Bitcoin price hovers around $87,300 on Tuesday after rebounding more than 4% over the past two days.

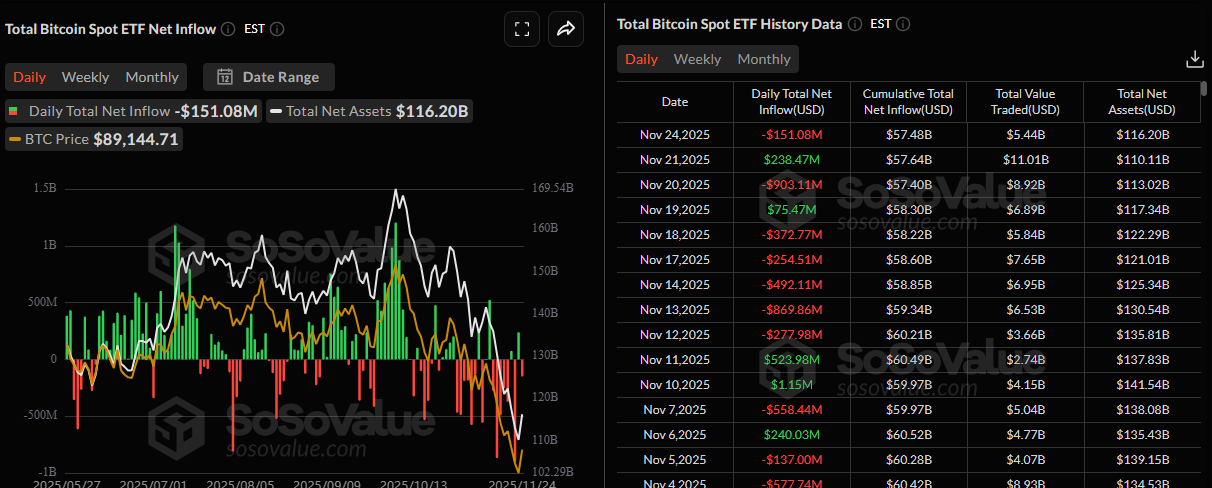

US-listed spot Bitcoin ETFs record an outflow of $151.08 million on Monday, indicating continued softness in institutional demand.

On-chain data suggests BTC may have formed a local bottom, supported by a strong rebound and accumulation among certain whale cohorts.

Bitcoin (BTC) price steadies around $87,300 at the time of writing on Tuesday, having recovered over 4% in the last two days. Despite continued outflows from spot Exchange Traded Funds (ETFs), which signal weak institutional appetite, on-chain metrics point to a potential local bottom forming, with renewed accumulation from select whale groups supporting the recent rebound.

Is Bitcoin bottom here?

Bitcoin price has begun to stabilize after an 11-day sell-off that saw BTC drop from the November 11 high of $107,500 to a low of $80,600. Over the past few days, BTC has mounted a strong rebound toward $88,000 and is holding near $87,000 at the time of writing on Tuesday, signaling that a potential local bottom may be forming—although confirmation is still lacking.

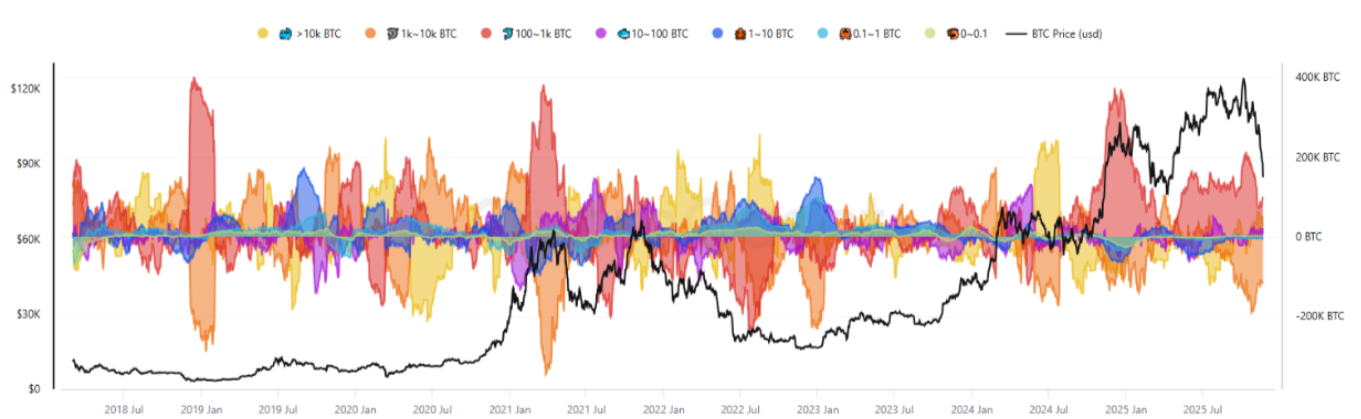

CryptoQuant data shows that mid-sized wallets holding 10-100 BTC and 100-1,000 BTC have been steadily accumulating, offering some support to the market, though not enough to offset the heavier selling pressure from the 1,000–10,000 BTC cohort, as shown in the graph below.

These large whales have continued to distribute, alongside retail investors (with 0–1 BTC and 1–10 BTC). Overall, BTC could have formed a potential local bottom, supported by a strong rebound and accumulation from the mid-sized wallets. However, persistent selling from the crucial 1,000–10,000 BTC group continues to limit confirmation of a broader trend reversal. The current price recovery is encouraging, but a decisive shift in whale behavior is still required to signal the end of the bearish phase.

Institutional demand continues to weaken

Institutional demand has started the week on a weak note, continuing the withdrawal trend that has weighed on Bitcoin’s price. SoSoValue data shows that US spot Bitcoin ETFs recorded an outflow of $151.08 million on Monday, following a hefty $1.22 billion in total withdrawals last week—marking the fourth straight week of net outflows since late October. If this trend persists or accelerates, Bitcoin could face a deeper price correction, reflecting waning institutional confidence.

Bitcoin Price Forecast: BTC shows early signs of recovery on momentum indicators

Bitcoin price has declined by more than 20% since it was rejected at $106,453 on November 11, reaching a low of $80,600 on Friday. BTC managed a mild rebound over the weekend and into Monday, closing at $88,300. At the time of writing on Tuesday, BTC hovers around $87,000.

If BTC continues its recovery, it could extend the rally toward the next key resistance at $90,000.

The Relative Strength Index (RSI) on the daily chart reads 31, after slipping below the oversold threshold last week, and is currently pointing upward, suggesting that downside pressure may be moderating as bearish momentum shows early signs of exhaustion. The Moving Average Convergence Divergence (MACD) lines are converging and nearing a possible bullish crossover, providing further technical support for the potential continuation of the recovery.

On the other hand, if BTC faces a correction, it could extend the decline toward the key psychological level at $80,000.