Bitcoin (BTC) is undergoing one of the most challenging periods of the year, with prices retracting nearly 30% from its all-time high of $126,000 reached last month. This decline has raised concerns about a potential bear market, fueling fears within the cryptocurrency community and among BTC investors.

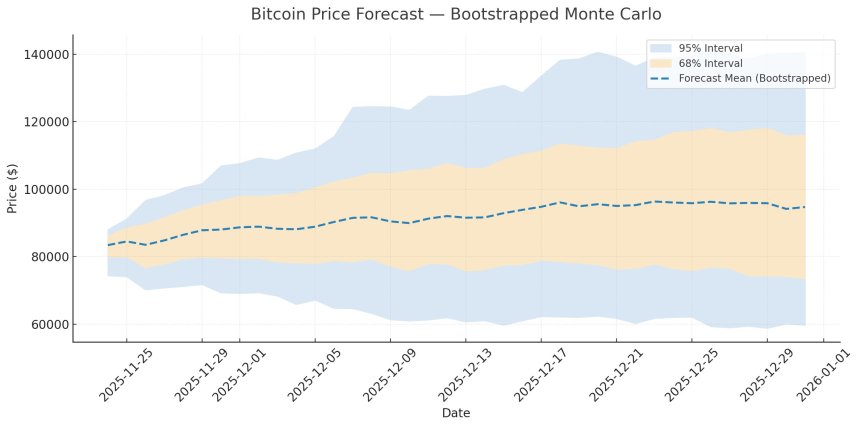

Despite this, a new AI-driven simulation by Bitcoin analyst Timothy Peterson offers a more tempered outlook. In a post on X (formerly Twitter), Peterson indicated that while the situation remains complicated, the simulation suggests that the bottom might have already been reached or could occur within the week.

Bitcoin Predicted To Experience Slow Recovery

In his analysis, Peterson predicts a slow recovery for the Bitcoin price leading up to the year’s end, though he projects less than a 50% chance that Bitcoin will reclaim the $100,000 mark by December 31.

The model presented suggests a nuanced scenario where there is at least a 15% chance that Bitcoin could close lower at approximately $84,500 and an 85% chance of finishing higher.

However, it is crucial to note that these estimates are based on seasonal averages and do not account for anticipated changes in the broader economic situation, to which BTC has shown vulnerability throughout the year.

Historically, Bitcoin has shown a pattern where significant price movements are often followed by periods of consolidation. If this trend holds, Bitcoin may stabilize within a new range between $84,000 and $90,000, with the $80,000 level serving as a crucial support point for short-term price action.

Fed’s December Rate Path

According to recent reports, one factor contributing to Bitcoin’s current struggles is the sentiment among investors, particularly those who purchased when prices hovered around $90,000.

With the cryptocurrency now trading below this threshold, approximately at $88,900 when writing, many investors may be hesitant to buy in again, especially if they are facing margin calls due to borrowed funds.

The upcoming days could prove pivotal for the broader cryptocurrency market as delayed economic data is set to be released ahead of Thanksgiving.

Barron’s reports that if the data strengthens the narrative for the Federal Reserve (Fed) to reduce interest rates in December, it could provide a boost to Bitcoin and its peers. Conversely, if the Fed opts to maintain interest rates, it might trigger further sell-offs in the crypto sector.

Victoria Scholar, head of investment at Interactive Investor, emphasizes the importance of the $80,000 technical support level for Bitcoin. She stated that a breach below this level could further embolden bearish sentiments, adding additional downward pressure on prices.

Featured image from DALL-E, chart from TradingView.com