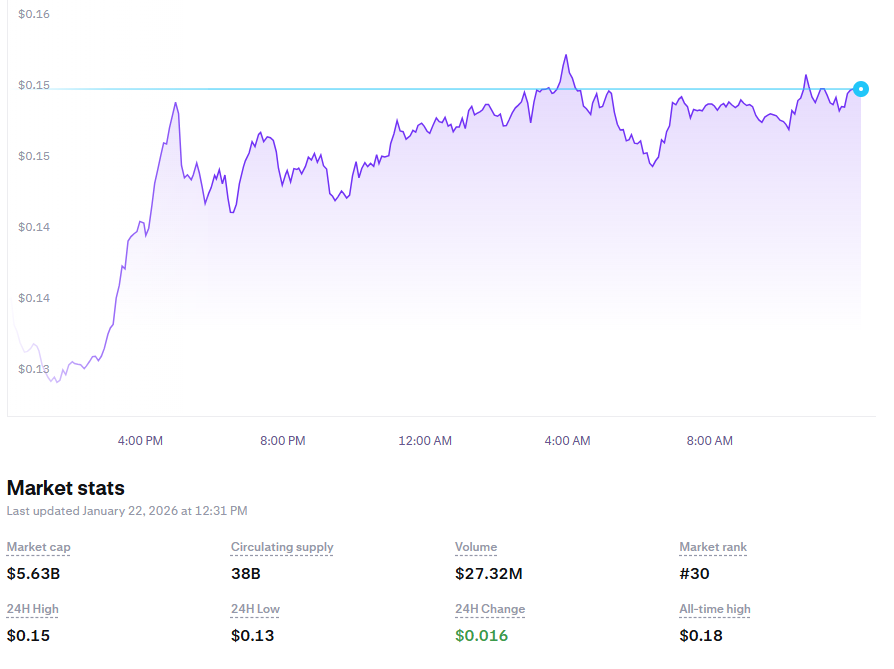

The Canton price forecast has turned bullish after a confirmed breakout above the cup-and-handle neckline near $0.13. Following a strong daily close, Canton Coin (CC) surged to $0.16 and now sits at a $5.58B market cap.

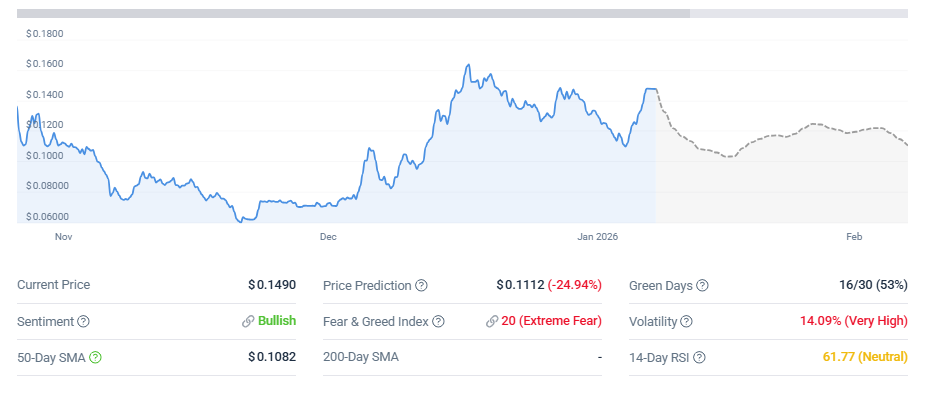

This move opens the path toward the projected target of $0.34 – representing a potential 141% gain from the breakout point. However, while the technical pattern holds, two key metrics suggest underlying market hesitation, even for new cryptocurrencies.

On-balance volume and Chaikin Money Flow indicate weakening capital inflows, raising the possibility of a short-term pullback before continuation. Whether CC climbs directly or retraces first now depends on key levels between $0.12 and $0.21.

Breakout Clears $0.13 as First Target Holds Above $0.21

Canton Coin officially entered price discovery after closing above the neckline resistance of its cup-and-handle pattern. The breakout was confirmed between December 30 and early January, with CC pushing through the $0.13–$0.14 zone and consolidating near $0.16.

From a chart perspective, the next major hurdle sits near $0.21, which aligns with the top of the handle’s projected range. Only a confirmed daily close above this threshold would validate the full pattern breakout, increasing the odds of reaching the $0.34 target. Until then, the move remains bullish but untested.

The market’s ability to sustain momentum above this line will determine if CC continues its climb as the next crypto to explode or enters a local consolidation.

Volume and Capital Flow Diverge from Price Strength

Despite the clean breakout, volume indicators signal hesitation. On-balance volume (OBV) has flatlined, meaning that buying pressure has not grown in parallel with price. This typically reflects reduced participation from new buyers during an uptrend.

Simultaneously, Chaikin Money Flow (CMF) has posted lower highs since mid-December, diverging from the rising price. This negative divergence implies that large capital inflows have weakened.

While CMF remains above zero, the downward slope highlights reduced confidence from institutional or whale buyers. These signals do not invalidate the breakout but suggest the next leg up might require a short-term reset to attract renewed interest.

Technical Levels Determine Pullback Risk vs. Immediate Rally

Canton Coin remains bullish above $0.14, but the market faces a decision point. If momentum fades and CC revisits $0.14, the structure of the pattern remains intact. A dip to $0.12 would still fall within the handle’s consolidation zone.

However, if CC drops below $0.12 on daily close, the breakout weakens and risks increase toward $0.09. A deeper breakdown opens a potential slide to $0.07, which marks the failed-pattern scenario.

On the upside, a daily close above $0.21 reactivates the breakout projection. That scenario puts $0.26 in sight, followed by the full target of $0.34 – a move that reflects the measured height of the cup pattern.

Canton Price Forecast Hinges on Momentum Recovery Above $0.21

For now, the chart still carries a bullish structure. Price is pushing higher, but both OBV and CMF lean toward a short-term pullback rather than straight continuation. The next 24 to 72 hours will be critical.

If CC holds above $0.14 and reclaims strength toward $0.21, the path to $0.26 and then $0.34 reopens. A failed retest or weakness under $0.12 shifts focus to downside risk.

In this Canton price forecast, the $0.20–$0.21 zone acts as the bullish gatekeeper, while $0.12–$0.14 defines structural support. The balance of volume and capital flow must shift soon – either to fuel continuation or confirm correction.