Ethereum is trading near the $3,000 level as institutional accumulation and steady on-chain activity provide support, even as short-term market sentiment remains mixed. After a volatile start to the year, ether has stabilized following a brief dip below the psychological threshold, underscoring continued interest from long-term participants despite broader crypto market fluctuations.

At the time of writing, ETH is changing hands around $3,025, according to market data, with a market capitalization of approximately $364 billion. Prices have ranged between $2,899 and $3,028 over the past 24 hours. While Ethereum remains nearly 40% below its August 2025 peak near $4,946, recent price action suggests consolidation rather than a sustained drawdown.

On-Chain Metrics Point to Accumulation

Blockchain data indicates Ethereum is trading within a dense cost-basis zone, a condition often associated with accumulation. The number of non-empty Ethereum wallets has reached an all-time high, reflecting continued user adoption even during periods of muted price momentum. According to Merlijin The Trader, Staking activity also remains strong, with validator entry queues growing while withdrawal volumes stay comparatively low, signaling that more participants are committing ETH to the network.

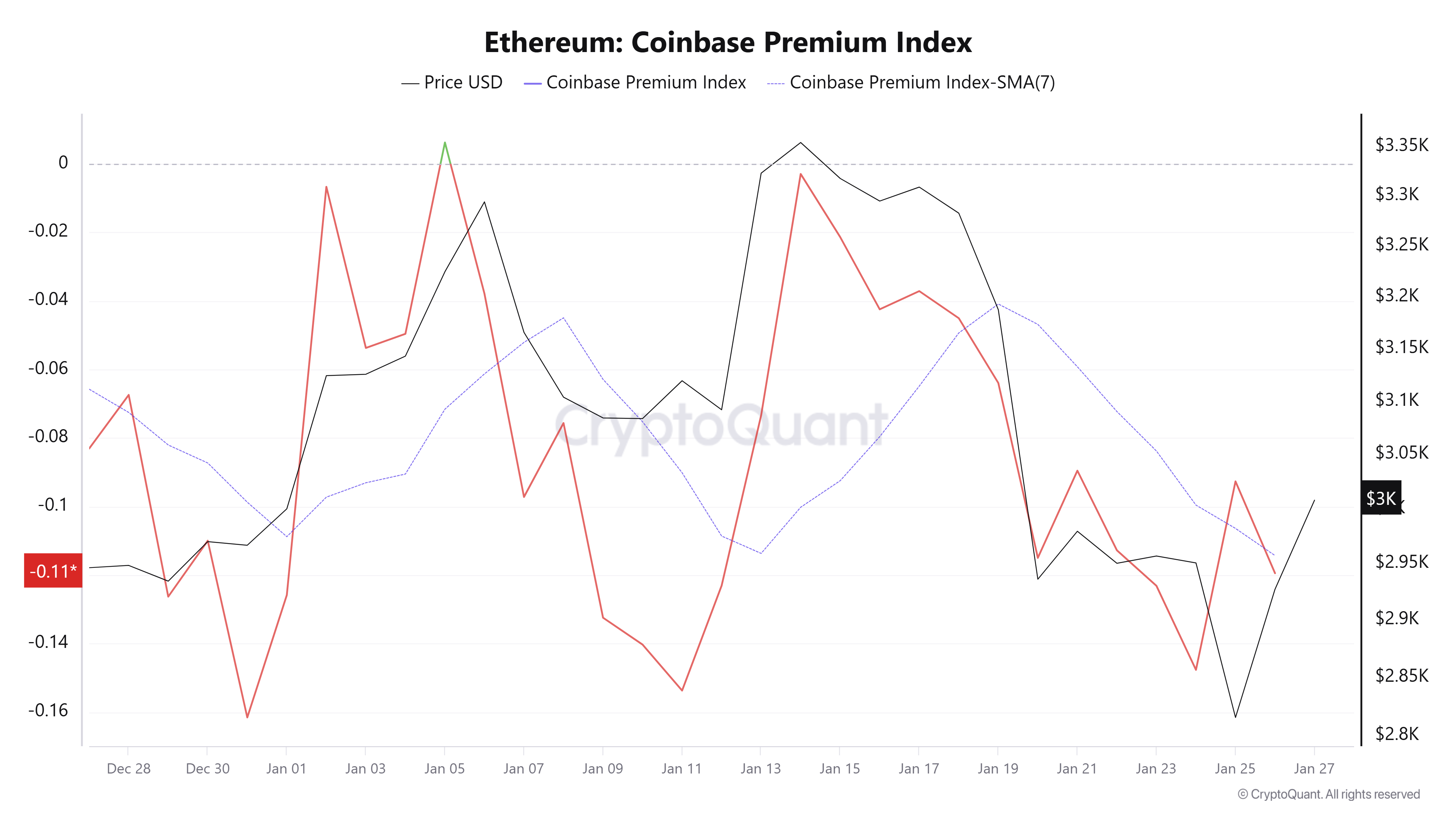

Institutional behavior has reinforced this trend. Recent reports show that companies and investment funds have collectively added more than one million ETH to their balance sheets over recent months. Spot Ethereum exchange-traded funds have also returned to net inflows after a brief period of outflows, led primarily by Fidelity’s ETH product. However, data from the Coinbase Premium Index suggests U.S.-based retail investors remain cautious, contributing to Ethereum’s current range-bound trading.

Source: CryptoQuant

Market Structure and Technical Levels

From a technical perspective, Ethereum is facing resistance in the $3,050 to $3,100 area, which aligns with short-term moving averages tracked by traders. Support has formed near $2,880, a level closely watched for signs of renewed selling pressure. The balance between institutional inflows and hesitant retail participation has so far prevented a decisive move in either direction.

Source: TradingView

Protocol Developments Add Long-Term Context

Beyond price dynamics, Ethereum’s development roadmap continues to attract attention. The network is preparing for the rollout of ERC-8004, a proposed standard aimed at enabling decentralized AI agents through on-chain identity, reputation, and verification mechanisms. Developers argue that such infrastructure could support autonomous, trust-minimized interactions without reliance on centralized intermediaries.

ERC-8004 is going live on mainnet soon.

By enabling discovery and portable reputation, ERC-8004 allows AI agents to interact across organizations ensuring credibility travels everywhere.

This unlocks a global market where AI services can interoperate without gatekeepers. https://t.co/Yrl0rvnSxj

— Ethereum (@ethereum) January 27, 2026

While adoption of ERC-8004 remains in its early stages, the proposal highlights Ethereum’s broader strategy of positioning itself as a settlement and coordination layer for emerging technologies. Combined with declining transaction fees, steady growth in active addresses, and sustained staking participation, these factors suggest that Ethereum’s current phase reflects structural resilience rather than diminished relevance within the digital asset ecosystem.