In the high-stakes economy of 2026, the store of value narrative is taking a backseat, and investors are looking for assets that can actually move value across borders instantly. The market is shifting from coins you just hold to coins you can spend.

Digitap ($TAP) is positioning itself as the answer to that gap. By combining a decentralized neobank model with Solana’s high-speed settlement layer, Digitap turns crypto into a borderless financial tool rather than a speculative instrument. That focus on usability has already pushed $TAP up 263% in presale performance, signaling where the next phase of global payments innovation is taking shape.

Here are the top 5 altcoins for global payments in 2026:

Digitap ($TAP): The high-growth omnibanking protocol, currently up 263% in presale.

Ripple (XRP): The institutional standard, currently consolidating at $1.91.

Stellar (XLM): The non-profit alternative to XRP, optimized for micro-payments but low on volatility.

Litecoin (LTC): The “silver” of crypto; reliable, widely accepted, but technically aging.

Tron (TRX): The global king of retail stablecoin settlement, hosting over $80 billion in USDT supply.

1. Digitap ($TAP)

While much of the payment sector remains trapped in consolidation, Digitap continues to excel in its presale at an entry price of $0.0454, drawing closer to its $0.14 price target. Early participants have already seen returns of 263%, driven not by hype but by a product designed to solve the payment barrier in crypto.

Digitap is not merely a settlement layer; it is a full-stack financial application, making it a top choice for investors seeking the best altcoins to buy.

Through its integration of Solana-native rails, the protocol can process up to 65,000 transactions per second with near-instant finality and low fees. Users can on-ramp USDC, USDT, and SOL directly and spend their balances via a virtual Visa card at over 60 million merchants worldwide.

For investors, the appeal extends beyond payments. Digitap offers a 124% staking APY funded by real transaction activity on the platform, aligning protocol growth with user adoption. This combination of velocity, yield, and usability positions $TAP as the best cheap crypto to buy, possessing both utility and upside.

2. Ripple (XRP)

XRP remains the most recognizable name in cross-border crypto payments, but its performance in early 2026 reflects structural maturity rather than growth. Trading around $1.91, the token continues to struggle below the $2.00 resistance level, frustrating long-term holders.

Ripple Labs has made meaningful progress securing partnerships with financial institutions and central banks, particularly through its RLUSD stablecoin initiative. However, this institutional momentum has not translated into proportional value accrual for XRP holders. The network excels at moving large sums between banks, but offers limited native functionality for everyday spending.

As a result, XRP increasingly functions as infrastructure rather than an investable growth asset.

3. Tron (TRX)

Tron has cemented its role as the backbone of global stablecoin liquidity. Hosting over $80 billion in USDT, it is the preferred network for retail users across Asia and emerging markets who require low-cost, high-speed dollar transfers.

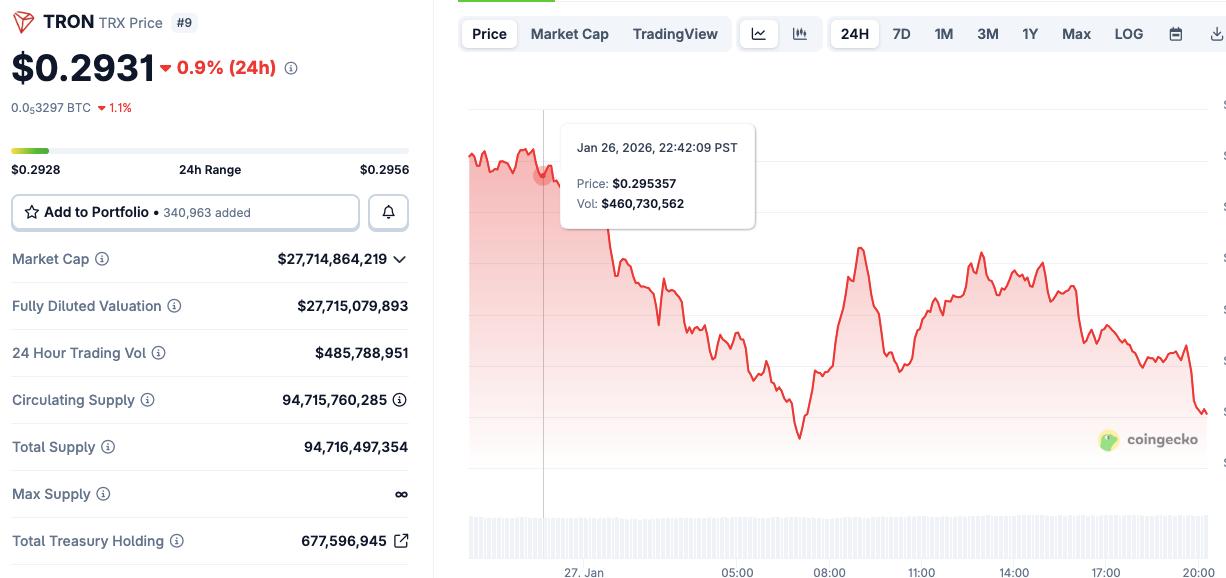

TRX price chart. Source: Coingecko

At the time of writing TRX is trading near $0.29, showing remarkable resilience compared to other Layer-1s. While TRX is a powerhouse for utility, its massive circulating supply often acts as a drag on price, preventing the strong upside that investors find in crypto presales with 100x potential.

4. Stellar (XLM)

Stellar continues to serve as a cost-efficient remittance network, particularly for NGOs and financial inclusion initiatives. Trading near $0.29, XLM mirrors much of XRP’s technical behavior, often moving in tandem with lower volatility.

XLM price chart. Source: Coingecko

While Stellar’s design is effective for micro-payments and transfers in developing regions, its tokenomics emphasize circulation over scarcity. The lack of staking incentives and limited upside potential make XLM a practical tool rather than a compelling investment. For users, Stellar works. For investors seeking performance, it rarely delivers.

5. Litecoin (LTC)

Litecoin has earned its reputation through reliability. With over a decade of uninterrupted uptime and wide merchant acceptance, LTC remains one of crypto’s most trusted payment assets, currently trading near $97.

However, the network’s 2.5-minute block times and absence of smart contract functionality limit its relevance in a market increasingly driven by high-speed, composable ecosystems. Litecoin excels at what it was designed to do, but has failed to evolve alongside newer payment protocols. As a result, LTC now serves more as a defensive allocation than a growth opportunity.

Why Digitap Is the Best Altcoin to Buy Now

When compared side by side, the divergence in this sector is clear. XRP, XLM, TRX, and LTC are established networks locked into multi-year consolidation patterns. They provide reliability but limited growth, serving as beta exposure to the broader market rather than as drivers of outperformance.

Digitap is capturing the liquidity rotating out of these mature assets by operating as an omnibanking protocol. Its native Visa integration, high-speed Solana settlement, and yield-generating staking model transform payments into an investable ecosystem rather than a static utility.

With 124% APY, instant global spending, and a 263% presale surge, Digitap represents the best crypto to buy in 2026.