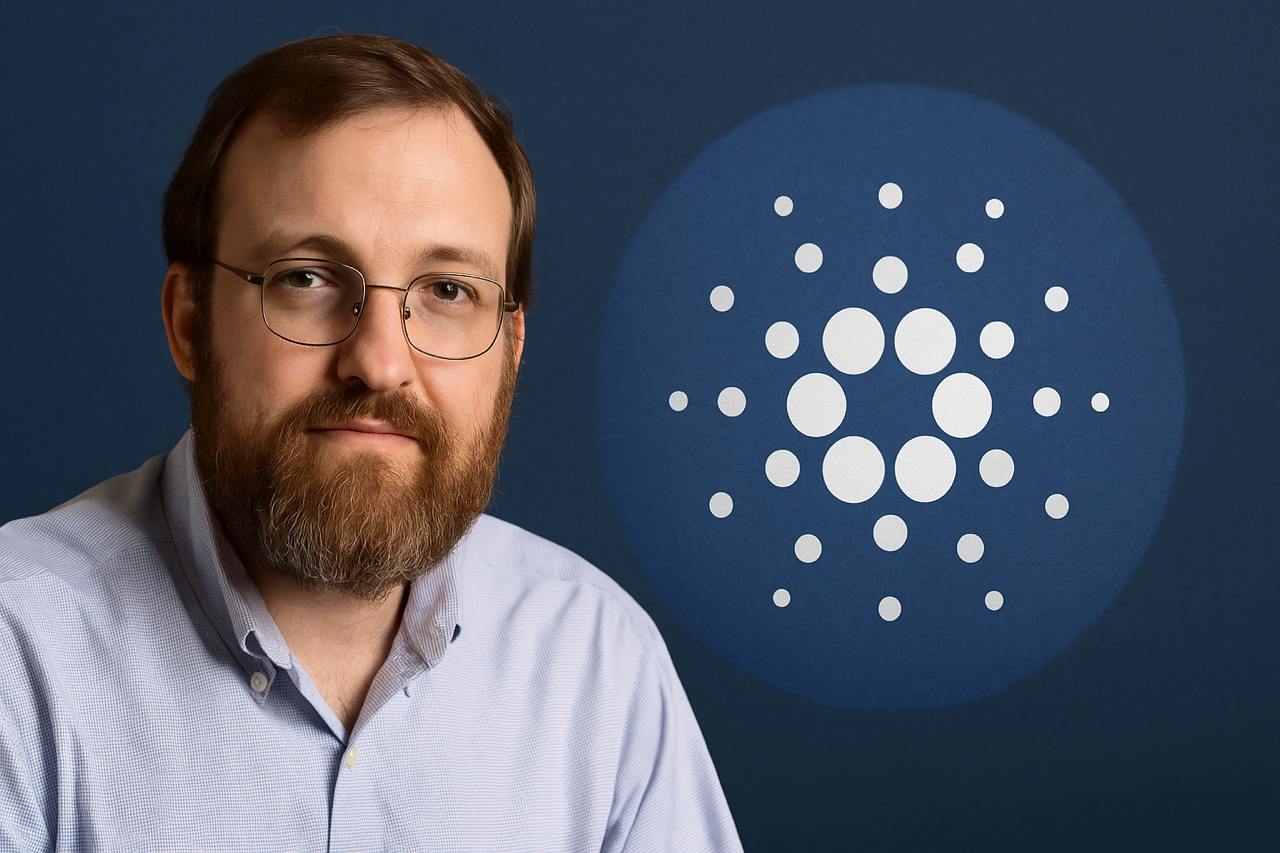

As Cardano’s price continues to struggle alongside the wider crypto market, its creator Charles Hoskinson has addressed the downturn in unusually blunt terms, revealing that his personal exposure to ADA has been hit far harder than most retail investors realize.

Key Takeaways

Hoskinson says his ADA holdings are down over $3B on paper, with no intention to sell.

Cardano trades near $0.263, down almost 19% over the past week amid heavy market pressure.

RSI and MACD remain bearish, suggesting weakness persists despite early signs of stabilization.

Rather than downplaying the damage, Hoskinson openly acknowledged that the market collapse has wiped out more than $3 billion from the paper value of his crypto holdings. He emphasized that the losses remain unrealized and said selling was never on the table, despite the scale of the drawdown.

The comments were made during a livestream from Japan, where Hoskinson used his own situation as an example to challenge the idea that project founders are insulated from prolonged bear markets. According to him, the current phase is less about financial comfort and more about conviction, particularly as sentiment across the crypto space continues to deteriorate.

Instead of offering optimism tied to short-term price recovery, Hoskinson struck a more pragmatic tone. He suggested that market conditions could still worsen and warned participants to mentally prepare for deeper red days ahead. His message, however, was not framed as defeatist. Rather, he portrayed the downturn as a stress test for builders and long-term believers, arguing that meaningful innovation often happens far from bull-market hype.

Red Days https://t.co/lO21fGjc0w

— Charles Hoskinson (@IOHK_Charles) February 5, 2026

Cardano under pressure as selling persists

That broader market stress is clearly reflected in Cardano’s price action. ADA is currently trading around $0.2631, showing a small intraday rebound but remaining locked in a well-defined downtrend.

On a daily basis, ADA is down 2.82%, while losses over the past week have reached 18.55%, underperforming several large-cap peers. Despite the decline, trading activity remains strong, with roughly $2.06 billion in volume recorded over the last 24 hours. This suggests active distribution and repositioning rather than investor apathy.

Cardano’s market capitalization stands near $9.49 billion, keeping it within the top tier of crypto assets, though its valuation has compressed sharply compared to previous cycles.

Technical picture shows weak but stabilizing momentum

From a technical standpoint, the 4-hour chart continues to favor bears. ADA remains below key resistance zones, and recent rebounds have failed to break the pattern of lower highs.

Momentum indicators reinforce this cautious outlook. The Relative Strength Index (RSI) is sitting near 38, well below neutral territory, indicating that bearish pressure still dominates. However, the RSI has edged higher from recent lows, hinting that aggressive selling may be losing some force.

The MACD remains in negative territory, with both lines below zero. While the histogram has started to contract, signaling that downside momentum is slowing, there is no confirmed bullish crossover yet. This places ADA in a consolidation phase rather than a clear reversal setup.

What comes next

Hoskinson’s remarks reflect a broader reality facing the crypto industry: price pain is no longer theoretical, even for those who helped build the ecosystem. For Cardano, the market appears to be in a waiting phase, balancing weakening momentum against the absence of a strong bullish catalyst.

Until technical indicators improve and broader risk sentiment stabilizes, ADA is likely to remain volatile, with short-term recoveries vulnerable to renewed selling. The message from Cardano’s founder, however, is clear – endurance, not price, is the real test of this market phase.