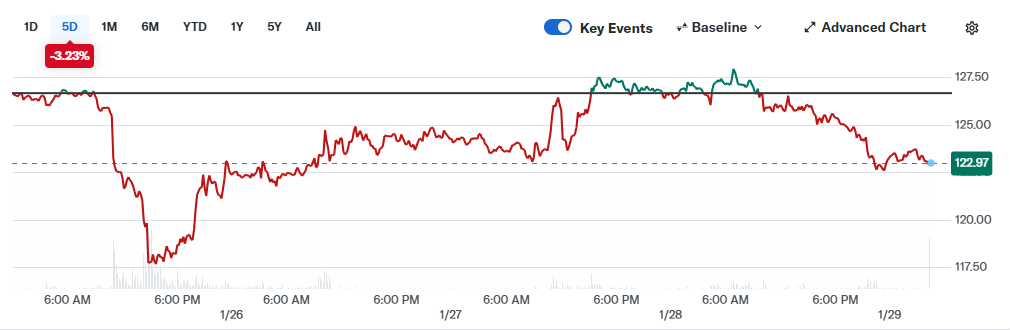

Solana price forecast sentiment has turned cautiously optimistic after the coin rebounded from its recent lows near $120. As of January 29, SOL is trading around $122.94, down 2.68% in 24 hours, but with rising support from staking inflows and $7.6B in futures open interest.

Analysts are now watching the $120–125 support zone closely as a possible launchpad for Solana’s next move.

With daily volume topping $3.81B and over 425M SOL staked, the network is showing signs of long-term confidence – even as momentum indicators cool and broader altcoin markets pause.

Solana Finds Short-Term Support Near $120 as Staking Surges

Solana’s recent slide into the low-$120s was met with renewed buying interest, helping the token recover toward the $127 level earlier this week. According to CoinGecko, SOL posted a +3% daily gain by January 28, with spot volume spiking to $3.9 billion.

The bounce was driven in part by a surge in staking participation. Data from SolanaFloor shows 425.7M SOL is now staked – the highest on record – with a network stake rate of 68.9% as the next 1000x crypto.

Roughly 15.64% of SOL is now being staked through liquid staking platforms, allowing tokens to circulate in DeFi protocols while still earning yield.

This hybrid utility is helping to anchor demand. SolanaFloor also reported increased institutional activity and growth in Marinade Select, which added 1.6M SOL in January alone.

Technical Chart Signals: Compression Before the Next Big Move?

From a charting perspective, Solana price forecast is hovering tightly above a well-tested demand zone. The $120–125 range has acted as a springboard several times over the past year, and the current rebound suggests buyers are once again stepping in at that level.

Price structure remains in a broader corrective phase, not a breakdown – especially when viewed in the context of the $240 peak earlier this month.

Volatility has contracted significantly, a condition that often precedes stronger directional moves. Analysts say compression near support zones tends to produce explosive follow-ups, especially if buying pressure increases.

The Relative Strength Index (RSI) continues to track within a downward channel, but hasn’t reached extreme oversold levels. That implies the current downtrend may be losing steam without triggering panic selling.

According to technical analyst James Easton, “Sharp retracement off key support and looking fine. A move lower? Good. Deep value is where winners are made.”

Machine Forecast Models Suggest Moderate Gains Into February

Forecast models are cautiously bullish for the short term. Based on five-day predictions, Solana is expected to reach $125.17 by February 3, 2026, reflecting a 1.77% increase from current levels.

While that’s not a breakout signal, it reinforces the idea that $120 is holding as a base, despite broader market softness.

Looking into February as a whole for the Solana price forecast, long-term forecasts predict an average price of $131.39, with a maximum of $139.80. That would mark a 13.65% gain over the month. The models become more aggressive by March, projecting $160+ highs, a sign that seasonal or cyclical strength may return.

Every major SMA and EMA from the 3-day to 200-day level is still trending above price, reinforcing resistance until stronger momentum emerges for the price prediction of Solana.

Long-Term Outlook: Solana Still Draws Capital, But Faces Rotation Pressure

Despite the short-term noise, Solana continues to command a $69.6B market cap, ranking it among the top-performing L1 chains in terms of staking, DeFi liquidity, and infrastructure development. Yet some traders believe the era of mega-cap altcoin breakouts is slowing.

An emerging narrative points to capital rotating into early-stage tokens with higher asymmetry. Projects like DeepSnitch AI (DSNT) – which offers AI tooling and Tier-1 listing potential – are increasingly seen as better bets for outsized gains.

DSNT, priced at $0.03681, is drawing interest for its utility and bonus-based presale structure, highlighting how some investors are shifting risk appetite toward microcaps.

Still, Solana’s fundamentals remain strong. Developer activity, staking metrics, and institutional interest continue to grow. For long-term holders, the current levels represent an accumulation window rather than a blow-off top.