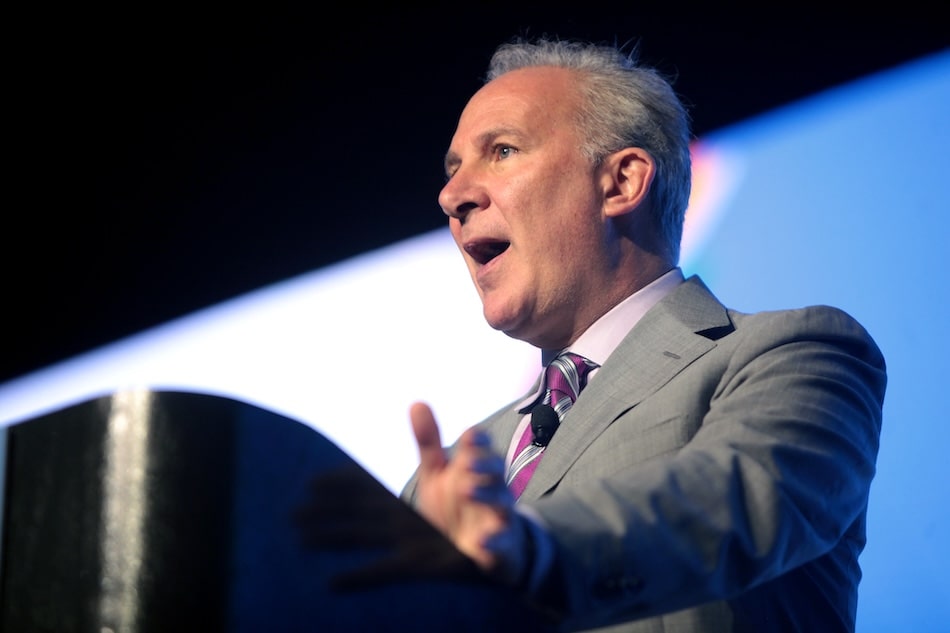

Tucker Carlson challenged gold advocate Peter Schiff on bitcoin’s role in a weakening dollar system during a recent interview.

Schiff argued bitcoin is purely speculative, has “no actual use,” and said proposals for a US strategic bitcoin reserve would function as a taxpayer-funded bailout for early adopters.

‘Complete waste of capital’

Schiff criticized US policy makers for “promoting” bitcoin and called it a “complete waste of capital,” claiming it has led many Americans to “throw their money away.”

When Carlson asked why buying bitcoin is different from buying gold or stocks, Schiff said demand for BTC is driven only by expectations of higher prices.

Schiff also argued that people who profited from bitcoin did so only because assets bought earlier rose significantly, not because they produced something of value.

Carlson pushed back by comparing that logic to gold ownership.

Schiff responded that gold differs because it has non-monetary uses.

Inflation and fiscal policy

Schiff spent much of the conversation attacking official inflation data.

He told Carlson Americans are “being lied to” about inflation and claimed changes to the Consumer Price Index allow the government to shift blame for rising living costs.

Schiff singled out President Donald Trump’s “Big Beautiful Bill” as “the worst thing that we’ve done under Trump,” arguing it preserved deficit spending and made it worse by increasing spending while cutting taxes.

Bitcoin as a global reserve?

Carlson asked why bitcoin could not become a new global reserve asset as confidence in the dollar erodes.

Schiff dismissed the idea, calling a strategic bitcoin reserve a “Bitcoin bailout fund,” and argued central banks could not rely on bitcoin because it lacks non-monetary demand.

The exchange came as bitcoin traded near $87,700 on the day.

Schiff pointed to gold’s recent surge, with prices hitting a new all-time high above $5,000 per ounce, while bitcoin briefly fell below $86,000.