Ethereum Name Service (ENS) is a domain naming system built on the Ethereum blockchain that allows the randomly generated letters and numbers of a standard ETH address to be converted into more easily recognizable words, such as a person’s or a brand’s name. ENS works similarly to the DNS system; however, it does not seek to replace it, but is instead designed to work alongside it. Over the last month, the ENS coin’s price has soared from $16.15 to $29.81 (+85%). The observed volatility underscores ENS’s susceptibility to niche market dynamics. In this article, we will examine the latest Ethereum Name Service price forecasts and analyze the key drivers behind its possible adoption.

| Current ENS Price | ENS Prediction 2025 | ENS Price Prediction 2030 |

| $29 | $40 | $135 |

Ethereum Name Service (ENS) Overview

The Ethereum Name Service is a decentralized domain naming system built on the Ethereum blockchain, designed to simplify cryptocurrency transactions by replacing complex wallet addresses with human-readable names. ENS operates similarly to the traditional Internet’s Domain Name System (DNS), but leverages blockchain technology to ensure decentralization, security, and user ownership. While not intended to replace DNS, ENS provides a complementary solution for Web3, enabling seamless interaction with Ethereum-based applications and services.

ENS is governed by a Decentralized Autonomous Organization (DAO), where ENS token holders participate in protocol decisions, including treasury management and future upgrades. ENS was initially funded through grants from the Ethereum Foundation and Chainlink. The system relies on two core smart contracts: the ENS Registry, which tracks domain ownership and subdomains, and the Resolver, which translates readable names into cryptographic addresses. Users can register .eth domains via the ENS app, customize subdomains, and define their rental period, enhancing usability across dApps and the broader Ethereum ecosystem.

ENS Price Statistics

| Current Price | $29 |

| Market Cap | $1,057,197,766 |

| Volume (24h) | $354,997,712 |

| Market Rank | #80 |

| Circulating Supply | 36,560,954 ENS |

| Total Supply | 100,000,000 ENS |

| 1 Month High / Low | $29.81 / $16.15 |

| All-Time High | $85.69 Nov 11, 2021 |

Ethereum Name Service was launched on May 4, 2017, by Nick Johnson and Alex Van de Sande from the Ethereum Foundation (EF). The ENS token was launched on November 8, 2021, and airdropped to all individuals who owned an ENS domain name (.eth address) before October 31, 2021.

Ethereum Name Service Features

ENS coin offers several features within the crypto space:

Human-readable addresses: ENS converts complex blockchain addresses (e.g., 0x1a2b…3c4d) into simple, memorable names like wallet.eth.

Decentralized ownership: ENS domains are self-custodied NFTs (ERC-721), eliminating reliance on centralized registrars.

Cross-chain compatibility: The platform supports addresses for multiple blockchains (BTC, LTC, etc.) under a single .eth name.

Multi-chain support: The platform is compatible with Ethereum L2s (Arbitrum, Optimism) for low-cost transactions.

Smart contract infrastructure: The platform is powered by two core components: the ENS Registry (stores domains) and Resolvers (translate names to addresses).

Extensible functionality: Ethereum Name Service supports DNS integration, decentralized websites (via IPFS), and identity solutions (DIDs).

Tradable domains: ENS names can be bought, sold, or leased as NFTs on marketplaces like OpenSea.

DAO governance: ENS token holders vote on protocol upgrades, treasury management, and ecosystem decisions.

Censorship-resistant: Domains cannot be seized or altered by third parties, ensuring user sovereignty.

ENS Price Chart

CoinGecko, July 18, 2025

Ethereum Name Service Price History Highlights

2021: The ENS token was launched in November 2021 and reached its all-time high of $85.69 that same month, but it declined in the months that followed.

2022-2023: In April 2022, the coin surged to $22 and hit another high of $19 in October. In 2023, ENS remained below $17 for most of the year, and the second half of 2023 was marked by lows of $6.9 and $7.

2024: In December 2024, ENS crypto soared to a high of $42.14.

2025: The crypto market spike has seen ENS coin grow at the start of 2025, reaching $34.93 on January 22. Just recently, ENS crypto peaked at $29.81. At the moment, $ENS fluctuates between $25 and $30.

Ethereum Name Service Price Prediction: 2025, 2026, 2030-2040

| Year | Minimum Price | Maximum Price | Average Price | Price Change |

| 2025 | $23.4 | $58.1 | $40 | +35% |

| 2026 | $44.8 | $68.8 | $55 | +90% |

| 2030 | $28.8 | $242.5 | $135 | +365% |

| 2040 | $0.6 | $16,773 | $8,400 | +29,000% |

Ethereum Name Service Price Prediction 2025

DigitalCoinPrice crypto experts think that in 2025, the ENS token could reach a maximum of $58.08 (+100%), with a potential low of $23.44 (-20%).

According to PricePrediction, $ENS is projected to reach a conservative minimum of $31.33 (+10%) with a bullish target of $36.19 (+25%), indicating stable appreciation based on current market dynamics.

ENS Coin Price Prediction 2026

DigitalCoinPrice experts think that in 2026, the ENS token will cost as much as $68.81 (+135%) per coin at its highest point. According to them, it will also cost no less than $57.09 (+95%).

PricePrediction indicates strong bullish potential for ENS in 2026, projecting a minimum price target of $44.82 (+55%) and an optimistic high of $55.27 (+90%), driven by accelerating adoption across DeFi and NFT platforms.

Ethereum Name Service Price Prediction 2030

By 2030, DigitalCoinPrice estimates $ENS could climb to $145.29 (+400%), with a conservative low of $126.2 (+335%); this forecast relies on the project’s expanding utility as critical Web3 infrastructure, Ethereum’s ongoing ecosystem growth, and increasing value from ENS DAO governance participation.

PricePrediction predictions estimate that in 2030, Ethereum Name Service can hit $242.45 (+735%) at its peak. At its lowest point, it will cost no more than $203.88 (+605%) per coin.

CoinLore‘s market analysis reflects similarly optimistic sentiment for the ENS token, forecasting a conservative level of $28.84 (-1%) alongside a highly bullish scenario reaching $100.08 (+250%). With this wide valuation range, their analysts underscore both the asset’s strong growth prospects and inherent volatility as adoption of blockchain naming services accelerates across institutional and retail crypto markets.

ENS Price Prediction 2040

CoinLore’s 2040 forecast presents a remarkably wide spectrum from $0.6426 (-98%) to $358.12 (+1,150%), reflecting the binary outcomes possible for blockchain naming protocols in an evolving digital asset landscape.

PricePrediction’s ultra-bullish scenario suggests almost inconceivable growth potentials between $13,507 (+46,500%) and $16,773 (+58,000%), and these wildly varying projections underscore how ENS’s valuation could range from near-obsolete to becoming one of crypto’s most valuable protocols, depending on its ability to maintain dominance in decentralized digital identity solutions amid future competition and technological changes.

Ethereum Name Service Price Prediction: What Do Experts Say?

Experts remain quite optimistic about ENS’s long-term price potential, citing its critical role in Web3 adoption as demand for user-friendly blockchain addressing grows. Analysts highlight ENS’s utility and its expanding integration with crypto wallets, dApps, and multi-chain ecosystems as key value drivers. Some bullish predictions even speculate 2-5x gains in the next bull market, assuming broader Ethereum scalability improvements and increased DeFi activity.

However, bearish scenarios warn of competition from alternative naming services and potential saturation in the .eth domain market. The key driver behind the token’s resurgence was Coinbase’s integration of ENS as the foundation for its Web3 naming system. The exchange’s move to transition its ‘.cb.id’ domains to the ENS protocol not only spurred institutional adoption but also significantly raised the network’s profile. This endorsement from a top-tier platform drives mainstream adoption and serves as a catalyst, solidifying ENS’s position. Some experts emphasize that ENS’s governance tokenomics could amplify its value if decentralized community proposals enhance utility. For instance, Gate remains optimistic about its future and believes that in 2030, $ENS will hit a maximum of $60 per coin.

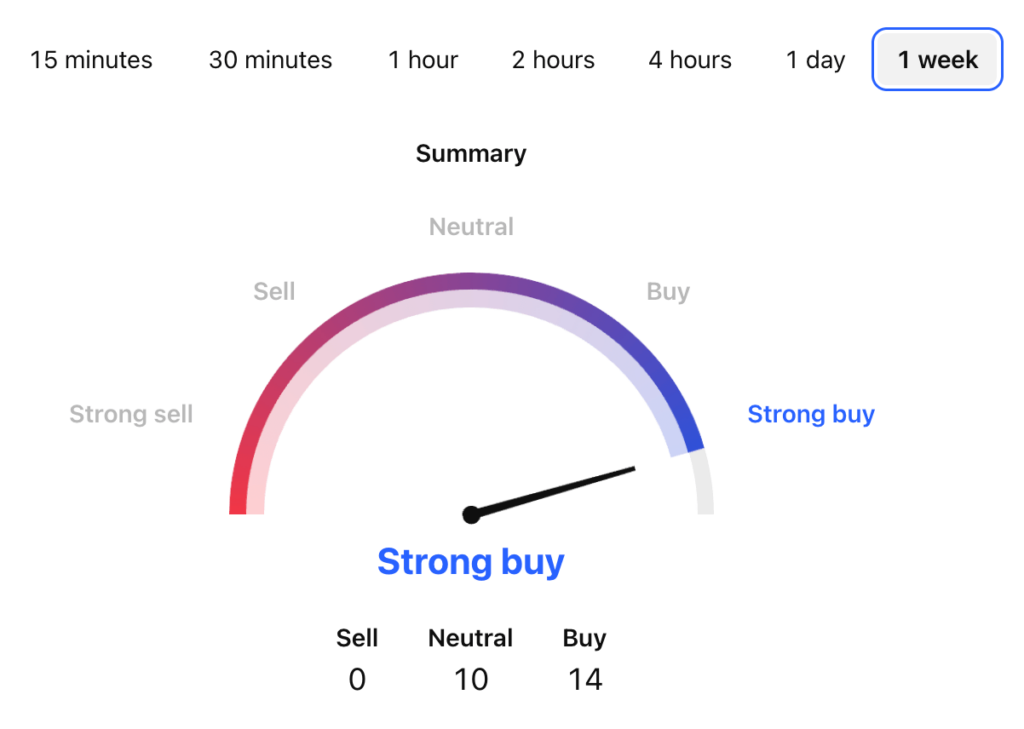

ENS USDT Price Technical Analysis

Tradingview, July 18, 2025

Now that we’ve seen possible price predictions for Ethereum Name Service crypto, let’s dissect the factors that can boost its price.

What Does the ENS Price Depend On?

The price of the Ethereum Name Service token is fundamentally driven by adoption and utility within the Web3 ecosystem. As the protocol becomes more widely integrated across wallets, exchanges, and decentralized applications, demand for ENS domains increases, creating upward pressure on the token price.

The growing need for human-readable blockchain addresses and digital identity solutions positions ENS as critical infrastructure, with its value closely tied to Ethereum’s expansion and the broader adoption of decentralized technologies. Additionally, ENS’s governance model, which gives token holders voting rights over protocol development, adds another layer of value as active community participation can lead to meaningful improvements and strategic decisions that enhance the network’s utility.

Risks and Opportunities

ENS presents significant opportunities as Web3 adoption accelerates. The growing need for decentralized identity solutions across DeFi, NFTs, and DAOs positions ENS as critical infrastructure. Expansion into multi-chain interoperability could dramatically increase its addressable market beyond Ethereum. The protocol’s first-mover advantage and strong brand recognition in the blockchain naming space provide a solid foundation for growth. ENS’s DAO governance model also offers opportunities for community-driven innovation and sustainable protocol development.

However, Ethereum Name Services also faces several risks that could impact its adoption and token value. Regulatory uncertainty surrounding blockchain-based naming services remains a key challenge, as potential restrictions could hinder growth. Competition from alternative naming protocols and traditional DNS systems integrating blockchain features also threatens ENS’s market position. Additionally, ENS’s heavy reliance on the Ethereum ecosystem makes it vulnerable to network congestion, high gas fees, and potential scalability issues that could limit usability.

Is Ethereum Name Service a Good Investment?

ENS presents a compelling but nuanced investment opportunity, offering exposure to the growing need for decentralized identity solutions in Web3. As a foundational protocol with first-mover advantage in blockchain naming, ENS stands to benefit from increasing adoption across DeFi, NFTs, and institutional crypto infrastructure, especially if it maintains dominance as Ethereum scales and multi-chain interoperability expands. However, quick profits often come with significant volatility and risk. The token’s price can swing wildly based on sentiment, with little warning, making it a risky choice for those unfamiliar with the fast-paced and unpredictable nature of crypto markets.

What Is the Max Supply of ENS?

The Ethereum Name Service (ENS) has a fixed maximum supply of 100 million ENS tokens, all of which were minted at launch.

Does ENS Have a Future?

ENS is well-positioned for long-term relevance as decentralized digital identity becomes increasingly critical in Web3. Its core utility solves a persistent usability hurdle for mainstream crypto adoption, and its expanding integrations (for instance, the one with Coinbase) demonstrate growing institutional and ecosystem demand. While competition from alternative naming services and regulatory uncertainty pose challenges, ENS’s first-mover advantage, Ethereum’s dominance, and its DAO-driven governance model provide a robust foundation. If ENS evolves beyond naming into a broader decentralized identity layer, it could become an indispensable infrastructure in the Web3 field.

How High Can an ENS Coin Go?

The price potential of ENS depends largely on its adoption as Web3’s primary naming standard and its expansion into broader decentralized identity solutions. Conservative projections suggest a 2-5x increase (e.g., $50-$100) in the next bull cycle if Ethereum scaling succeeds and major platforms continue integrating .eth domains.

Can Ethereum Name Service Reach $100?

ENS reaching $100 is achievable under favorable conditions, though it would require significant growth in adoption and utility. Currently trading at a fraction of this target, ENS would need to see accelerated integration across major exchanges, wallets, and dApps, along with broader recognition of .eth domains as the standard for decentralized identity.

Will ENS Reach $500?

While a $500 ENS price remains highly speculative, it’s not impossible in an extreme bull case where ENS becomes the universal naming layer for Web3. This, however, would require mass adoption across enterprises, governments, and mainstream users.

Can Ethereum Name Service Hit $1,000?

A $1,000 ENS price would represent an unprecedented 300x+ increase from current levels, with its market cap comparable to today’s entire Ethereum valuation. While theoretically possible in a decades-long hyper-bullish scenario where ENS becomes the global standard for decentralized digital identity (replacing DNS for Web3), this would require near-total adoption across enterprises, governments, and everyday internet users.

What Is the Price Potential for ENS?

ENS demonstrates strong but measured upside potential, with realistic mid-term targets between $50 – $100 if it solidifies its position as Web3’s leading naming protocol.

What Is Ethereum Name Service Price Prediction for 2025?

According to DigitalCoinPrice, in 2025, $ENS can go as high as $58.

How Much Will ENS Be Worth in 2030?

According to PricePrediction, in 2030, the Ethereum Name Service coin can reach a peak of $145.

What Is the Price Prediction for ENS in 2040?

CoinLore analysts believe that in 2040, $ENS will hit a maximum of $358 per coin.

Is Ethereum Name Service a Good Buy?

ENS presents a compelling speculative investment for those bullish on Web3’s future, offering unique exposure to decentralized identity, a critical missing piece in mainstream crypto adoption. Its fixed supply, growing utility, and strategic integrations can create fundamental demand drivers. However, as a mid-cap crypto asset, ENS carries higher volatility and risk, with price swings tied to Ethereum’s performance and broader market sentiment. While it offers growth opportunities, ENS’s price is highly volatile and dependent on crypto market trends. It could be a viable investment option for investors with high risk tolerance.

Conclusion

Ethereum Name Service has established itself as a foundational protocol for blockchain-based identity and naming solutions. Its ability to transform complex wallet addresses into human-readable names addresses a critical need in Web3, bridging the gap between crypto-native users and mainstream adoption. While ENS faces challenges (including regulatory uncertainty, competition, and Ethereum’s scalability), its first-mover advantage, strong community governance, and expanding multi-chain utility position it for long-term relevance.