Chainlink (LINK) fell below the $10 threshold and briefly touched $8.9, marking its lowest level since September 2024 amid broad-based selling pressure. At the time of writing, LINK was trading near $9.5, down 3.9% on the day and roughly 19% over the past week. The move reflects heightened risk aversion across parts of the altcoin market, with Chainlink experiencing heavy liquidation and reduced investor exposure.

Market data indicates that the decline was driven primarily by aggressive selling rather than a gradual loss of momentum. Observers noted a sharp imbalance between sellers and buyers across both spot and derivatives venues, underscoring the intensity of the drawdown.

Spot Market Sees Heavy Exchange Inflows

According to recent data, seller strength rose to 75 while buyer strength fell to 25, signaling clear dominance by sell-side activity. Spot sell volume climbed to approximately 26.2 million LINK, compared with 22.2 million LINK in buy volume, producing a negative delta of around 4 million tokens.

Source: TradingView

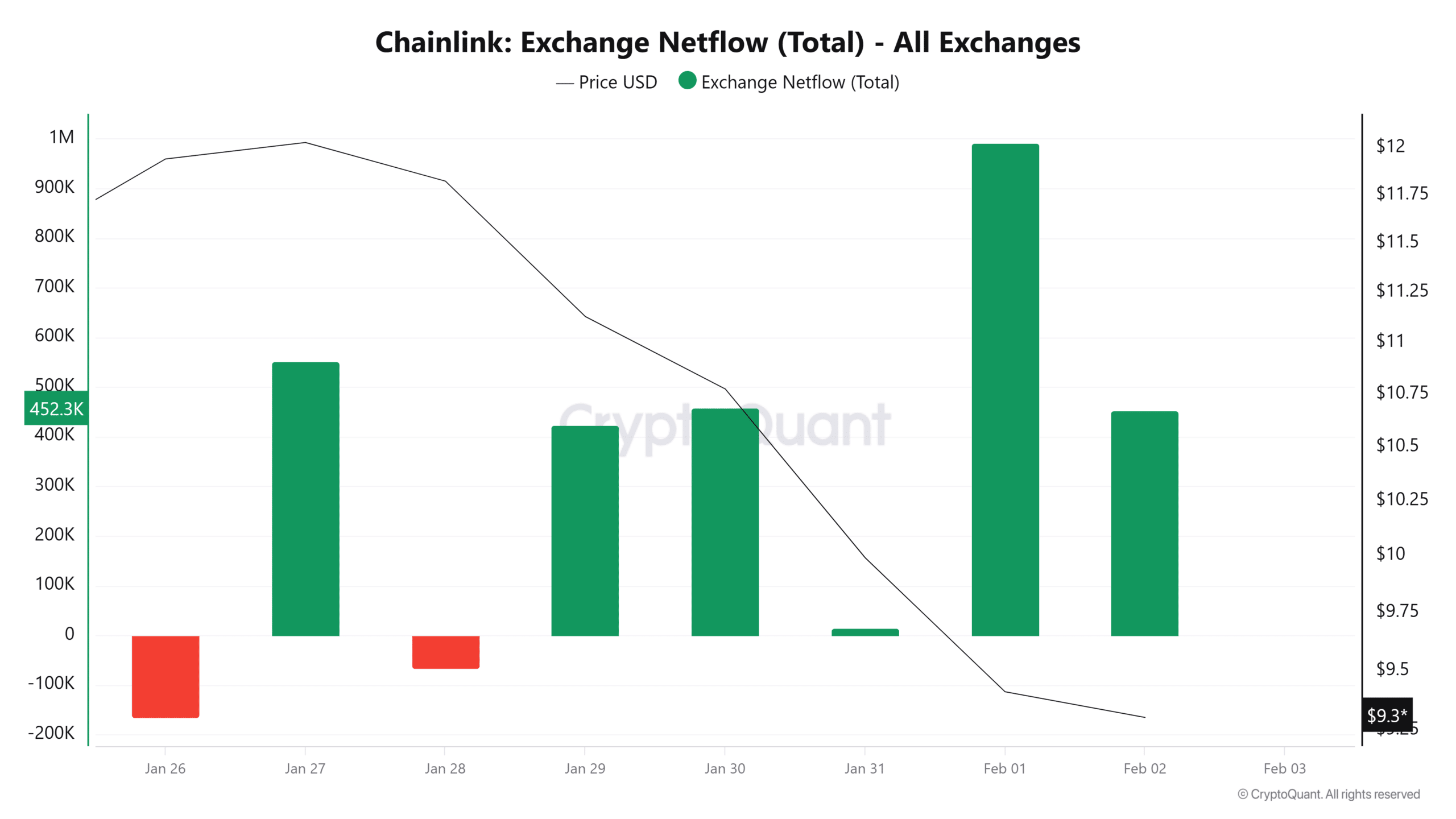

Exchange flows reinforced this picture. On February 1, more than 2.8 million LINK moved onto exchanges, followed by an additional 973,200 tokens the next day. In total, roughly 3.8 million LINK flowed into exchanges over this period, while only about 2.3 million LINK exited. This resulted in a positive Exchange Netflow of approximately 1.4 million LINK, a metric commonly associated with increased selling pressure as assets are positioned for liquidation.

Source: Cryptoquant

Futures Exposure Drops to Annual Lows

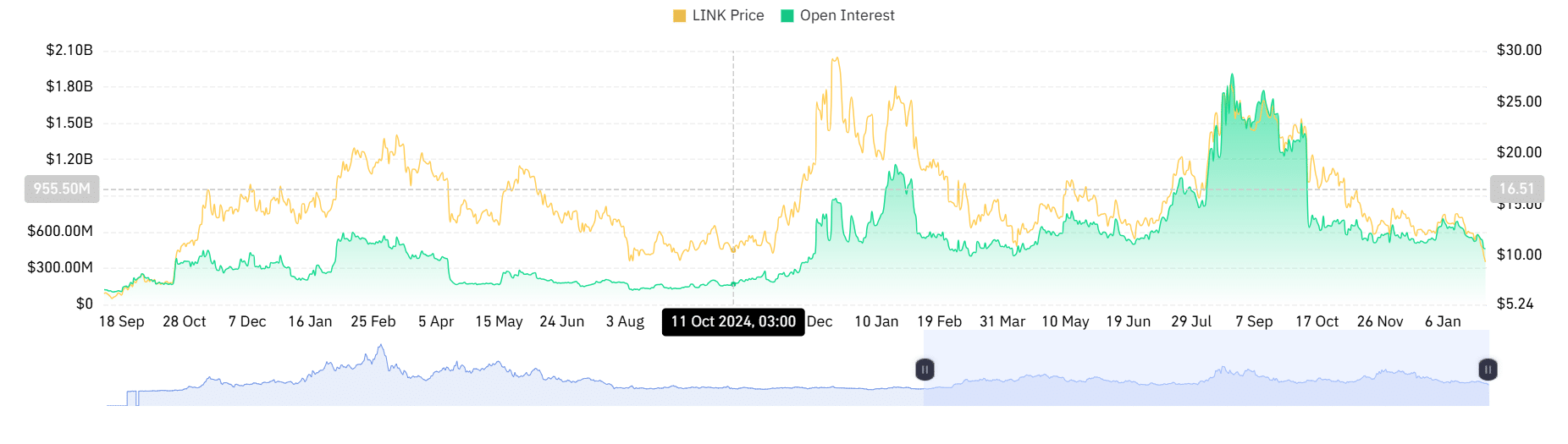

Derivatives markets reflected similar caution. Data from CoinGlass shows that Chainlink’s futures Open Interest declined to $458 million, its lowest level of the year. At the same time, derivatives trading volume fell 22% to around $1.09 billion, indicating a contraction in speculative activity and capital committed to LINK futures.

Source: Coinglass

Net flows in the futures market also turned negative. CoinGlass data recorded roughly $318 million in futures outflows compared with $312 million in inflows, leaving a net outflow of $6.49 million. Historically, periods marked by concurrent spot selling and futures de-risking have coincided with elevated downside volatility for digital assets.

Technical Indicators Reflect Market Stress

Momentum indicators suggest that selling pressure has pushed Chainlink into deeply oversold conditions. The Relative Strength Index dropped to around 20, a level often associated with extreme bearish sentiment. While such readings can precede stabilization phases, they primarily reflect the intensity of recent selling rather than a confirmed shift in trend. However, Crypto trader Investing DeCrypted believed that LINK’s price could go much higher in the future.

$LINK – Even though it feels different right now, we still have nearly perfect price action! We are likely going much higher in the future and now is not the time to exit imo.#Chainlink

Not financial advice! pic.twitter.com/pEEv5FS131

— Investing DeCrypted (@InvestDeCrypted) February 1, 2026

Broader Implications for the Market

Chainlink’s decline highlights the sensitivity of liquid altcoins to rapid sentiment changes, particularly when both spot holders and derivatives traders reduce exposure simultaneously. For market participants, the episode underscores the importance of monitoring liquidity conditions, exchange flows, and derivatives positioning alongside price action. As volatility remains elevated, LINK’s recent move serves as a case study in how coordinated selling across market segments can accelerate short-term drawdowns in the crypto market – both Bitcoin and altcoins.