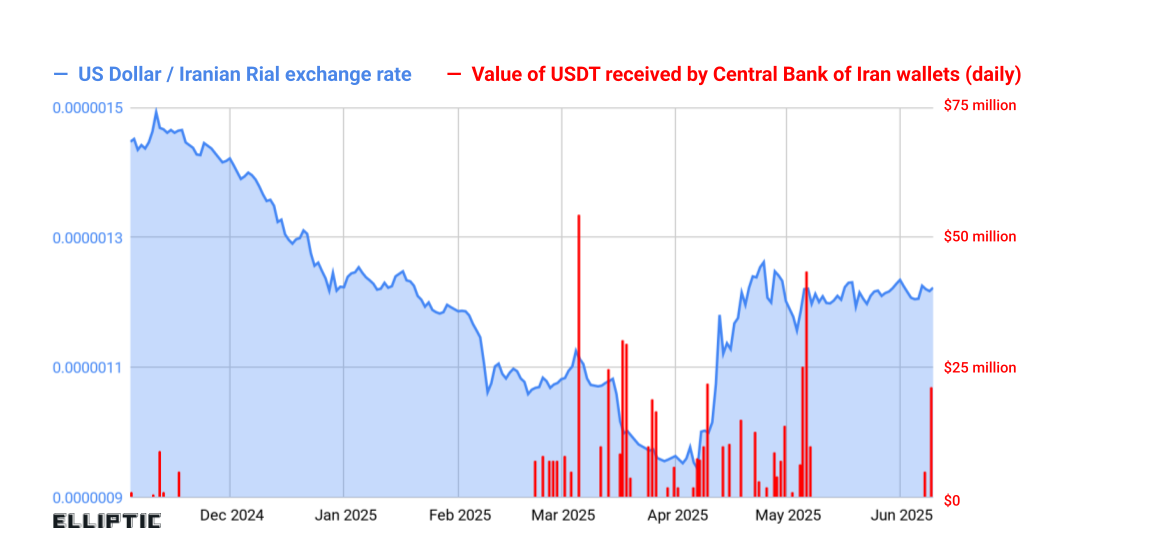

A detailed investigation by Elliptic has uncovered how the Central Bank of Iran quietly accumulated at least $507 million in USDT, the dollar-backed stablecoin issued by Tether.

Using a network of crypto wallets, the central bank appears to have systematically built a reserve of digital dollars outside the traditional banking system. Elliptic stresses that this figure is likely a minimum, as it only reflects wallets that could be confidently linked to the bank.

Key Takeaways

Iran’s central bank built a large USDT position to manage currency pressure and maintain access to dollar value under sanctions.

After a major exchange hack, the flow of funds shifted from local platforms to cross-chain and decentralized routes, signaling a more sophisticated operational approach.

Despite attempts to operate outside the banking system, blockchain transparency allowed investigators and issuers to trace and freeze part of the funds.

From Local Exchange to Cross-Chain Routes

In the early stages, most of the USDT was routed to Nobitex, Iran’s largest crypto trading platform. This flow suggested a relatively direct use case: injecting dollar-linked liquidity into the domestic market during a period when the rial was rapidly losing value.

That pattern changed sharply after June 2025. Elliptic observed funds being sent through cross-chain bridges, moving USDT from TRON to Ethereum and then dispersed via decentralized and centralized venues. This shift followed a major hack at Nobitex, after which the central bank’s on-chain behavior became more complex and harder to follow.

Stabilizing the Rial and Sidestepping Sanctions

The timing of the USDT accumulation coincided with extreme pressure on Iran’s currency, which had lost roughly half its value against the dollar in a matter of months. Elliptic’s analysis suggests the central bank may have used USDT to buy rials on local exchanges, effectively performing digital open market operations that would normally rely on cash reserves.

Beyond domestic currency support, the strategy appears aimed at creating a sanctions-resistant financial layer. By treating USDT as a form of “synthetic dollar,” Iran’s central bank could settle trade, hold dollar value, and move funds internationally without relying on correspondent banks or SWIFT.

Transparency Cuts Both Ways

While stablecoins offer new ways to bypass traditional controls, Elliptic highlights that they are not opaque. Public blockchains allow investigators to trace flows, identify counterparties, and flag sanctioned activity.

In fact, several wallets linked to the central bank were blacklisted in mid-2025, freezing around $37 million in USDT. The case underscores how blockchain transparency can both enable and constrain sanctions evasion.