Bitcoin remains in a corrective phase this week after failing to sustain a breakout above the mid-$90,000s. Price briefly dipped below $90,000, trading as low as the $88,000–$89,000 area before stabilizing, reflecting a pullback within a broader range rather than a confirmed trend reversal.

January volatility has kept Bitcoin in a broad $83,000–$96,000 range, but the loss of the $90,000 handle signals growing downside pressure. Spot Bitcoin ETFs logged net outflows for the third straight week and saw $1.22B in weekly outflows, reducing marginal institutional demand at a time when macro uncertainty remains elevated.

DATA: U.S. spot Bitcoin ETFs saw $1.22B in weekly outflows, the largest since November.

Past spikes like this have aligned with local $BTC bottoms. pic.twitter.com/cyOy2HsRMi

— CoinDesk (@CoinDesk) January 23, 2026

What does the recent multi-week pullback mean for traders?

Rather than signaling a single liquidation-driven selloff, the recent series of lower weekly closes points to a gradual unwinding of prior upside momentum. This behavior is more consistent with a corrective or post-euphoric phase, where marginal buyers step aside and weaker hands rotate out, instead of broad capitulation.

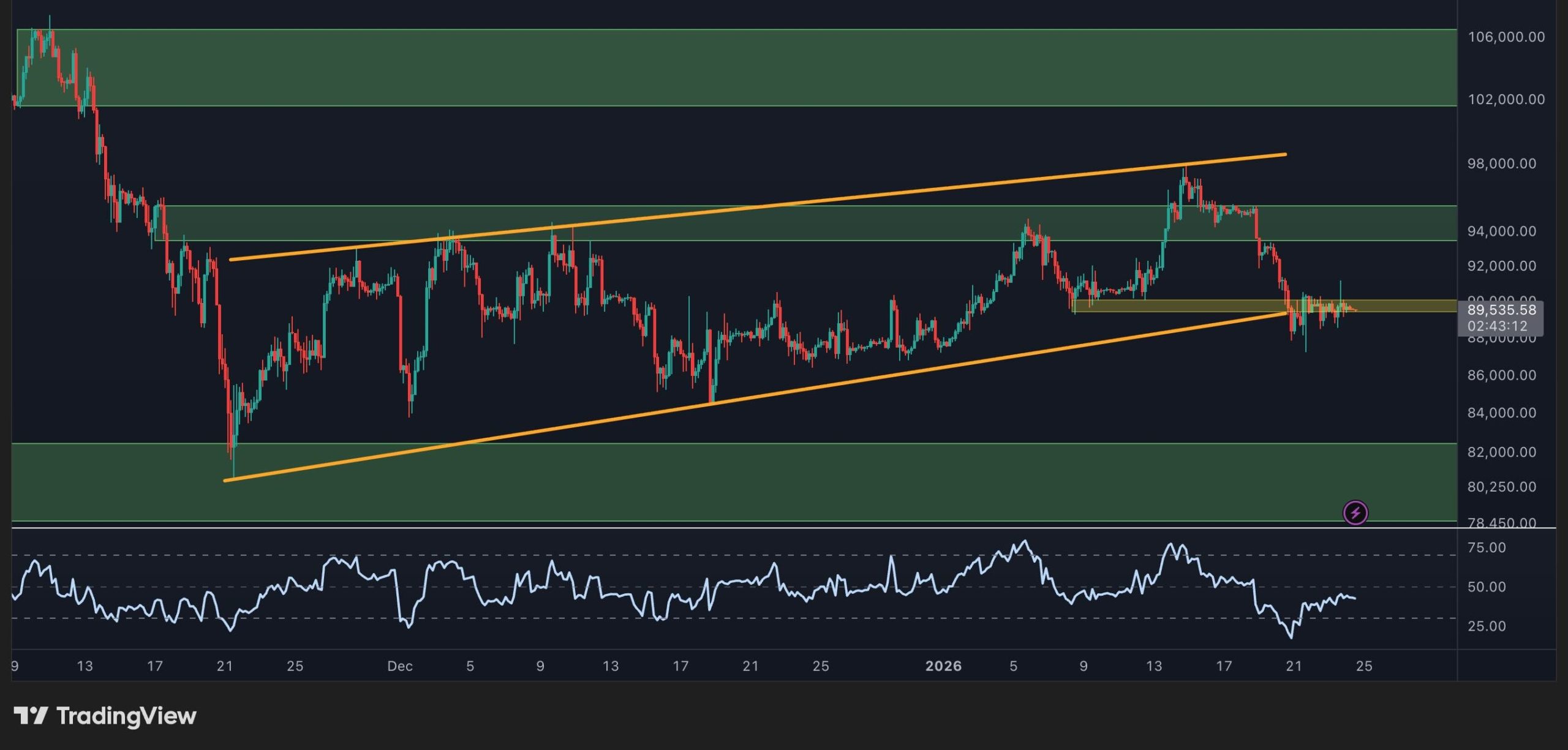

Bitcoin currently trades below its short- to medium-term moving averages, with the 100-day moving average acting as resistance in the $94,000–$96,000 region. As long as price remains capped below this level and fails to reclaim the prior ascending wedge structure, the short-term balance of risk favors continued range trading with a downside bias.

Source: TradingView

Technical levels tighten as volatility compresses

January price action has kept Bitcoin locked in a broad $82,000–$96,000 range. The breakdown from the rising channel and ascending wedge that previously carried BTC higher suggests that upside momentum has stalled, but key higher-timeframe demand remains intact.

Source: TradingView

Immediate support sits in the $88,000–$89,000 zone, which aligns with the origin of the last impulsive leg higher on the 4-hour chart. A sustained break below this area would increase the probability of a deeper test toward the $82,000–$84,000 daily demand zone. On the upside, bulls would need a decisive reclaim of $92,000–$94,000 to open the door for a retest of the $95,000–$97,000 supply region.

Institutional flows and on-chain signals remain mixed

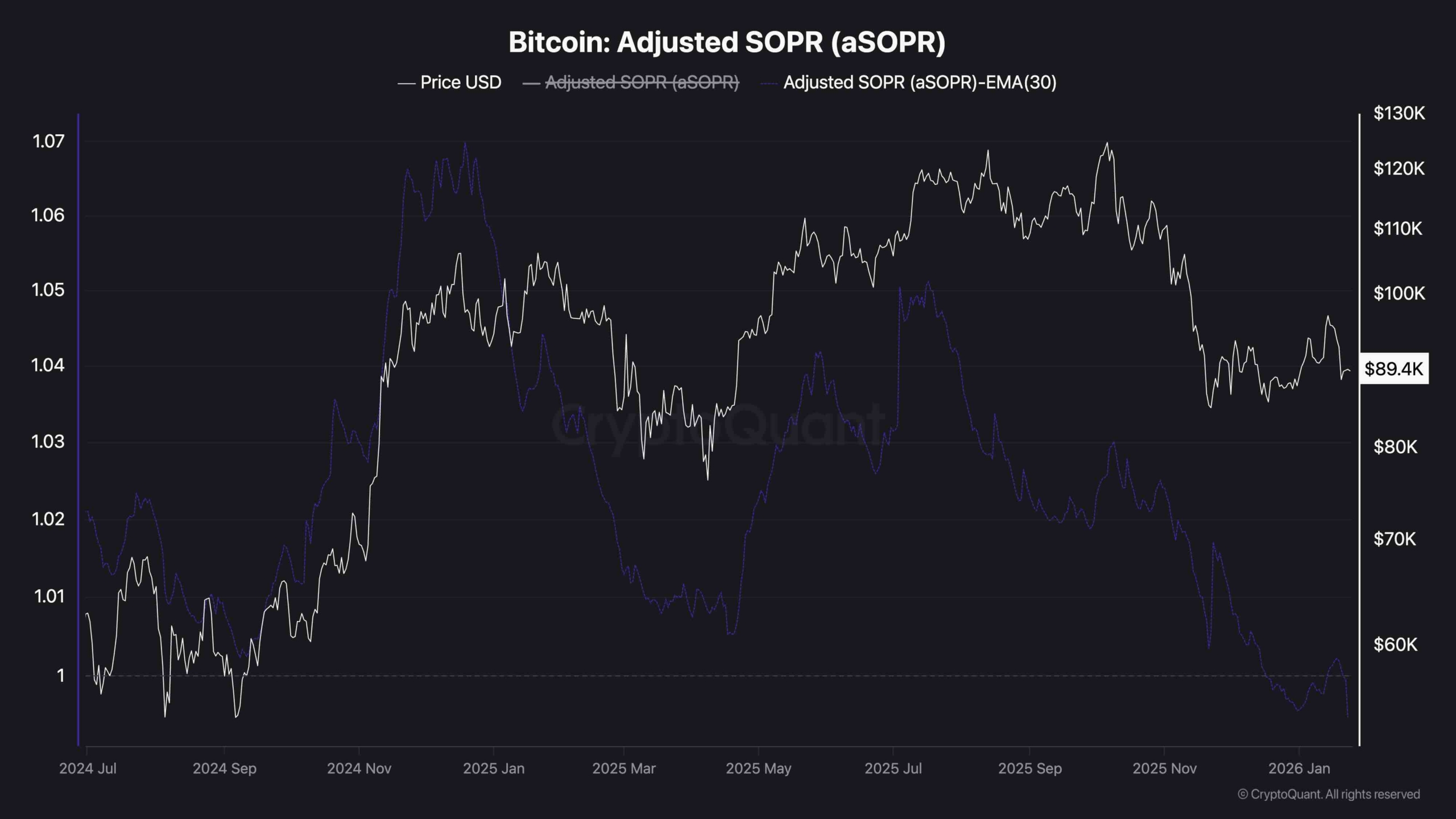

On-chain data continues to reflect a market transitioning out of peak profitability. The adjusted SOPR (aSOPR) and its 30-day exponential moving average have trended lower over recent months, moving toward the neutral 1.00 level. This indicates that an increasing share of coins is being spent near breakeven, with occasional realized losses during downside pushes.

Source: CryptoQuant

Such behavior is typical of a corrective or late-cycle phase, where speculative excess is gradually unwound. As long as aSOPR stabilizes near 1 while price holds higher-timeframe demand, the market structure remains constructive. A sustained move of the aSOPR’s 30-day EMA below 1 would signal a more prolonged corrective regime.

Risk factors still frame the near-term outlook

While downside risk remains present following the rejection from $95,000 and the loss of short-term structure, the absence of panic selling and the continued defense of higher-timeframe demand suggest that Bitcoin is consolidating rather than reversing trend.

Failure to hold the $88,000–$89,000 support zone would significantly raise the odds of a move toward the $82,000–$84,000 region. Conversely, a sustained recovery above $92,000–$94,000 would improve the short-term outlook and shift focus back toward the $126,000 suggested by our analyst.

For now, Bitcoin remains in a corrective range, with traders watching whether downside tests are absorbed or if sellers gain control below key demand.