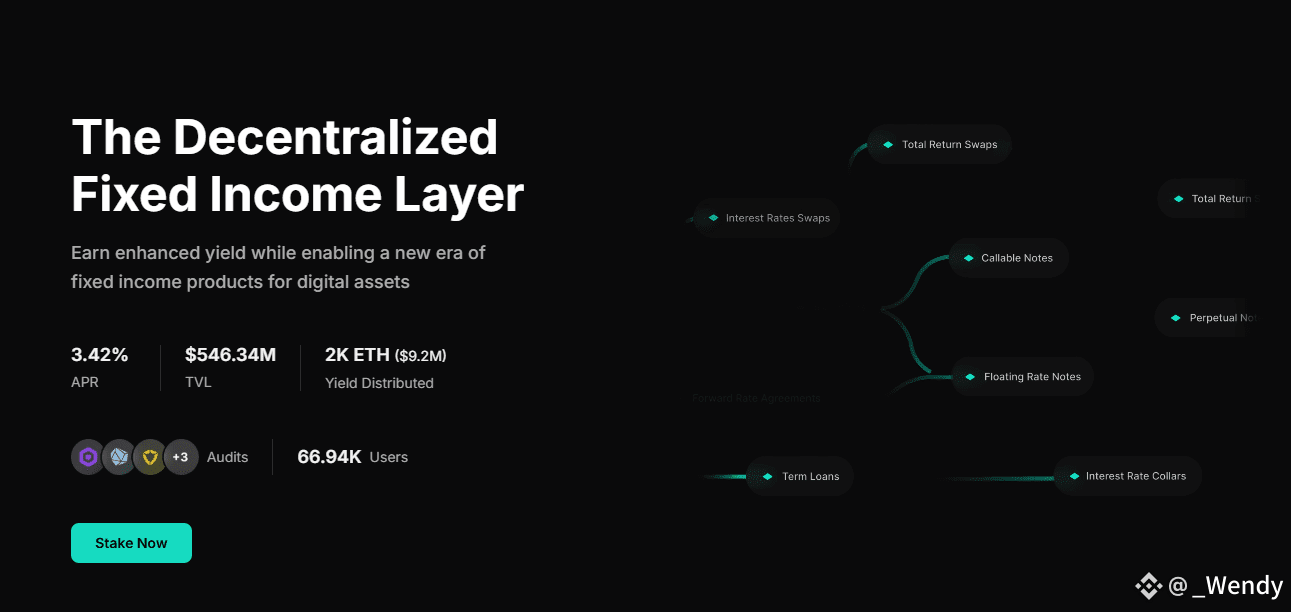

In the fast-moving world of decentralized finance (DeFi), Treehouse (TREE) has emerged as a pillar of stability. Founded by Treehouse Labs in 2021, the protocol is reshaping how investors access fixed-income opportunities on the blockchain. By introducing tAssets—next-generation liquid staking tokens—and Decentralized Offered Rates (DOR), Treehouse delivers transparent, predictable yields in a market known for volatility. As of July 2025, Treehouse has reached $550M in Total Value Locked (TVL), with 66,000 users staking 120,000 ETH, proving its strength and growing adoption.

Solving DeFi’s Biggest Gap: Standardized Rates

At the heart of Treehouse is a mission to address a critical challenge in DeFi: the absence of standardized interest rate benchmarks. Its flagship Treehouse Ethereum Staking Rate (TESR) under the DOR framework functions like LIBOR in traditional finance, enabling advanced products such as on-chain treasuries and interest rate swaps.

Meanwhile, tAssets such as tETH combine traditional staking rewards with Market Efficiency Yield (MEY) from arbitrage opportunities, plus Nuts points for added incentives. The result: higher returns without sacrificing liquidity. Currently live on Ethereum, Arbitrum, and Mantle, Treehouse is set to expand to Solana and Avalanche, ensuring seamless integration across leading DeFi ecosystems.

Backed by Leading Investors & Partners

Treehouse’s credibility is reinforced by its strong funding and partnerships. In 2022, the project raised $18M in a seed round led by Binance Labs, Lightspeed Venture Partners, and Jump Capital. A strategic round in Q2 2025 valued the company at $400M, backed by a global financial powerhouse managing over $500B in assets, along with notable angels like Jordi Alexander (Selini) and Guy Young (Ethena). Partnerships with Staking Rewards, RockX, and LinkPool further strengthen its data infrastructure and ecosystem reliability.

TREE Tokenomics: Built for Long-Term Growth

The TREE token (ERC-20, 1B total supply) launched in July 2025 with 186.1M tokens (18.6%) in circulation. Allocation includes:

10% for community airdrops

10% for ecosystem development

17.5% for investors

20% for community rewards

Team and investor tokens are subject to a 48-month vesting schedule, ensuring long-term alignment. Full details are transparently published in the TREE Tokenomics documentation.

A New Era of Stable Wealth in DeFi

Treehouse is not just another DeFi protocol—it represents a vision of stability in an unpredictable market. By combining cutting-edge blockchain technology, robust financial infrastructure, and a community-driven approach, Treehouse is paving the way for a new era of sustainable wealth creation.