Bombie Price Crash: What’s BOMB Price Prediction After Bybit Delisting

The crypto market saw another sudden shock when the Bombie price crash hit investors hard. On 16th November, the official X account confirmed that Bybit will delist the $BOMB token.

As soon as this Bybit delisting news came out, panic spread in the market. Many traders rushed to sell, and within just 24 hours, the token crashed by nearly 40%.

Many investors are now asking: why this happened and what the future holds. Let’s analyze the crash reason, price prediction, and its recovery phase details.

Bybit Delist $BOMB Token: Important Dates for Investors

The Bombie team shared a clear timeline given by the exchange. Every holder should understand these dates properly:

December 22, 2025 at 8:00 AM UTC: Deposits of tokens will stop

December 23, 2025 at 8:00 AM UTC: Spot trading of the coin will stop

Along with this, they also shared clear steps for investors affected by the this Bombie coin news:

Close all open or pending orders before the deadline

Withdraw your tokens to another exchange or a personal wallet

Withdrawals will still be available even after delisting

The project will continue on other platforms. This message is important for long-term holders who follow the asset closely.

Why $BOMB Crypto Is Going Down Today: Bombie Price Crash 40%

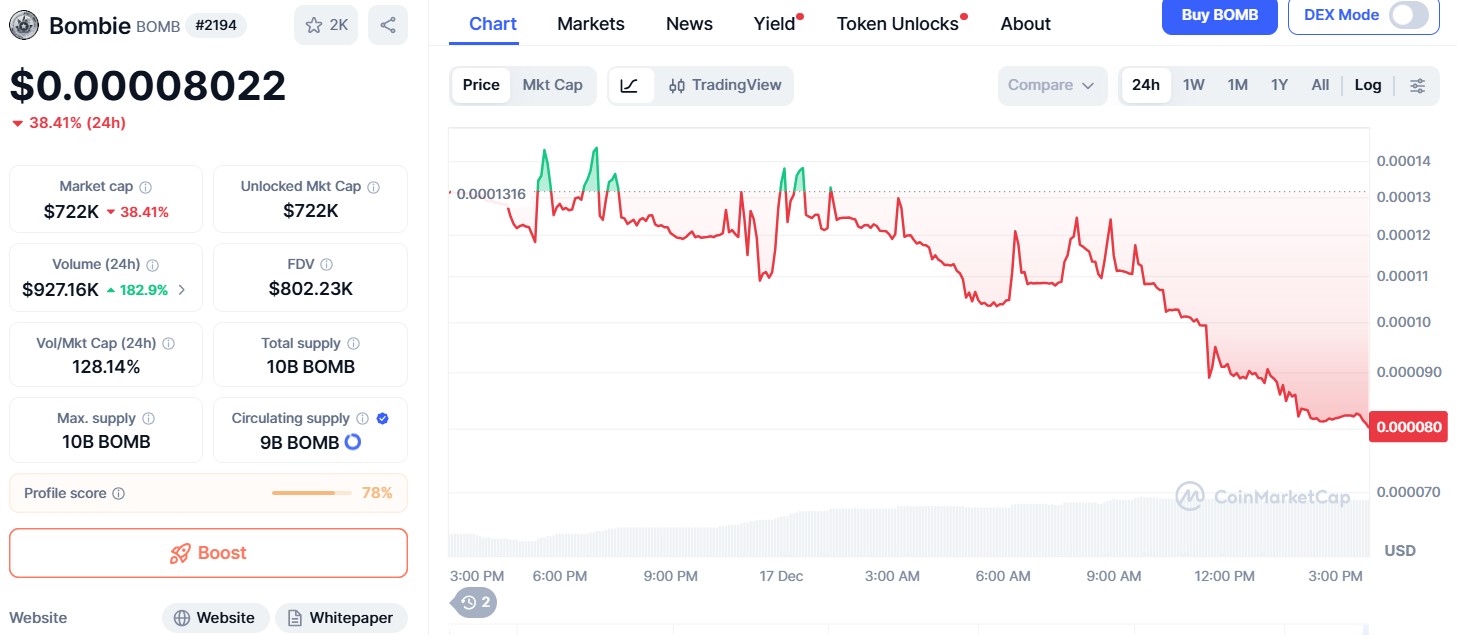

The CoinMarketCap chart clearly shows that this Bombie price crash was caused by the delisting news, not by slow market weakness. Before the announcement, it was trading around $0.00013 - $0.00012 range.

After the Bybit delist BOMB token update, the price fell straight to around $0.000080. There was almost no bounce in between. As per top crypto market watchers, this kind of move usually happens when people panic and sell quickly.

Trading volume also jumped sharply. In 24 hours, volume reached $926.02K, up by 185.29%. At the same time, the price kept falling.

In the last 7 days, the $BOMB token price is down about 57%. This shows heavy selling and fear in the market, not strong buying interest.

Technical Analysis: Trend Is Still Weak, But Is Reversal Soon?

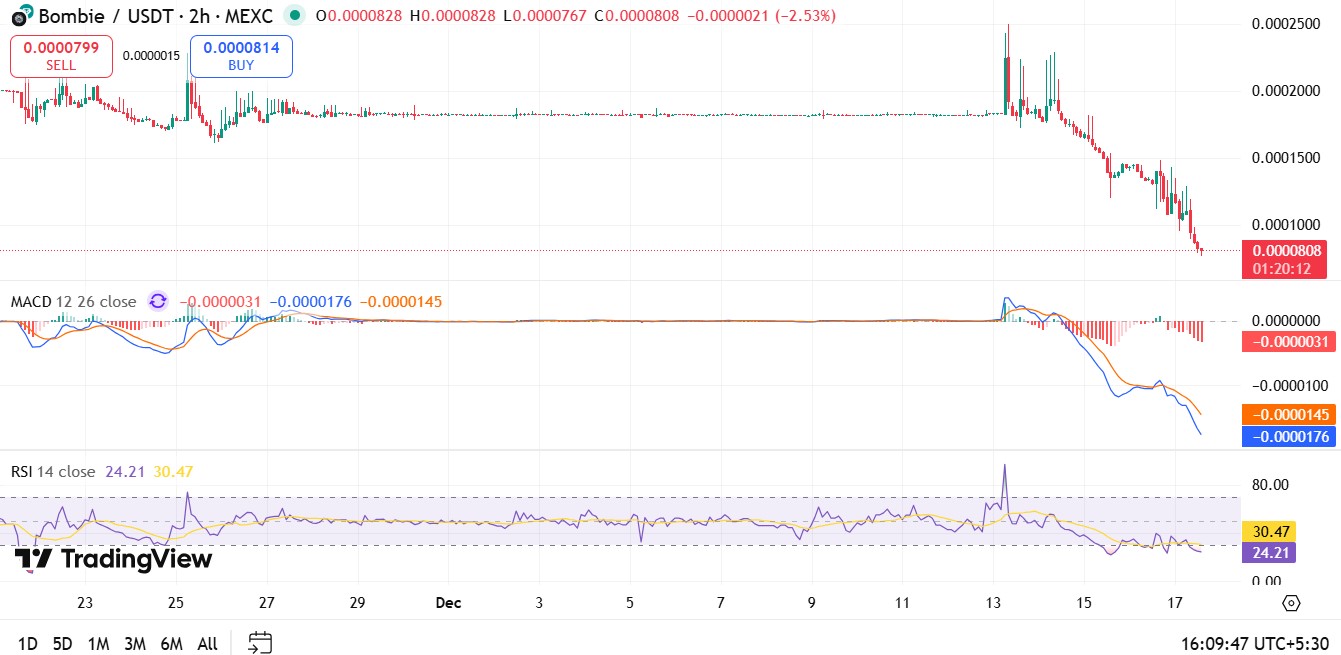

From a crypto expert’s technical point of view, the Bombie price crash has not fully ended yet. The price is still making lower highs and lower lows, which means the downtrend is strong.

TradingView chart Indicators:

RSI is around 24, which means the asset is oversold, but trend flip is not confirmed yet.

MACD is still negative, showing selling pressure is active

Earlier volume spikes show panic selling, and current candles show weak buying

The price has also broken below the $0.00018 - $0.00020 zone and is now trading near $0.000080. This shows loss of trust after the Bybit delisting news.

Bombie Token Price Prediction: What Could Happen Next?

Short-Term Outlook: In the short term, a small bounce can happen because the token is oversold. Price may try to move toward $0.000095 - $0.00011. But if it falls below $0.000075, another drop is possible.

Mid-Term Outlook: After a careful $BOMB token price analysis, in the mid term, it needs to stay above $0.00010 to survive the ongoing bloodbath.

Long-Term Price Target: After big exchange delistings, many tokens fall 70 - 90% from their old highs. If the project survives, gets new listings, and improves volume, price can recover 2x–4x from the bottom.

If the bottom stays near $0.00005 - $0.00007, long-term targets could be $0.00030–$0.00060. This matches expert’s expectations around Bombie price target for 2026 and beyond.

Conclusion

The Bombie price crash happened mainly because of the Bybit delisting, not because of normal market movement. People got scared after the delisting news, so many sold their tokens very quickly. This fear and loss of trust made the price fall fast.

Traders should note that exchange delistings often cause sharp trust loss and liquidity exit. A short-term bounce is possible, but a full recovery will take time.

Disclaimer: Disclaimer: This article is only for general information. Crypto prices can go up or down very fast. Always do your own research before putting money into crypto.