Bitcoin (BTC) exhibits cautious bullish signals, as technical analysis highlights a possible short-term rally toward $96,000.

However, market uncertainties and historical volatility suggest measured optimism is warranted.

After recent price fluctuations, BTC has maintained key support levels and formed an inverse head-and-shoulders pattern on the 4-hour chart. According to Feral Analysis, a crypto research firm specializing in technical modeling, this formation often signals a potential short- to mid-term reversal. However, success rates vary depending on volume confirmation and market context.

BTC Forms Bullish Technical Pattern

The inverse head-and-shoulders pattern resembles three consecutive valleys: the central “head” is the lowest point, flanked by two higher “shoulders.” This pattern is widely cited in technical analysis textbooks, including Technical Analysis of the Financial Markets by John Murphy, as an indicator that selling pressure may be waning.

BTC is forming an inverse head-and-shoulders pattern on the 4-hour chart, suggesting a potential bullish reversal with a possible rally toward $96,400 if it breaks the $87,000 neckline. Source: MindTrader on TradingView

Chart-based projections estimate that a confirmed breakout above the $87,000 neckline could allow BTC to approach roughly $96,400. Feral Analysis notes, “The height of the pattern from head to neckline is used to approximate potential upside. However, actual outcomes depend on market liquidity, macroeconomic sentiment, and trading volume confirmation.”

Bitcoin Price Today: Key Support Levels

Following a short-term decline, Bitcoin successfully held the $84,000 support level, demonstrating resilience in a predominantly bearish market. BTC briefly touched $80,000 but rebounded to $86,850 by the weekly close.

BTC has broken out of a descending channel and is approaching 88K–92K resistance, with a break above 88K targeting 92K or a rejection pushing back to support. Source: Mira Clara on TradingView

Traders cite additional support zones:

$75,000 – secondary floor

$72,000–$69,000—high-volume cluster offering stronger resistance to downside pressure

$58,000–$57,700—long-term support, including the 0.618 Fibonacci retracement

Historical analysis of similar rebounds shows that oversold conditions, as indicated by daily RSI readings, can trigger short-term rallies even in a broader bearish trend.

Resistance Levels and Targets

Upside resistance clusters are calculated using standard technical tools such as Fibonacci retracements and high-volume price nodes. Key levels include:

$91,400 – 0.236 Fibonacci retracement

$94,000 – high-volume node

$98,000 – next resistance zone

$103,000–$109,000 – Fibonacci and historical volume barriers

$116,500—the last obstacle before potential new highs

While these levels provide structured guidance, they are probabilistic rather than deterministic. Traders should monitor volume and macro conditions, as highlighted by Crypto Metrics Research, which emphasizes that low-volume holiday trading can amplify volatility.

Short-Term Outlook

Technical indicators currently suggest a moderate bullish potential if BTC sustains support above $84,000. Scenarios include:

A successful breakout above $87,000 may push BTC toward $91,400–$94,000.

Failure to hold $80,000 could lead to a temporary decline to $75,000.

Ethan Greene, a crypto analyst at MarsBit, cautions, “Inverse head-and-shoulders patterns are not guaranteed. Historical data shows some breakouts fail, especially when extreme leverage and low liquidity are present.”

Broader Market Context

Macro conditions add complexity to BTC price movements. Federal Reserve interest rate speculation, delayed U.S. economic data, and ongoing liquidity concerns can all influence short-term trends.

BTC has so far maintained stability above key support, but historical cycles suggest that external shocks can trigger rapid corrections even during technically bullish setups.

Bitcoin Price Forecast 2025 and Beyond

Long-term projections, including the Bitcoin price forecast for 2025, remain cautiously optimistic. Analysts expect BTC to consolidate near current support levels before attempting new highs. Key considerations include:

Liquidity and market depth

Macro sentiment and interest rate shifts

Historical reliability of technical patterns under similar conditions

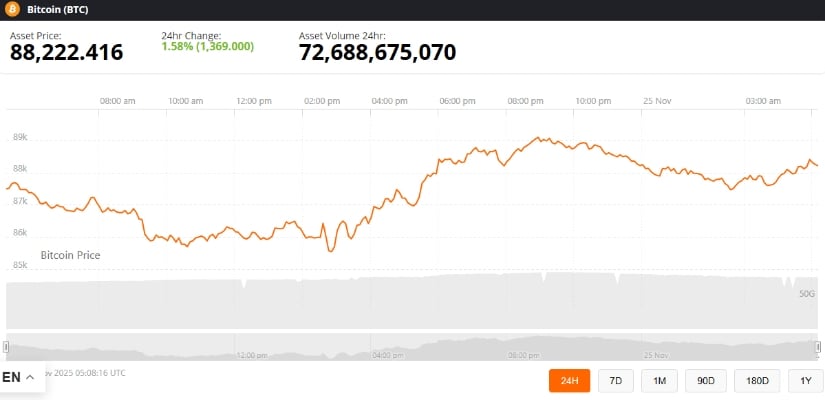

Bitcoin was trading at around 88,222.41, up 1.58% in the last 24 hours at press time. Source: Bitcoin price via Brave New Coin

While models suggest upside potential, these are estimates, not guarantees, and traders should weigh both bullish and bearish outcomes.