Bitcoin declined just over 1% over the past 24 hours, but recent price action has drawn closer scrutiny after the asset briefly tested a critical technical threshold over the weekend. The move brought BTC near a potential bearish breakdown before a short-term rebound emerged, highlighting a fragile balance between weakening sell pressure and unresolved downside risks.

The episode matters for market participants because Bitcoin remains positioned within a broader bearish technical structure, with its next directional move likely to shape short-term sentiment across digital asset markets. While some momentum indicators suggest selling activity has slowed, other signals point to limited buyer conviction.

Technical Structure Remains Fragile

Bitcoin continues to trade within a head-and-shoulders pattern on the daily chart, a formation commonly associated with trend reversals when confirmed. For BTC, the neckline of this structure is located near the $86,100 area. On January 25, the price briefly dipped into that zone before rebounding, avoiding a confirmed breakdown for now.

Source: TradingView

A daily close below the $86,100–$85,900 range would activate the pattern’s downside projection of roughly 10%, placing renewed focus on lower support levels. The recent bounce, however, coincided with a notable momentum signal. Between mid-December and late January, Bitcoin formed a higher price low while the Relative Strength Index (RSI) printed a lower low, a configuration known as hidden bullish divergence. This signal typically reflects slowing sell pressure rather than a full trend reversal.

On-Chain Data Signals Cooling Distribution

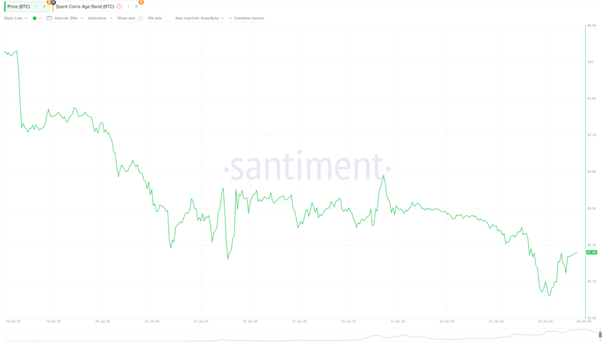

Blockchain data supports the view that immediate selling pressure has eased. The Spent Coins Age Band metric, which tracks on-chain movement across all holding periods, declined sharply during the recent pullback. Coin movement dropped from approximately 27,000 to around 7,690, representing a decrease of roughly 72%. Lower on-chain activity generally indicates fewer holders are distributing coins, helping explain why the price stabilized rather than breaking lower.

Source: Santiment

However, reduced selling alone has not translated into renewed demand. Bitcoin spot exchange-traded funds (ETFs) have recorded multiple consecutive sessions of net outflows, signaling muted institutional participation. Historically, rebounds without ETF inflows have struggled to develop into sustained recoveries.

Profit Metrics and Resistance Zones in Focus

Profit-taking risk also remains present. Bitcoin’s Net Unrealized Profit/Loss (NUPL) metric currently sits near 0.35, above levels that previously coincided with local market bottoms. Prior pullbacks in late November and mid-December saw NUPL move closer to the 0.33–0.34 range, according to on-chain analytics firm Alphractal.

Bitcoin: the market is bleeding, but the true bottom hasn’t arrived yet — according to on-chain analysis.

? NUPL (Net Unrealized Profit/Loss) is falling, but remains positive — historically, true cycle bottoms only form once it turns negative (full capitulation).

? Delta… pic.twitter.com/iITNmUPfSv

— Alphractal (@Alphractal) January 26, 2026

Cost-basis data further outlines nearby resistance. A significant concentration of previously acquired Bitcoin sits between $90,168 and $90,591, creating a notable overhead supply zone. Additional resistance appears near $91,210, while the broader technical structure would remain vulnerable unless Bitcoin can reclaim the $97,930 region.

Until those levels are addressed, Bitcoin’s short-term outlook remains cautious, with price behavior around established support and resistance zones likely to determine near-term market direction.