What to Know:

IMF concerns about dollar stablecoins eroding local currencies reinforce the appeal of scarce, non-sovereign assets like Bitcoin in a fragmented monetary system.

Bitcoin’s base layer remains constrained by slow confirmations, fee volatility, and minimal smart contract support, creating renewed interest in specialized Layer 2 infrastructure.

Competing Bitcoin scaling projects, from Lightning to sidechains, are racing to capture BTC liquidity as programmable capital for payments and DeFi.

Bitcoin Hyper uses an SVM-based Layer 2 anchored to Bitcoin to deliver extremely low-latency smart contracts, targeting DeFi, gaming, and high-speed BTC payments.

Stablecoins are a threat. At least that’s according to the International Monetary Fund (IMF).

In a recent report, the IMF shared concerns that dollar-backed stablecoins might hollow out weaker local currencies and dilute central banks’ control over domestic liquidity. If a digital dollar reaches everyone’s smartphone, what happens to the Peruvian sol, Nigerian naira, or Turkish lira?

The report also discussed the positives of stablecoins like cheaper and quicker payments, and a simpler UX, so it wasn’t all doom and gloom.

However, the warning does not just read as a technocratic worry. It reinforces a deeper macro story that crypto has been circling for a decade: demand for scarce, non-sovereign assets that cannot be printed at will, especially Bitcoin.

In a world of increasingly digital dollars, Bitcoin’s hard cap can look less like a curiosity and more like a hedge.

That backdrop is why attention keeps shifting from ‘number goes up’ to ‘what actually gets built on top of Bitcoin.’ If you believe Bitcoin will matter more as a neutral reserve asset, then the highest-beta plays sit in the infrastructure that makes $BTC programmable, spendable, and usable in DeFi at scale.

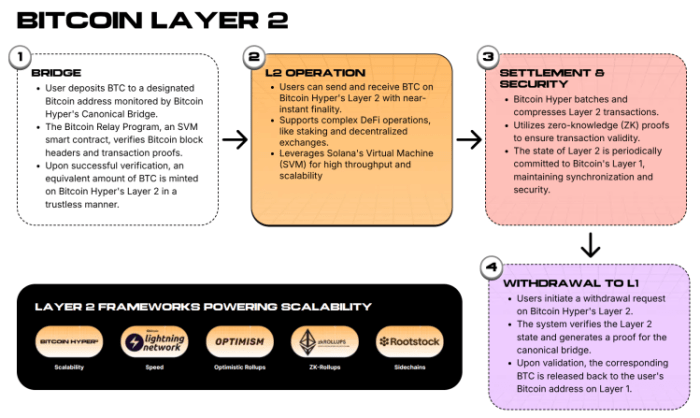

In that lane, Bitcoin Hyper ($HYPER) is trying to position itself as a key liquidity rail. It pitches itself as the first Bitcoin Layer 2 using the Solana Virtual Machine (SVM), aiming to merge Bitcoin’s hard-money appeal with Solana-style throughput and developer tooling.

Why Bitcoin Layer 2 Infrastructure Is Back In Focus

When a body like the IMF flags dollar stablecoins as a systemic risk for smaller economies, it implicitly admits that monetary power is splitting. You are not just choosing between local cash and a bank account anymore; you are choosing between local fiat, dollar tokens, and non-sovereign assets like Bitcoin at the tap of an app.

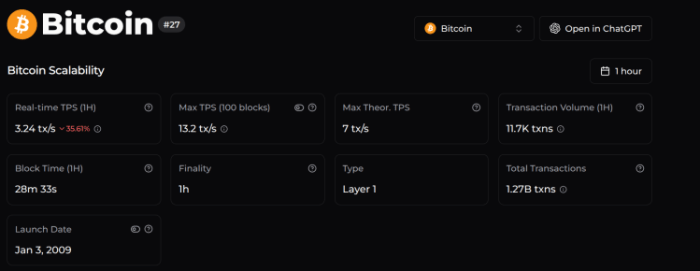

That split has pushed capital toward Bitcoin itself, but it has also exposed how limited the base layer is for real-world usage. On-chain Bitcoin still moves with minutes-long confirmation times, variable fees, a slow 7 TPS rate, and almost no native smart contract support.

Competing Bitcoin scaling efforts have rushed to fill that gap. Lightning Network pursues off-chain payment channels for instant $BTC transfers, while projects like Stacks and Rootstock lean on sidechains and alternative virtual machines to bring DeFi into the Bitcoin orbit.

In that growing field, Bitcoin Hyper ($HYPER) is standing out to turn dormant $BTC liquidity into programmable capital using Solana Virtual Machine (SVM) tech and a canonical bridge. See how to buy into the action with our ‘How to Buy Bitcoin Hyper’ guide.

How Bitcoin Hyper Tries To Turn $BTC Into High-Speed Capital

For years, the crypto trilemma suggested you couldn’t have speed, security, and decentralization in one place. Bitcoin Hyper ($HYPER) challenges that by changing the geometry of the network.

Instead of forcing Bitcoin to be fast, Bitcoin Hyper accepts Bitcoin as the heavy, secure anchor (Settlement Layer). It then attaches a Ferrari engine on top: a modular SVM Layer 2 (Execution Layer).

What does this unlock?

Rust-based Smart Contracts: Developers can build complex dApps (Gaming, NFT, DEXs) identical to Solana’s ecosystem.Latency: Sub-second finality that beats Solana’s own benchmarks.Security: State is periodically anchored back to $BTC, preserving the ‘hard money’ thesis.

The market is voting with its wallet. The presale has breached $29M, with whales accumulating and making purchases as large as $500K. With a price point of $0.013375 and high-APY staking currently at 40%, Bitcoin Hyper is positioning itself as the execution layer for the next bull run.

Our experts predict $HYPER possibly reaching $0.08625 by the end of 2026. If you invested today, that means a potential ROI of over 544%.

Don’t miss the upgrade. Buy your $HYPER today.

Remember, this isn’t intended as financial advice, and you should always do your own research before investing.

Authored by Aaron Walker , NewsBTC — https://www.newsbtc.com/news/imf-warns-stablecoins-threaten-banks-boosting-bitcoin-hyper-layer-2