XRP was trading at $1.92 at press time, down around 6% over the past 10 days after losing the $2.00 psychological level. The pullback followed Bitcoin’s decline below $90,000, which pressured high-beta altcoins across the market. Despite the retracement, XRP remains above its January swing low at $1.81, keeping the medium-term structure intact.

Market focus has narrowed to $1.8, a 3-day chart swing low that has not been breached since early January. This level now defines whether XRP’s January rally was a corrective bounce or the start of a broader trend continuation.

The broader backdrop remains one of caution, with Bitcoin showing risk-off behavior after losing $90k, a dynamic that continues to weigh on derivatives sentiment. That environment matters for XRP, as upside follow-through has historically required both BTC stability and improving risk appetite.

Why $1.8 has become XRP’s technical fault line

Crypto Trader, Yimin X, pointed out that $1.8 is the important point. If $1.8 holds, it might reclaim the 50-day MA.

$XRP is trying to stop the bleeding.

If $1.80 holds, the next task is reclaiming the 50-day MA (white line).

Beyond that, $2.50 is the big “prove it” zone overhead with a significant volume profile.

Commen why you are bullish / bearish on XRP. pic.twitter.com/qwIhnkNegV

— Yimin X (@yxinsights) January 26, 2026

On the 3-day timeframe, $1.8 also marks the key unbroken swing low, making it a structural support rather than a simple horizontal level. As long as this level holds, the internal market structure remains bullish, despite January’s gains being largely retraced.

Source: TradingView

Momentum indicators explain why patience is still required. The Chaikin Money Flow (CMF) has stayed below -0.05 since December, signaling extended and steady capital outflows rather than sustained accumulation. The Money Flow Index (MFI) also failed to reclaim 50, reinforcing the lack of strong buying pressure on higher timeframes.

Together, these indicators warn that choppy price action or a deeper liquidity sweep remains possible, even while the broader bias stays constructive.

Liquidity dynamics and downside risk remain intertwined

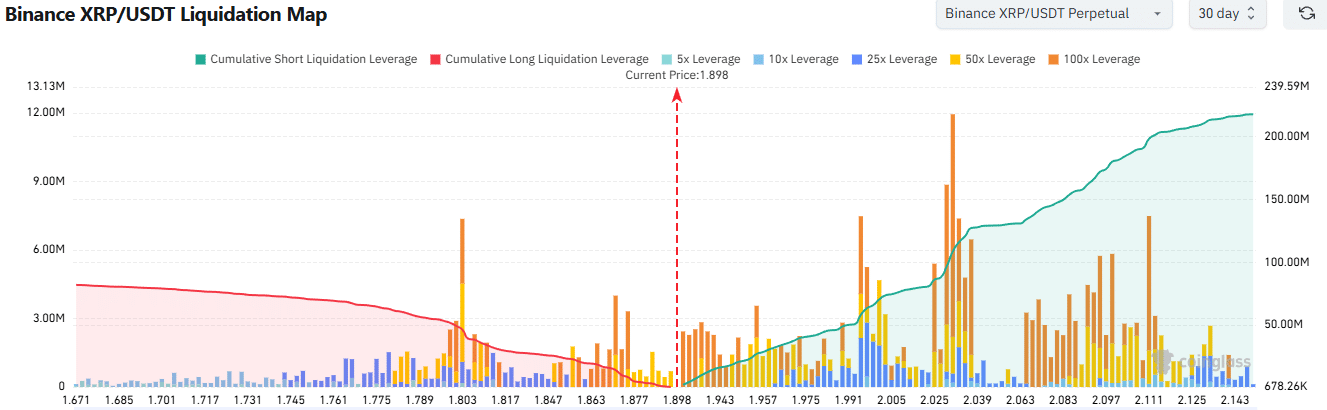

Derivatives data shows that the area just below $2.00 previously held a dense liquidation cluster, which has now been swept. This aligns with expectations that XRP would be drawn lower to clear overhead leverage.

With that liquidity now flushed, the XRP price might go up again, particularly if price holds above the $1.77–$1.80 zone. Liquidation maps indicate sizeable cumulative leverage down to around $1.80, suggesting XRP could briefly dip lower before finding stronger support.

As long as $1.8 remains intact, the liquidation profile favors a rebound rather than trend continuation lower.

Why traders may need more patience

While near-term volatility remains elevated, the directional bias stays bullish as long as $1.8 is unbroken. A sweep of liquidity toward $1.80 or slightly below would still fit within a bullish framework, especially given that internal structure flipped bullish earlier in the month.

Source: Coinglass

If bulls can defend this zone and bring in sustained spot demand, a short squeeze toward $2.05 appears increasingly likely. Beyond that, momentum-driven follow-through could resemble the strong rally seen earlier in January.

Risk balance: what validates the bullish case?

The bullish scenario hinges on holding $1.8 followed by a reclaim of $2.00 on expanding volume. A move above $2.05 would likely trigger short covering and shift sentiment decisively back in favor of the bulls.

Failure to hold $1.8, however, would invalidate the bullish structure and expose XRP to deeper downside. Until that happens, $1.8 remains the make-or-break level separating a corrective pullback from a structural breakdown.