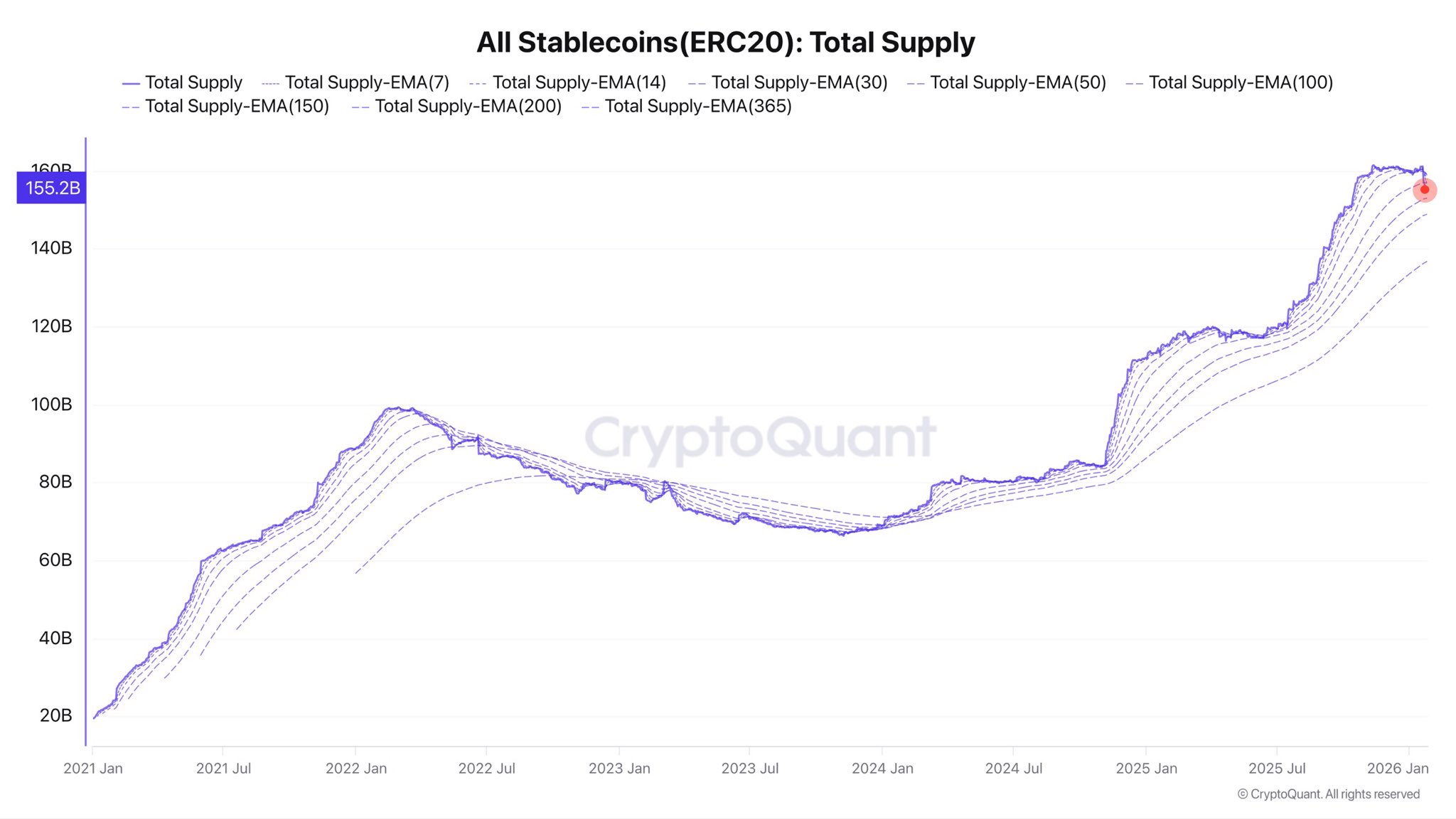

The crypto market is flashing a warning sign that hasn’t appeared at this stage of the cycle until now. The total market capitalization of ERC-20 stablecoins has dropped sharply, signaling that liquidity is actively leaving the crypto ecosystem rather than rotating within it.

Over the past week alone, stablecoin market cap has fallen by roughly $7 billion, sliding from around $162 billion to $155 billion. That kind of move is not noise. Stablecoins are the backbone of crypto liquidity, acting as both dry powder for buying and a parking place during periods of uncertainty. When their supply contracts this quickly, it usually points to a broader shift in investor behavior.

Key Takeaways

ERC-20 stablecoin market cap dropped by $7B in one week, a rare move for this stage of the cycle

Falling stablecoin supply signals capital exiting crypto rather than waiting on the sidelines

Liquidity contraction weakens rebounds and increases downside risk

A quick stabilization is needed to keep this move cyclical, not structural

What makes this decline especially concerning is the broader market context. Crypto assets have been correcting, while precious metals continue to surge and equity markets maintain a strong underlying uptrend. Instead of waiting on the sidelines in stablecoins, some investors appear to be fully exiting crypto and reallocating capital to markets offering clearer momentum and returns.

How stablecoin outflows reflect liquidity stress

When stablecoin market capitalization falls, it means demand for these tokens is shrinking. Investors are converting stablecoins back into fiat to deploy capital elsewhere, and stablecoin issuers respond by burning excess supply that is no longer needed. The result is a visible contraction in on-chain liquidity.

In simple terms, fewer stablecoins mean less capital ready to re-enter crypto markets quickly. That reduces buying power, weakens rebounds, and makes price moves more fragile. In an environment where liquidity is already tight, this effect becomes even more pronounced.

A bearish signal confirmed across chains

This isn’t an isolated Ethereum-only phenomenon. Similar patterns are emerging across other blockchain networks, reinforcing the idea that this is a market-wide liquidity issue rather than a technical anomaly on a single chain.

Historically, sustained declines in stablecoin supply have aligned with periods of deeper weakness in crypto. In 2021, a falling stablecoin market cap was one of the signals that Bitcoin was transitioning into a bear market, with additional stress later amplified by events like the Terra-Luna collapse. While today’s situation is different, the historical parallel is hard to ignore.

Cyclical pause or structural shift?

The key question now is speed and direction. If stablecoin demand stabilizes and begins to recover, this move could remain cyclical – a temporary pullback during a broader market rotation. If the decline continues, however, it risks becoming structural, pointing to a longer-lasting drain of liquidity from crypto markets.

For now, the message is clear. Liquidity is not just cautious; it is actively leaving. Until this trend reverses, the crypto market remains vulnerable, with fewer resources available to support sustained upside moves.