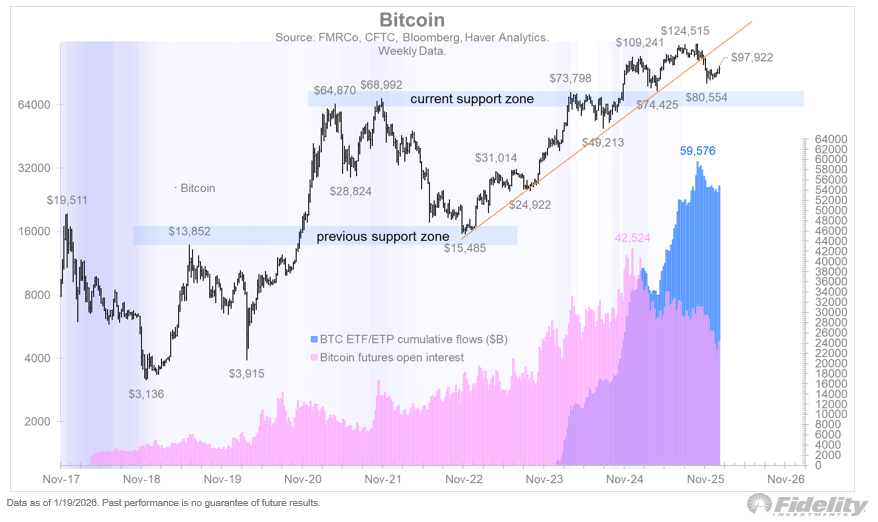

Bitcoin’s recent price action is sending mixed signals after failing to hold its rebound toward $95,000 and slipping back below the $90,000 mark.

The move has sharpened the debate over whether the earlier surge was the start of a renewed uptrend or a short-lived countertrend bounce that has already run out of steam.

Key Takeaways

Bitcoin failed to hold its rebound to $95,000 and is now back below $90,000.

Falling futures open interest and weaker ETF flows suggest the bounce lacked conviction.

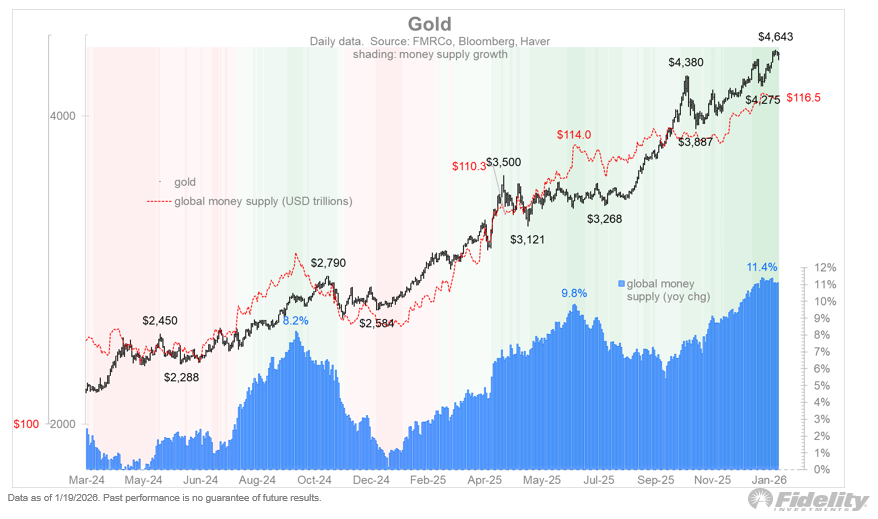

Gold continues to track global money supply growth, diverging from Bitcoin’s choppy setup.

That question was highlighted by Jurrien Timmer, who leads global macro strategy at Fidelity. In his latest commentary, Timmer contrasted Bitcoin’s faltering recovery with gold’s much steadier advance, arguing that the divergence between the two assets has become more pronounced.

Gold tracks liquidity, Bitcoin loses momentum

Gold has continued to climb alongside the expanding global money supply, which now sits around $116.5 trillion and is growing at an annual pace of roughly 11.4%. Timmer points out that gold’s alignment with liquidity trends remains intact, helping explain why its rally has looked orderly and persistent rather than speculative.

Bitcoin’s behavior has been far less convincing. While the rebound from the low-$80,000 area to roughly $95,000 initially suggested strength, the failure to hold those levels has shifted the tone. With Bitcoin now trading back under $90,000, the prior move increasingly looks like a corrective bounce rather than a clean continuation of the broader uptrend.

The $95K rebound in hindsight

Timmer notes that the push toward $95,000 lacked confirmation from underlying market dynamics. Futures open interest fell notably during and after the rebound, indicating that leverage was being reduced instead of rebuilt. At the same time, ETF and ETP flows softened, removing a key source of steady demand that had previously supported higher prices.

The subsequent drop back below $90,000 reinforces that caution. Rather than attracting fresh momentum buyers, the rebound appears to have met selling pressure, suggesting the market may still be in a digestion phase after its earlier advance.

Momentum curves flash warning signs

Another element weighing on Timmer’s assessment is Bitcoin’s momentum profile. Compared with other major assets, Bitcoin’s momentum curve has been a clear outlier over the past cycle, running far hotter than equities or even gold.

Historically, such extremes tend to be followed by rebalancing or consolidation. The recent inability to sustain prices near $95,000, followed by a slide back under $90,000, fits that pattern more closely than a renewed breakout.

Gold’s momentum, by contrast, remains smoother and more consistent with periods of accelerating money supply growth.

A pause, not a verdict

Timmer stops short of calling a trend reversal. Instead, he frames the current setup as unresolved. Bitcoin’s long-term narrative may still be intact, but the market has yet to prove that the correction is over. The failed hold above $95,000 and the return below $90,000 suggest the path forward is likely to involve further consolidation rather than an immediate push to new highs.

For now, the contrast is clear: gold continues to benefit from macro forces in a straightforward way, while Bitcoin is struggling to regain momentum after a rebound that, so far, has not held.