offering 124% APR presale staking.

Ethereum (ETH) – Leading proof-of-stake network with 3-6% staking yields.

Cardano (ADA) – Delegated staking with 1.5-5% APY and no minimum requirement.

Tron (TRX) – Blockchain platform with voting-based rewards ranging from 3-8% APY.

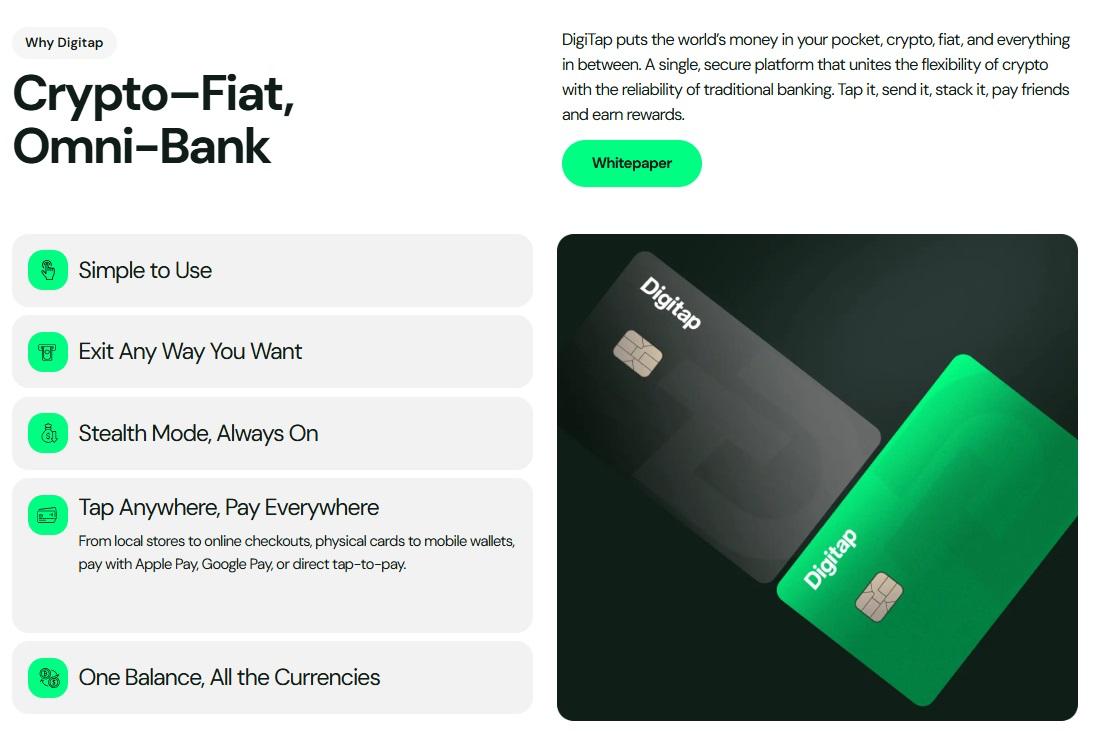

1. Digitap: The Best Crypto Presale with Unmatched Staking Returns

Digitap takes the top spot for good reason. This project offers staking rewards that dwarf traditional networks. Early adopters can earn up to 124% APR during the crypto presale, with 100% APR available after launch. These numbers are not based on inflationary token printing. Digitap uses a fixed pre-allocated pool, which means rewards come from real value, not dilution.

The project has already delivered what most presales only promise. The omni-banking app is live on both the Apple App Store and Google Play Store. Users can download it today, create accounts, and start managing crypto and fiat in one place. The platform supports virtual and physical cards, offshore banking, and instant transfers.

Source: Digitap

Digitap’s tokenomics reinforce long-term value. The total supply is capped at 2 billion tokens with no future minting. 50% of all platform profits go toward token buybacks and burns, which reduces the circulating supply over time. Team tokens are locked for five years, showing commitment to the project’s future.

The current $TAP price is $0.0439. The launch price is set at $0.14, which represents significant upside potential for early participants. Tokens can be claimed 72 hours after launch. The crypto presale has crossed $4.3 million raised. For anyone looking for the best crypto to buy with both staking income and product utility, Digitap delivers on both fronts.

2. Ethereum: The Established Leader in Proof-of-Stake

Ethereum remains the most trusted option for staking in the crypto market. After moving to proof-of-stake, ETH holders can now earn passive income by securing the network. The base staking yield sits around 3-4% APY, though total returns can reach 3-6% when MEV rewards and transaction fees are included.

Staking ETH is accessible through multiple methods. Direct staking requires 32 ETH and running a validator node. For most people, liquid staking services like Lido or exchange platforms like Coinbase offer easier entry points. Ethereum is a solid choice for conservative investors who want reliable returns with lower risk compared to newer networks.

3. Cardano: Easy Delegation with Variable Returns

Cardano uses a delegated proof-of-stake model that makes staking simple. Holders can delegate ADA to staking pools without any minimum requirement or lockup period. Historical yields have ranged from 4-5% APY.

Source: Cardano

The staking experience on Cardano is user-friendly. Native wallets allow direct delegation to pools, and rewards are automatically distributed. For investors evaluating ADA as a crypto to buy, the main drawback is yield variability and returns that fall short of what newer projects like Digitap offer.

4. Tron: Voting Rewards Through Super Representatives

Tron operates on a delegated proof-of-stake system where holders vote for Super Representatives who validate transactions. TRX holders lock their tokens to vote for elected representatives, and those representatives share block rewards with their supporters.

Typical returns range from 3-8% APY, depending on which Super Representatives are chosen. The yield varies because each Super Representative sets their own reward-sharing policy.

Tron has built a strong presence in stablecoin activity and processes high transaction volumes. The main consideration is that, as a crypto to buy for staking, TRX offers non-standardized returns that provide modest passive income compared to Digitap.

Digitap Takes First Place on the Top Staking Altcoin to Buy List

Digitap stands out as the clear winner in this comparison. The 124% APR during the crypto presale and 100% post-launch APR are unmatched. Ethereum offers 3-6%, Cardano ranges from 1.5-5%, and Tron provides 3-8%. The difference in returns is massive.

Beyond staking yields, Digitap delivers a live, functional product. The app works today with real users spending on cards and managing accounts. This separates it from projects that only exist on paper. The deflationary tokenomics, profit-sharing buyback system, and five-year team lock add layers of long-term value.

As a top staking altcoin to buy in 2026, Digitap offers the strongest combination of high staking rewards, working technology, and real-world use cases. This crypto presale gives early investors access to premium staking rates before the wider market catches on. That window creates an opportunity that won’t last forever.