Bitcoin (BTC) traded near $76,406 on February 4 after a sharp $2.5 billion liquidation event wiped out leveraged long positions across derivatives markets. The rebound coincided with Binance reportedly deploying $100 million into BTC as part of a broader $1 billion accumulation plan, providing a short-term demand shock during a fragile recovery phase. This buying activity unfolded as macro conditions improved, with the Federal Reserve holding rates steady and ETF flows showing early signs of reversal.

? BINANCE IS BUYING THE DIP.

While you’re panicking, Binance’s SAFU fund just loaded $100.7M worth of $BTC.

It’s a reminder that every cycle punishes impatience and rewards preparation.

So what are you doing right now: Panic selling Or Quietly stacking? pic.twitter.com/XpC0y3P49k

— Wise Advice (@wiseadvicesumit) February 2, 2026

On a 24-hour basis, BTC traded within a $74,500–$79,200 range, down roughly 14.7% over the past seven days. Trading volume increased 23.3% day-over-day to $66.7 billion, suggesting the move was driven by real spot demand rather than thin liquidity. For traders, this matters because volume-confirmed rebounds are more likely to hold key support levels.

What does Binance’s treasury move mean for Bitcoin?

Binance began converting its Secure Asset Fund for Users (SAFU) from stablecoins into Bitcoin on February 2, shifting the insurance fund’s risk profile toward a crypto-native asset. SAFU, created in 2018, historically held USDT and USDC; reallocating $1 billion into BTC effectively removes that supply from liquid markets. Reduced exchange-available supply tends to tighten sell-side pressure, a dynamic often monitored through exchange balance metrics.

On-chain data already shows exchange BTC balances stabilizing after weeks of net inflows, a sign that panic selling may be easing. Similar institutional bitcoin buying has previously preceded multi-week consolidation phases rather than immediate breakouts. For investors, the signal is structural support rather than guaranteed upside.

Technical levels define the near-term battle

From a chart perspective, Bitcoin is testing the 0.236 Fibonacci retracement at $78,400 after bouncing from $74,666 support. The daily Relative Strength Index sits near 27.5, firmly in oversold territory, indicating selling pressure was extreme and increasing the probability of a short-term relief rally. However, BTC remains below the 50-day EMA and 200-day SMA, both clustered near $85,000, which now act as layered resistance.

Source: TradingView

A confirmed daily close above $80,700 would expose the $88,000–$89,000 zone, aligning with prior consolidation and rising volume nodes. Failure to hold $78,000, by contrast, risks a pullback toward high-liquidity areas at $70,837 and $67,387. Traders watching momentum should also note that the MACD histogram remains negative, signaling trend weakness despite the bounce.

Institutional demand builds as ETF flows turn

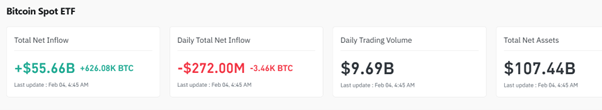

Beyond Binance, broader institutional appetite is improving. Spot Bitcoin ETF outflows slowed dramatically in January to $272 million, down from $3.48 billion in November. During U.S. trading hours, ETFs now account for an estimated 30–40% of spot BTC volume, amplifying the impact of directional flows.

Source: Coinglass

This backdrop mirrors other examples of major bitcoin accumulation, reinforcing the narrative that large players are positioning during consolidation rather than chasing breakouts. Still, resistance between $92,500 and $93,500 remains critical, with $98,000–$100,000 marking the upper boundary of the current market structure.

Binance’s $100 million purchase, and its intention to deploy up to $1 billion, adds measurable demand at a technically sensitive juncture. Since volatility remains elevated and downside risks persist below $74,500, improving ETF flows and institutional accumulation suggest Bitcoin is building a base rather than topping out. For now, the market is signaling patience, with confirmation needed above $90,000 to shift the broader trend.