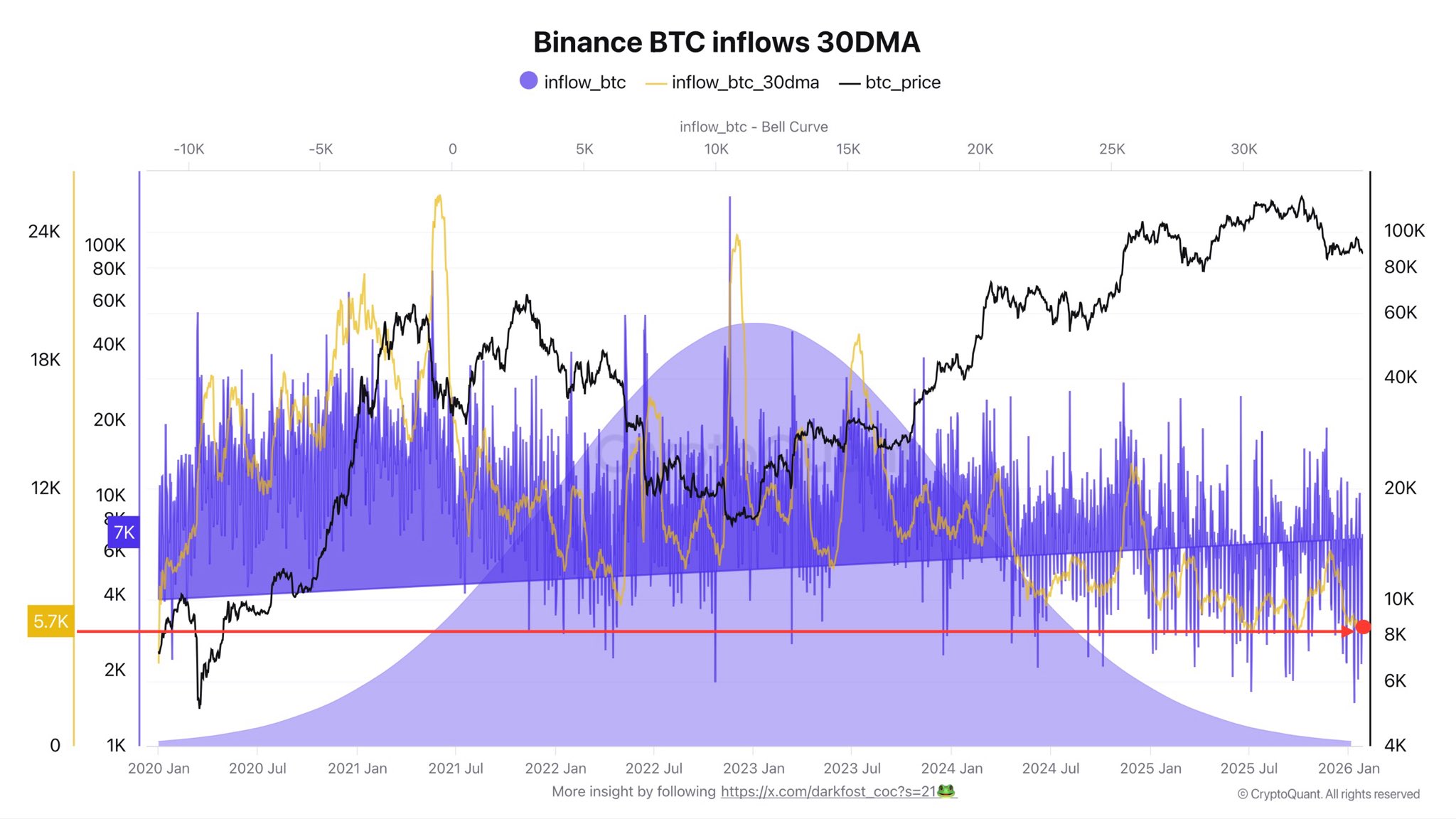

Bitcoin flows into Binance have dropped to their lowest monthly level since 2020, highlighting a major shift in investor behavior following the recent market correction.

Average monthly BTC inflows now stand at roughly 5,700-5,800 BTC, less than half of the long-term historical average of around 12,000 BTC.

Key Takeaways

Monthly Bitcoin inflows to Binance have fallen to around 5,700 BTC, the lowest level since 2020

Current inflows are less than half of the historical average of roughly 12,000 BTC per month

The trend has persisted for months, suggesting a structural shift rather than a temporary reaction

This sharp decline comes after Bitcoin suffered a drawdown of more than 30% from its latest all-time high, a phase that has traditionally been associated with rising exchange deposits and increased selling activity.

A structural change, not a short-term reaction

What stands out is the persistence of this trend. For several consecutive months, Bitcoin inflows to Binance have remained well below the historical norm, suggesting the slowdown is becoming structural rather than temporary.

Instead of reacting to volatility by moving coins onto exchanges, investors appear to be maintaining their positions. The use of monthly averages smooths out one-off transfers and abnormal spikes, reinforcing the view that this behavior reflects a deeper change in market dynamics rather than short-lived noise.

Why exchange inflows matter for market pressure

Bitcoin inflows to exchanges are closely monitored because they are often linked to potential selling pressure. When BTC moves from on-chain wallets or cold storage to centralized platforms, the intent is frequently to sell or trade.

Binance’s data is particularly relevant, as the exchange still captures a dominant share of global Bitcoin flows. Sustained weakness in inflows therefore provides meaningful insight into broader investor sentiment and intentions across the market.

Holding behavior strengthens despite uncertainty

The historically low level of BTC inflows comes at a time of ongoing price consolidation and elevated macroeconomic uncertainty. Rather than distributing coins, investors appear increasingly inclined to hold Bitcoin off exchanges.

This trend is generally viewed as constructive, as reduced exchange supply can limit immediate selling pressure and point to growing conviction among long-term holders, even after a significant correction.