Takeaways:

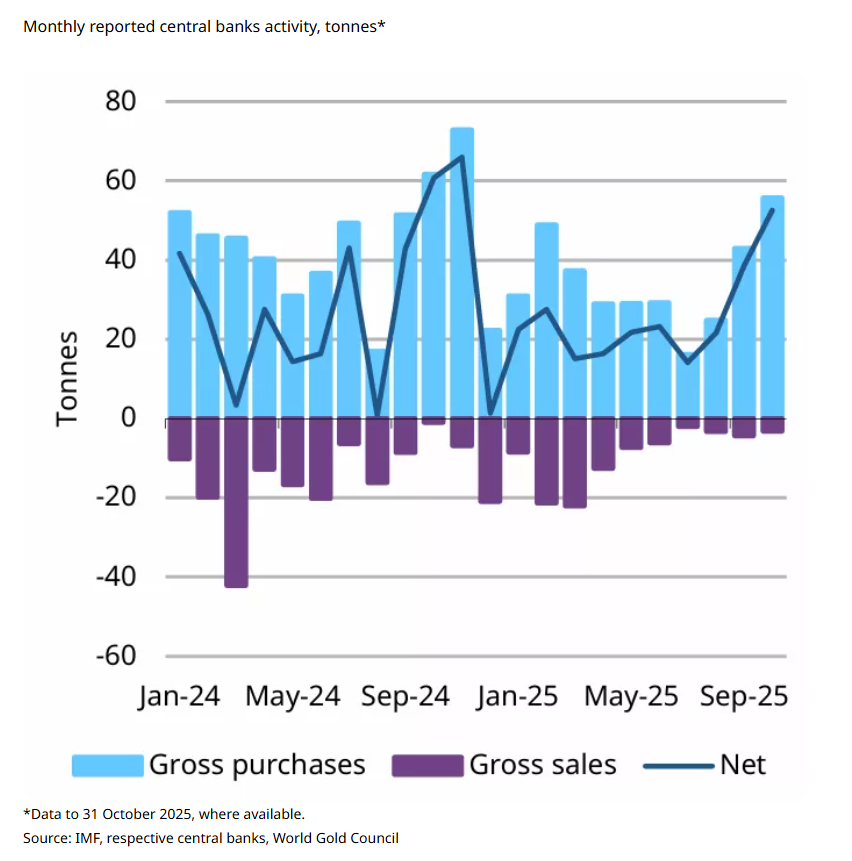

Gold purchases by central banks surged in recent months to heights not seen since last year.

254T tons of gold have been snapped up this year, with much of that going to strategic purchases.

Interest in Bitcoin is also rising, as the price hovers around $91K and presents a buying opportunity.

In a hard-money world where central banks favor gold and eye Bitcoin, infrastructure projects like Bitcoin Hyper, PEPENODE, and BNB are emerging as the best altcoins to buy.

Central banks are buying gold at the fastest pace in decades, quietly rebuilding hard-asset reserves as faith in fiat erodes.

At the same time, more monetary authorities are openly exploring Bitcoin as a future reserve asset, from research papers to pilot programs and policy debates.

That shift matters. As stats pile up showing renewed, aggressive central bank interest in gold, it strengthens the ‘hard money’ narrative and pushes capital toward assets and infrastructure that sit closest to Bitcoin’s monetary premium.

In other words, when sovereign balance sheets lean toward sound money, narratives tied to Bitcoin and real utility tend to outperform speculative hype.

But just stacking spot $BTC isn’t the only way to express that thesis. The bigger opportunity may be in infrastructure that makes Bitcoin more programmable, more scalable, and easier to plug into global capital flows.

That’s where smart Layer 2s, high-throughput chains, and new economic primitives come in.

Below are three altcoins aligned with that macro backdrop: Bitcoin Hyper ($HYPER) as a Bitcoin Layer 2 built for speed and DeFi, PEPENODE ($PEPENODE) as a mine-to-earn experiment in user engagement, and BNB ($BNB) as a blue-chip smart contract token anchored in one of crypto’s largest ecosystems.

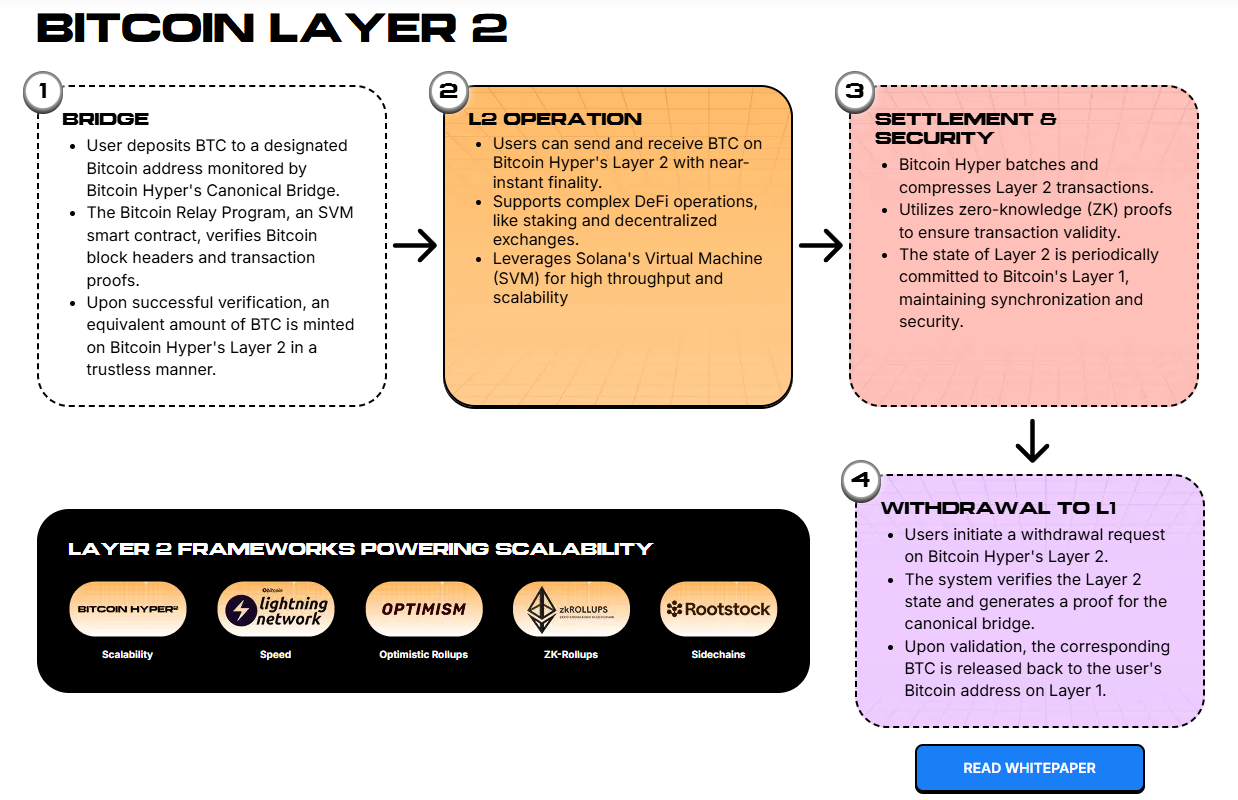

1. Bitcoin Hyper ($HYPER) – First SVM-Powered Bitcoin Layer 2

Bitcoin Hyper positions itself as the fastest-ever Bitcoin Layer 2 thanks to Solana Virtual Machine integration. It aims to deliver transaction performance that rivals Solana while anchoring security to Bitcoin.

The core idea is simple: keep Bitcoin as settlement but move high-speed execution to a specialized Layer 2.

Under the hood, Bitcoin Hyper uses a modular design: Bitcoin L1 handles final settlement, while a real-time SVM Layer 2 executes smart contracts with extremely low latency.

A single sequencer batches transactions and periodically anchors state back to Bitcoin, while a decentralized canonical bridge enables $BTC transfers into the L2 as wrapped assets.

For you, that translates into concrete use cases. High-speed payments in wrapped $BTC with minimal fees, DeFi primitives like swaps, lending, and staking protocols, plus NFT platforms and gaming dApps, all powered through SVM-compatible Rust SDKs and APIs.

It effectively brings Solana-style performance and tooling to the Bitcoin monetary base.

The market is already leaning in. The $HYPER presale has raised $29M, with tokens at $0.013375, signaling strong early conviction around its thesis. Smart money saw whale buys of $500K, 396K, and $274K over the course of the presale. Learn how to buy $HYPER to get in now.

For investors rotating from passive Bitcoin exposure to yield-generating hard-money infrastructure, that combination of $BTC-aligned narrative and performance is compelling.

Join the $HYPER presale today.

2. PEPENODE ($PEPENODE) – Mine-to-Earn Memecoin with Virtual Nodes

If Bitcoin Hyper is the macro-aligned infrastructure play, PEPENODE is a more speculative bet on user engagement and gamification.

Branded as the world’s first mine-to-earn memecoin, $PEPENODE flips the usual ‘buy and wait’ meme model into an interactive virtual mining experience.

The project centers on a Virtual Mining System where users deploy and upgrade virtual nodes to earn token rewards over time.

A tiered node rewards structure incentivizes early and higher-tier participants, while a gamified dashboard wraps the entire experience in a casual, accessible interface. It’s a crossover between DeFi incentives and game design.

On the funding side, the $PEPENODE presale has raised $2.2M, with tokens priced at $0.0011778. That puts it firmly in high-upside territory for investors comfortable with meme volatility but looking for more structured token mechanics than a simple hype coin.

Learn how to buy $PEPENODE with our guide.

In a market where central banks accumulate hard assets and Bitcoin solidifies its monetary role, meme coins like PEPENODE are clearly a different risk bucket. But for a diversified portfolio, exposure to a mine‑to‑earn experimental design can complement more conservative, infrastructure-led bets.

Explore the $PEPENODE presale now.

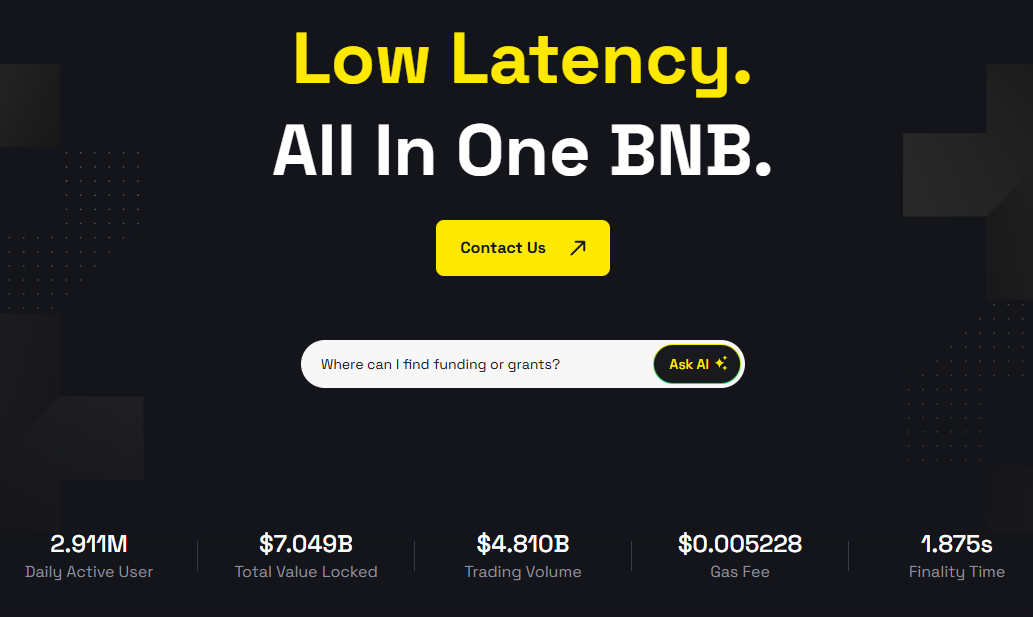

3. BNB (BNB) — Blue-Chip Smart Contract Token With 2025 Upgrades

BNB remains one of crypto’s most established altcoins, acting as the native token of the BNB Chain ecosystem. It powers transaction fees, smart contract execution, and participation across a wide range of DeFi protocols, gaming platforms, and Web3 applications on BNB Smart Chain.

Technically, BNB Chain focuses on low-cost, high-speed transactions, enabling thousands of transactions per second with fees that typically sit well below a cent.

That cost-performance profile has made it a go-to environment for retail users and developers who prioritize throughput and affordability over maximum decentralization.

BNB’s utility extends into staking and governance, where token holders help secure the network and influence protocol direction. The chain emphasizes further scalability and user security enhancements, reinforcing its position as a core infrastructure layer for everyday users and dApps.

From a macro lens, BNB offers diversified smart contract exposure alongside a Bitcoin-centric thesis. While central banks may favor Bitcoin as a reserve asset, retail and institutional users still need efficient networks for day‑to‑day transactions and applications.

BNB, consistently ranked among the top cryptocurrencies by market cap, fills that role as a leading smart contract platform token.

Learn more on the official BNB Chain website.

Recap: As central banks stockpile gold and quietly evaluate Bitcoin as a reserve asset, infrastructure and narrative-aligned plays stand out. Bitcoin Hyper, PEPENODE, and BNB each target different parts of that landscape, positioning them among the best altcoins to buy right now.