The long-running narrative that the world is steadily abandoning the U.S. dollar is facing a serious reality check.

Key Takeaways

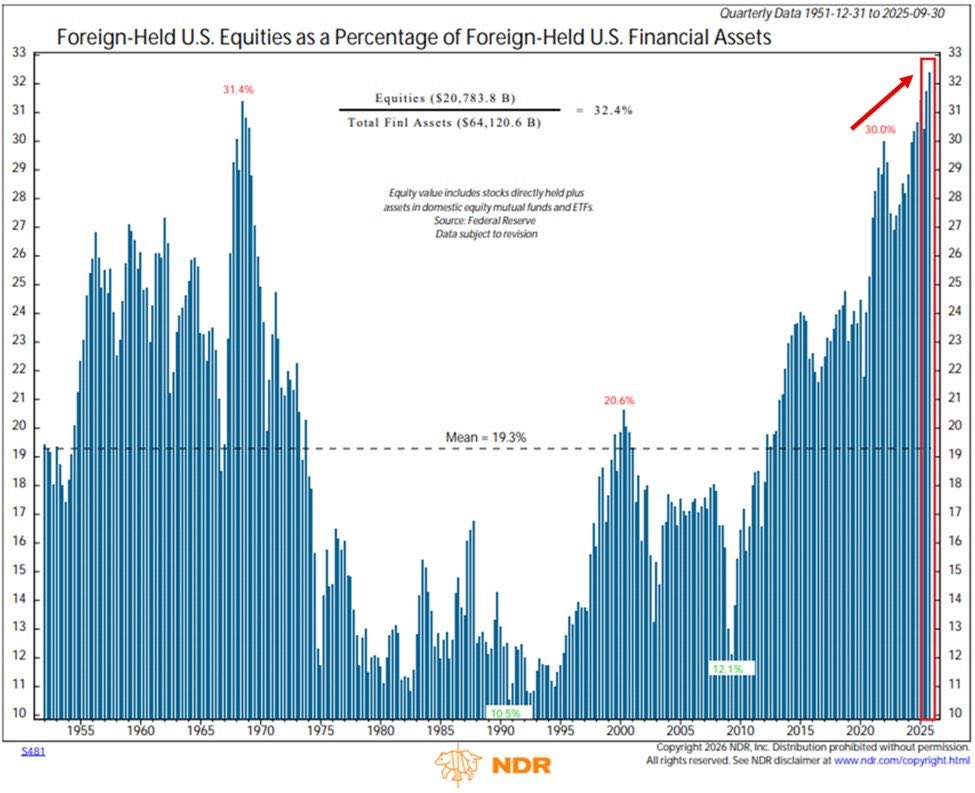

Foreign investors now hold a record share of U.S. equities relative to total U.S. financial assets.

The surge in equity exposure contradicts claims of meaningful global de-dollarization.

U.S. stocks are increasingly functioning as the world’s preferred long-term store of value.

Fresh data on global capital flows shows that foreign investors are not retreating from U.S. markets – they are doubling down, particularly on American equities.

According to long-term flow data, foreign-held U.S. equities now account for 32.4% of total foreign-held U.S. financial assets as of late 2025. That figure stands far above the historical average of 19.3%, marking one of the strongest foreign equity allocations on record.

Rather than signaling de-dollarization, the numbers point to a deeper integration of global savings into U.S. capital markets.

Foreign Capital Is Chasing U.S. Growth

The data highlights a crucial distinction often lost in the de-dollarization debate. While some countries discuss settling trade in alternative currencies or reducing reliance on dollar-based reserves, global investors are actively increasing exposure to U.S. companies themselves.

Foreign investors are not merely holding dollars or Treasury securities. They are allocating aggressively toward U.S. equities, effectively expressing confidence in American corporate earnings, innovation, and long-term growth prospects. If global capital were truly attempting to distance itself from the dollar system, U.S. equity exposure would be shrinking, not reaching historic highs.

Instead, the opposite is happening.

Equity Exposure Reaches Multi-Decade Extremes

The current 32.4% allocation is not only elevated relative to recent decades but also exceeds prior peaks seen during major global equity booms. Past cycles show that when foreign investors reduce dollar exposure, equity allocations tend to fall alongside broader capital inflows.

This time, foreign participation in U.S. markets has surged even as geopolitical tensions, sanctions risks, and currency diversification rhetoric have intensified. That contrast underscores how dominant U.S. equities have become as a global store of value, functioning as a proxy for growth, liquidity, and financial stability.

De-Dollarization Talk vs Market Reality

Political messaging around alternative trade currencies and reserve diversification continues, but capital flows tell a different story. The world’s savings are still gravitating toward U.S. assets, particularly stocks, at a pace inconsistent with any structural move away from the dollar-based financial system.

In practice, global investors appear willing to tolerate geopolitical noise as long as U.S. markets continue to offer depth, transparency, and superior returns. The result is a dollar system that remains deeply embedded not just through currency usage, but through ownership of American companies themselves.

What This Means for the Dollar’s Role

Rather than weakening, the dollar’s global influence may be evolving. Instead of relying solely on reserve holdings or trade invoicing, its dominance is increasingly reinforced through equity ownership. U.S. stocks have effectively become a global savings vehicle, tying international wealth directly to the performance of the American economy.

That dynamic suggests the dollar’s role as a global store of value is not fading – it is being reinforced through capital markets.