Key takeaways

Intro

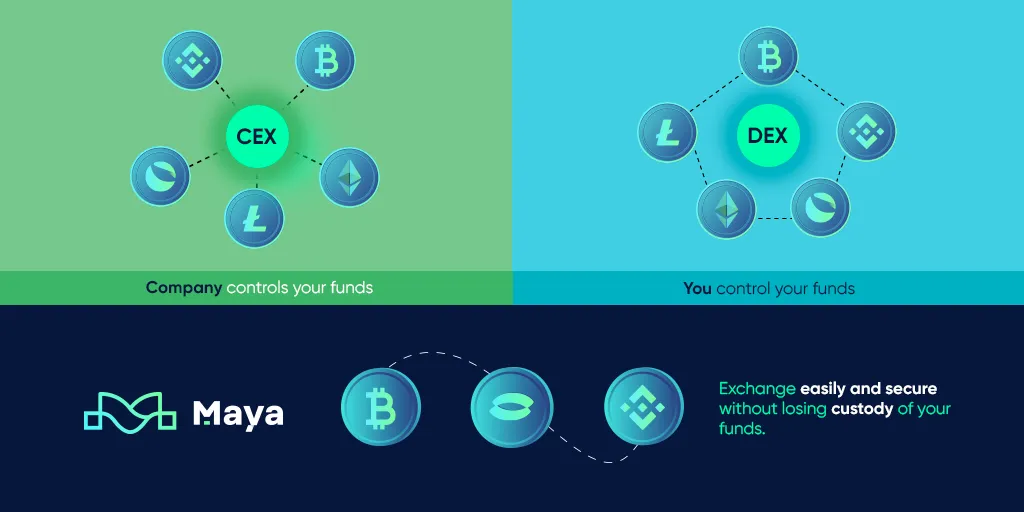

Decentralized exchanges (DEx’s) are one of the foundations of the DeFi ecosystem and ideals. However, exchanges like Uniswap on Ethereum and PancakeSwap on BSC do not handle cross-chain token swaps. Moreover, most of the liquidity and volume of trading still resides in Centralized Exchanges (CEx’s) which still attract the majority of users in the crypto space, both experienced and new comers.

What is Maya?

I. Decentralization, censorship-resistance and self-custody are what cryptocurrencies are all about, right? But apart from ThorChain - and now Maya - there is usually only one place where people can efficiently trade native cryptocurrencies: Centralized Exchanges (CEx’s).

Whether well-meaning or not, these actors expose their users to coercion and constitute a weak link in the chain of cryptocurrency interchange. CEX’s are after all, corporate entities that need to comply with legal requirements, banking regulations or other similar “protective” measures.

II. The current total liquidity in crypto is scattered across many different blockchains, like Bitcoin, Ethereum, Avalanche, Solana, etc. If someone wants to trade assets inside one of them, they might find several options, like trading ERC-20 tokens on Uniswap, inside the Ethereum blockchain.

Nevertheless, trading * across * blockchains can get more complicated. People who opt to “bridge” or “wrap” their assets into other blockchains often find that this method brings back centralized actors and that it can easily become expensive and insecure.

Blockchains being unable to easily interact with each other natively is exactly what brings us all the way back to problem I.

The Solution

In 2021 ThorChain team launched a protocol to trade assets without wrapping them first, rather it is a system that allows to “swap” native assets, in their own blockchain.

They are able to do this by having assets sitting inside specific addresses in each supported blockchain and then virtually pairing their notional value against $RUNE, in the THORChain blockchain, to form “Liquidity Pools”.

Since Maya is a THORChain fork, we use the same technology and principles to accomplish non-custodial, permissionless, native trades. More details on how these pools and swaps work below.

Enter MAYA

Maya is a DEx infrastructure that allows for trading between crypto assets on different blockchains, for example, trading BTC on the Bitcoin blockchain (ie. “native BTC”) to ETH on the Ethereum blockchain (ie. “native ETH”). Maya does so without ever having custody of the assets involved and without any centralized intermediaries or KYC processes.

This is all actually very big. In the same way that Bitcoin changed how we think about money and Ethereum is changing the way we do financial services, Maya Protocol aims to help change the way we exchange cryptocurrencies.

The Basics of how Maya works

Maya Protocol was built using the Cosmos Software Development Kit, most commonly referred to as the Cosmos SDK, and uses a Proof of Bond (PoB) consensus mechanism. It is secured and maintained by “Node Operators” who bond capital into the system and earn yield as a reward for their work and capital. Basically, nodes are computers running code that validate users’ swaps and that supervise assets in predefined addresses, in different chains.

For a swap to be completed, supported cryptocurrency has to be received in one of our addresses - sent by one of our users - and then an equivalent amount has to leave another one of our addresses, in a different chain. This process is always operated and authorized by two thirds of our nodes - especially the part where we supervise that the funds are received!

This way, users send one type of token, in one blockchain, and then receive another one, in another blockchain. All natively, without any wrapped tokens.

Validator Nodes

Our nodes are responsible for the security and correct performance of the system, they communicate and operate in coordination, to create the cross-chain swapping network by running the necessary software and by signing transactions.

Maya nodes use a security arrangement called the “Threshold Signature Protocol” (TSS) to underpin the protocol security, which basically means that, to sign a transaction, two thirds of them must validate and authorize it.

The system is designed with an over-collateralized system of bonding in mind, to prevent any malicious nodes from acting dishonestly and, for that purpose, validator nodes are incentivized to post double the monetary value of the assets that is held in our liquidity vaults, via a mechanism that we called “Incentive Pendulum”. Please find a more detailed explanation about this concept in our official Whitepaper.

Liquidity Providers

Liquidity providers (LP’s) “lend” us their own assets to the system to facilitate the trades that our users request. They do this to earn yield, which comes from the fees that the protocol charges for every trade.

To do this, they deposit $CACAO and another different, external asset inside our “liquidity pools” and get an “LP token” in exchange, which works as a receipt for their input.

Why “Protocol”?

Our system is not an Exchange per se; instead it is intended to work as the underlying pipes for other, different systems and exchanges. We designed the “back-end” of native swapping and now hope to see other people design different “front-ends” for it.

You can’t swap or deposit your asset directly into Maya but might do it with Obsidiex, the first DEX built around our tech. In the near future, we hope to have a vast array of interfaces and exchanges using the Maya protocol behind them, similarly to what happens with Thorchain, where users get to choose between Thorswap, Asgsdex, DeFiSpot or Shapeshift!

In subsequent posts, we will continue exploring the mechanics and technical features of Maya, as well as the $CACAO’s tokenomics and its tantamount role securing the network. Don’t forget to join our social networks, including Twitter, Discord and Reddit!