XRP price prediction is back in focus after Ripple has fallen below the $1.60 level, a support zone that had held for several months, extending its recent decline amid broader weakness in the cryptocurrency market. The token dropped more than 10% over the past 24 hours to around $1.42, marking its lowest price since late November 2024 and making it one of the weakest performers among large-cap cryptocurrencies during this period.

? JUST IN: $XRP slides below $1.60

— Xaif Crypto??|?? (@Xaif_Crypto) February 3, 2026

Meanwhile, early-stage tokens like Bitcoin Hyper are gaining traction as investors search for safer upside while XRP remains volatile.

The latest move for XRP comes as risk sentiment across crypto remains fragile, with heightened volatility, liquidation cascades, and investor caution weighing on prices. XRP’s decline is notable given recent developments around Ripple’s ecosystem and mixed signals from exchange-traded product flows tied to the asset.

Will XRP Reclaim $1.6?

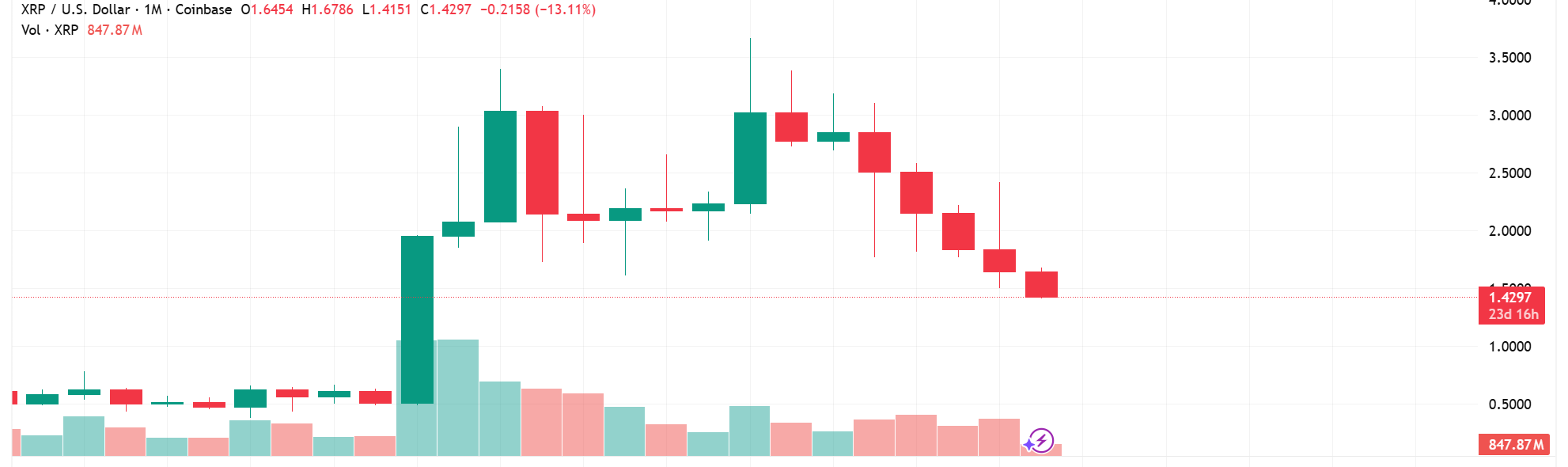

Technical indicators point to sustained downside pressure. XRP has now posted consecutive red monthly candles since October 2025, highlighting the strength and persistence of the sell-off. A brief rebound toward the $2.00 area earlier this year failed to gain traction, and sellers quickly reasserted control.

Source: TradingView

Market observers note that the break below $1.60 opened the way for further downside tests. Analysts including CryptoWZRD have highlighted that the loss of intermediate support near $1.51 accelerated the move lower, with $1.42 and $1.27 identified as remaining technical areas of interest before the psychological $1.00 level.

On higher timeframes, momentum indicators such as the monthly MACD continue to reflect a bearish trend, suggesting that the broader downtrend has yet to fully reset. A recovery would first require reclaiming $1.60, while a failure to hold support may expose the $1.27–$1.00 range.

XRP Daily Technical Outlook:$XRP closed slightly bearish. However, it's testing the $1.5160 Daily support. A bullish reversal will occur if we get a positive move from XRPBTC, which is likely if BTC.D continues to weaken. I'll track the intraday chart to get the next scalp ?♂️ pic.twitter.com/pmDextuh9Z

— CRYPTOWZRD (@cryptoWZRD_) February 5, 2026

ETF Flows and Broader Market Stress

Part of the recent volatility can be traced to activity in XRP-related exchange-traded products. According to data from SoSoValue, XRP-focused ETFs saw heavy outflows of $40.8 million in a single day last week, the largest withdrawal since their launch. That episode coincided with a sharp market-wide pullback.

However, more recent data shows a shift in ETF behavior. Investors added $52.26 million last week into XRP Sport ETF, indicating that institutional positioning has stabilized in the short term. Despite these inflows, XRP’s price has continued to weaken, suggesting that macro sentiment and broader crypto market dynamics are currently exerting greater influence than product-specific flows.

? US Spot Crypto ETF Flows (Last Week)

? Net Inflows:

• $XRP: +$52.26M? Net Outflows:

• $BTC: −$1.49B

• $ETH: −$326.93M

• $SOL: −$2.45METF flows continue to highlight rotation into $XRP pic.twitter.com/SEUoUzoHOy

— XRP Update (@XrpUdate) February 2, 2026

Fundamentals Versus Market Sentiment

Ripple announced new institutional support for Hyperliquid through its prime brokerage platform earlier this week, a development that would typically be viewed as constructive for the ecosystem. Analysts note that the ongoing decline does not appear to be driven by negative project-specific news or operational issues within Ripple.

Hyperliquid, meet Ripple Prime: https://t.co/RZWdbRfHoe

We’re now enabling institutions to access onchain derivatives liquidity through @HyperliquidX in a streamlined and secure way. Customers can also efficiently cross-margin crypto with all asset classes supported by our prime…

— Ripple (@Ripple) February 4, 2026

Instead, market participants point to elevated fear, uncertainty, and doubt across the digital asset sector, combined with forced liquidations, as key drivers of the move. In periods of heightened volatility, retail investors often reduce exposure quickly, amplifying short-term price swings.

Broader Implications

XRP’s decline underscores the current sensitivity of crypto markets to shifts in sentiment and liquidity conditions. While the asset retains an active ecosystem and institutional engagement, near-term price action reflects broader risk-off behavior rather than fundamentals alone. How XRP behaves around remaining support zones may offer insight into whether selling pressure is easing or continuing as the wider market searches for stability.

Bitcoin Hyper Gains Attention Right Now

While XRP struggles to reclaim the $1.6 level, retail and presale-focused investors are eyeing Bitcoin Hyper ($HYPER).

$31.5 million has already been raised, and the token price is about to rise above $0.0136 as the current stage nears its cap.

With XRP locked in a stalemate, Bitcoin Hyper offers early-stage volatility with controlled upside. It’s become a strategic hedge for traders wary of top-10 coins but still eager to position for 2026’s bull cycle.